Highlights

- The December sales of the UK hospitality sector were down by about 40 to 50 per cent compared to December 2019.

- Average venues' sales in December for Christmas Day were sharply down by 60 per cent.

- Rishi Sunak had recently announced a £1 billion emergency support package for the sector.

The December sales of the UK hospitality sector were down by about 40 to 50 per cent compared to December 2019, according to data from trade body UKHospitality.

The drop came as pub-goers opted to stay home amid concerns over Omicron. Moreover, the average venues' sales in December for Christmas Day were sharply down by 60 per cent. Sales were down by 25 per cent on Christmas Eve and were down by 35 per cent on Boxing Day, according to UK Hospitality.

Recently, Chancellor Rishi Sunak announced an emergency support package of £1 billion for the hospitality and leisure sector as the industry has been severely impacted by Omicron fears.

Let us take a look at 2 FTSE listed pub stocks and see how they reacted to the news:

- Marston’s PLC (LON: MARS)

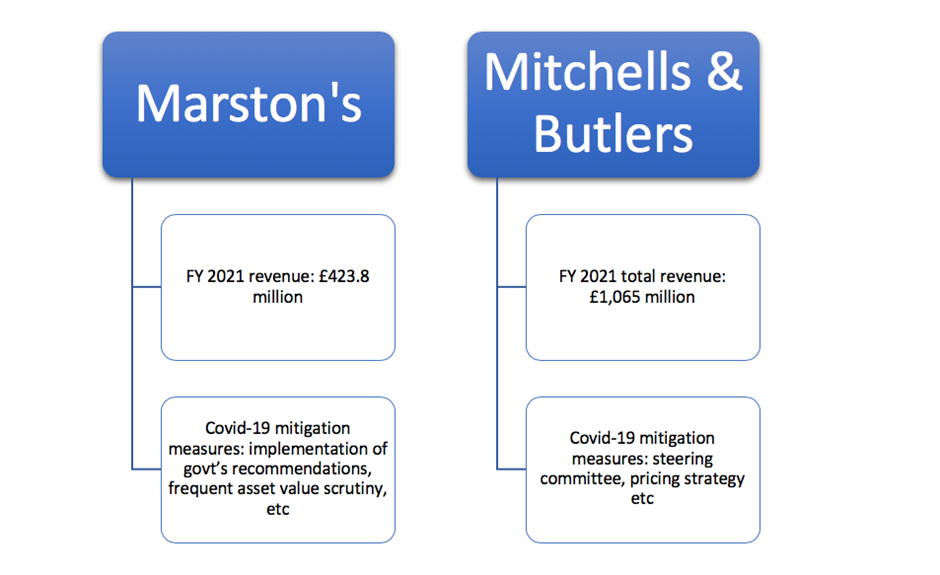

Marston’s is a UK-based operator various pubs and hotels. The group’s covid-19 risk uncertainty-related mitigation measures included tracking and effective implementation of the government’s recommendations, frequent asset value analysis, and scrutiny, according to its 2021 annual report.

Its 2021 revenue, for the 52 weeks ended on 2 October, was at £423.8 million, down from £821.0 million in the year before.

Its profit before tax, for the period, was at £119.3 million, reversing from a loss of £397.1 million in the previous year.

Marston’s shares ended higher by 1.75 per cent at GBX 75.75 on Thursday, 30 December 2021, and it had a market capitalisation of £475.29 million.

The FTSE All-Share index, which it is a part of, was at 4,217.70, down by 0.17 per cent.

© 2021 Kalkine Media®

- Mitchells & Butlers Plc (LON: MAB)

Mitchells & Butlers is a UK based operator of pubs, bars, and restaurants.

According to its 2021 annual report, some of the mitigating actions the company plans to undertake to manage the rising risk of declining sales performance due to covid-19 and other factors include:

- Frequent meetings of a steering committee to manage covid-19 related disruptions

- Pricing strategy for each brand, and development of price promotions aligning with the strategy

- Increased digital marketing activity, takeaway and delivery orders.

Its FY 2021 total revenue stood at £1,065 million, compared to £1,475 million in FY 2020. And its FY 2021 operating profit was at £81 million, up from £8 million in the year before.

Mitchells & Butlers’ shares closed higher by 1.13 per cent at GBX 250.60 on Thursday, 30 December 2021, and it had a market capitalisation of £1,471.58 million.

The FTSE 250 index, which it is a part of, closed at 23,539.55, up by 0.11 per cent.

.jpg)