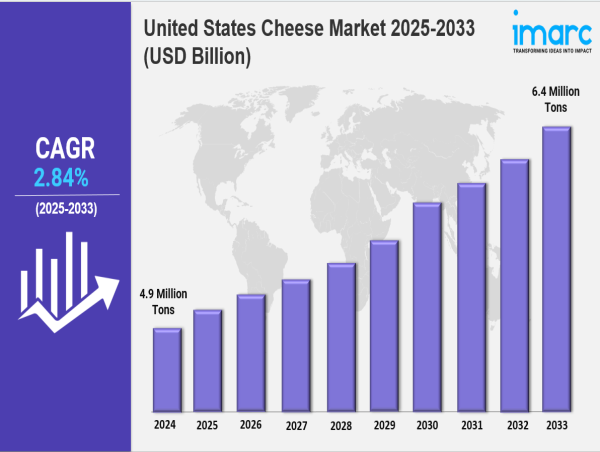

The United States cheese market size hit 4.9M tons in 2024 and is projected to reach 6.4M tons by 2033, growing at a CAGR of 2.84% from 2025 to 2033.

BROOKLYN, NY, UNITED STATES, June 25, 2025 /EINPresswire.com/ -- Market Overview 2025-2033

The United States cheese market size reached 4.9 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 6.4 Million Tons by 2033, exhibiting a growth rate (CAGR) of 2.84% during 2025-2033. The market is growing due to rising demand for convenient, protein-rich foods, expanding fast-food consumption, and evolving consumer preferences. Growth is driven by innovation in specialty cheeses, increased domestic production, and diverse retail channels, making the industry more dynamic, flavorful, and competitive.

Key Market Highlights:

✔️ Robust market growth fueled by rising demand for specialty and artisanal cheese varieties

✔️ Increasing consumption across foodservice, retail, and snacking segments

✔️ Expanding innovation in plant-based and health-focused cheese alternatives

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-cheese-market/requestsample

United States Cheese Market Trends and Drivers:

The United States Cheese Market is undergoing a dynamic transformation, driven by increasing consumer interest in artisanal and specialty cheeses. As shoppers seek distinctive flavors and high-quality ingredients, demand is shifting away from mass-produced options toward locally sourced, small-batch varieties. This trend reflects a larger movement centered on sustainability, authenticity, and culinary craftsmanship—core values influencing purchasing behavior across food categories.

Small-scale producers are playing a central role in reshaping the United States Cheese Market. These cheesemakers are reviving traditional techniques and forging partnerships with local wineries and breweries to create unique, regionally inspired offerings. Retailers are expanding their specialty cheese selections, and foodservice providers are incorporating artisanal varieties into menus, elevating consumer expectations. Although challenges such as limited production scale and supply chain constraints remain, the momentum behind craft cheese is strong. Consumers are drawn to the seasonality, transparency, and storytelling behind these products—factors that are helping to expand the United States Cheese Market Share.

E-commerce is accelerating this growth by enabling direct-to-consumer sales, allowing producers to bypass conventional distribution models. Demand is rising for raw-milk cheeses and products with transparent sourcing and sustainability credentials. Limited-edition batches and eco-friendly packaging further distinguish these cheeses in a competitive landscape, positioning them as premium, curated experiences rather than everyday commodities.

Health trends are also influencing the United States Cheese Market Growth. With consumers increasingly mindful of their dietary intake, there is growing interest in cheeses with reduced sodium, added probiotics, or plant-based alternatives. Flexitarian buyers, in particular, are seeking lactose-free and functional cheese options without compromising on flavor or texture. At the same time, full-fat, minimally processed cheeses remain popular among those following high-protein diets like keto and paleo, reinforcing demand across both health-conscious and traditional segments.

Rising production costs—driven by inflation, feed price hikes, labor shortages, and higher transportation expenses—are impacting both manufacturers and consumers. To remain competitive, companies are turning to localized sourcing, energy-efficient processes, and supply chain optimization. Some brands have also formed partnerships with producers in Mexico to control costs and mitigate logistical challenges.

Consumer preferences are evolving as well. While staple cheeses like cheddar and mozzarella continue to perform well, especially when offered under affordable private-label brands, buyers are becoming more selective with premium purchases. Budget-conscious consumers often seek value through loyalty programs or promotional discounts, but continue to expect quality and variety.

Innovation remains a key growth driver in the United States Cheese Market. Bold flavor profiles—such as habanero cheddar and espresso-rubbed gouda—are capturing attention, while globally inspired offerings like halloumi and queso fresco are broadening the domestic palate. Snack-friendly and resealable packaging formats have gained popularity as more Americans work from home and seek convenient, protein-rich options.

Sustainability is another major influence on the United States Cheese Market Size. Leading brands are investing in regenerative agriculture, waste reduction, and environmentally responsible sourcing to appeal to younger, eco-conscious consumers. Industry experts anticipate continued consolidation, as mid-sized producers face pressures from rising compliance costs and automation demands.

Emerging technologies, including precision fermentation, may eventually reshape the market by enabling the production of animal-free dairy proteins. Although regulatory hurdles remain, these innovations represent a long-term opportunity. Meanwhile, interactive tools—such as virtual cheese tastings, AR-enabled labels, and subscription models—are enhancing consumer engagement and brand loyalty.

Despite ongoing challenges, the United States Cheese Market is poised for sustained expansion. With artisanal producers gaining traction, mass-market players adapting to shifting preferences, and consumers seeking meaningful food experiences, the market is evolving in both depth and diversity. This combination of innovation, tradition, and demand signals continued United States Cheese Market Growth through 2025 and beyond.

Checkout Now: https://www.imarcgroup.com/checkout?id=3270&method=1190

United States Cheese Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Breakup by Source:

• Cow Milk

• Buffalo Milk

• Goat Milk

• Others

Breakup by Type:

• Natural

• Processed

Breakup by Product:

• Mozzarella

• Cheddar

• Feta

• Parmesan

• Roquefort

• Others

Breakup by Distribution Channel:

• Supermarkets and Hypermarkets

• Convenience Stores

• Specialty Stores

• Online

• Others

Breakup by Format:

• Slices

• Diced/Cubes

• Shredded

• Blocks

• Spreads

• Liquid

• Others

Breakup by Region:

• Northeast

• Midwest

• South

• West

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=3270&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Browse Related Reports

https://www.imarcgroup.com/united-states-sugar-market

https://www.imarcgroup.com/canada-organic-food-market

https://www.imarcgroup.com/canada-dairy-market

https://www.imarcgroup.com/united-states-business-process-management-market

https://www.imarcgroup.com/united-states-pasta-market

Elena Anderson

IMARC Services Private Limited

+1 631-791-1145

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()