Source: muratart, Shutterstock

Summary

- EasyJet’s accurate capacity forecasting & focus on cash generative flying, minimized cash burn in the second quarter.

- The budget airline expects to fly up to 20 percent of pre Covid (2019) capacity levels in the next quarter and anticipates that the capacity levels will increase from late May onwards.

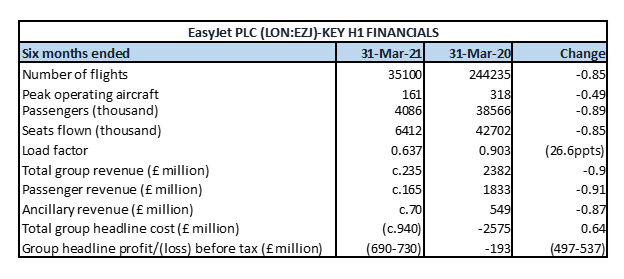

As economies around the world open up and the UK Government confirms to reopen international travel by mid-May, EasyJet (LON: EZJ) the low-cost European airline is looking forward to revenue improvement. Although in the first half of the 2019 financial year, passenger numbers fell 89 per cent and EasyJet flew just 14 per cent of the capacity, which led to revenue slumping almost 90 per cent to GBP235 million, however now the company has a positive outlook for future.

The key reason for EasyJet’s struggle was the Covid-19 situation in Europe and lockdown restrictions reinforced due to third waves in France, Germany and Italy, being key destinations for EasyJet flights. With vaccination programmes accelerating, EasyJet is hopeful of taking customers on their long-awaited summer holidays this year. The budget carrier expects to fly up to 20 per cent of 2019 capacity levels in the next quarter and is hopeful that capacity levels will start to increase towards May end. The total group headline costs are expected to show a reduction of 64 per cent. The company has been prompt in taking decisive actions in the past and has garnered more than £5.5 billion in liquidity since the outbreak of the Coronavirus and its resultant scenario, through debt, equity as well as government announced pandemic support benefits.

Expects revival

Its’ precise capacity forecasting & focus on cash propagative flying, in the reported period, has helped it to lower cash burn. Now, given the continued level of short-term uncertainty, the group’s headline loss (before tax), for the H1 ending 31 March 2021, is expected to be between £690 to £730 million, which shall be reviewed on 20 May 2021 when actual results are released. It means the risks and opportunities of this large cap stock remain balanced.

Trading Update Highlights for Six Months ended 31 March 2021 as given below-

(Data Source: Company Release)

Rapid increase in flights

In the continued level of short-term uncertainty, customers are booking closer to departure and visibility remains limited, still using the millions of data points it collects every day, EasyJet aims to improve revenues in H2 in current Financial year. EasyJet’s management has ensured operational flexibility with data-driven dynamic interactions among its’ operations, financial and commercial teams, to rapidly increase flying and add destinations to match expected demand by May.

Copyright © 2021 Kalkine Media Pty Ltd.

EasyJet had announced structural cost-out programmes last year, which seems to be on track to help it realise the targeted cost savings. Throughout the pandemic the airline has seen increasing inflationary pressures and competition, but its’ accurate capacity forecasting has helped deliver strong cost control and EasyJet is looking to sustain its focus on profitable flying. They are even offering more flexibility than ever before to improve consumer confidence.

Reacting to the numbers and company’s optimistic outlook, shares surged on Wednesday, 14 April 2021, closing up by 5.54 per cent at GBX 978.00. The Stocks with market capitalisation of GBP 4,220.37 million has given a return of 17.83 per cent since the beginning of the year till date.