Highlights

- The used car market in the UK has shown exceptional growth in 2021.

- Many consumers are opting for used cars because of the long waiting period for the new car models amid chip shortages.

- Apart from the short supply of new car models, the secondhand car market boom is supported by solid underlying demand from consumers.

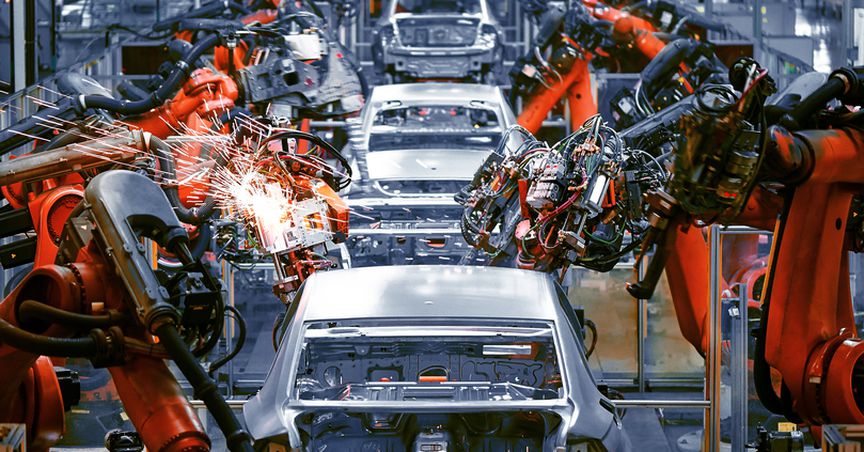

The used car market in the UK has shown exceptional growth in 2021. Many consumers are giving preference to used cars because of the long waiting period for the new car models. New age modern cars require multiple semiconductor chips to control different functions of the vehicle. However, due to supply chain and logistics issues, there is a global shortage of semiconductor chips resulting in low car production and supply of new cars.

Apart from the short supply of new car models, the boom in the secondhand car market is supported by solid underlying demand from consumers as many individuals prefer personal vehicles over public transports due to the Covid-19 virus. Also, high household savings during the pandemic period are diverted towards vehicle purchases.

Let us look at 3 FTSE listed stocks that operate in the used car space and their investment prospects:

Motorpoint Group Plc (LON: MOTR)

The company operates as an independent vehicle retailer in the UK, offering new and used vehicles to customers through its online portal and retail stores. The company witnessed strong demand for used vehicles from customers resulting in market share gain for the company. During the six months to 30 September 2021, the company reported a 56.1% rise in revenue at £605.2 million, while its gross profit was £55.5 million.

Motorpoint Group Plc’s current market cap stands at 306.6 million as of 08 December 2021. In the last one year, company’s stock has returned 20.2% to its shareholders.

Auto Trader Group Plc (LON: AUTO)

FTSE100 listed company operates in the digital automotive space. It allows sellers to post vehicle advertisements on its online portal. It also offers insurance and financing products. In the six months to 30 September 2021, the company managed to achieve its highest ever half-yearly revenue and profits. Its total revenue was £215.4 million, a rise of 82%, while its operating profit was £151.7 million during the period. The company has close to 436,000 used cars listed on its online portal.

Auto Trader Group Plc’s current market cap stands at 7,046.5 million as of 08 December 2021. In the last one year, the company’s stock has returned 33.8% to its shareholders.

Vertu Motors Plc (LON: VTU)

The company sells used and new cars along with commercial vehicles through its dealership network. It also offers aftersales services to its customers. For the six months to 31 August 2021, the company reported a 10.3% rise in used vehicle volume resulting in revenue of £1.9 billion. Adjusted profit before tax for the company stands at £51.8 million. Following the good performance, the company has re-established its dividend payout policy with an interim dividend of 0.65p per share to its shareholders.

Vertu Motors Plc’s current market cap stands at 244.5 million as of 08 December 2021. In the last one year, the company’s stock has returned 141.1% to its shareholders.