Highlights

- The statistics released by CoreLogic Inc. revealed that there is a 1.4% rise in the value of residential property in Australia in October.

- 47,040 new property listings were observed in the property market within four weeks ending October.

- There are signs that the Australian property market might cool down are coming because of an increase in the supply, worsening affordability and withdrawal of government support.

- The demand of international investors decreased significantly in the Aussie property market over past 6 years.

While APRA made mortgage loans more challenging, the Australian house value is inching higher for the 13th month straight. The statistics released by CoreLogic Inc. on Monday revealed a 1.4% rise in the value of residential property in Australia in October. A similar rise was reported in the month of September (1.51% increase) and August (1.5% increase). The monthly growth rate nationally has eased up a little, as the rate is reduced from 1.51% to 1.4%.

In almost all the major cities, the prices were on rising. For example, 2.54% rise in Brisbane, 2% rise in Hobart and 2% rise in Adelaide.

The rise in the housing prices of regional areas is more than the cities, as prices increased by 1.87% within a month and a 24.29 increase was observed within a year. The growth rate in Sydney has been 3.7% and in Melbourne, the growth rate is 2.4% only.

47,040 new property listings were observed in the advertisement property market within four weeks ending October.

Are there any signs that the Australian property market will cool down?

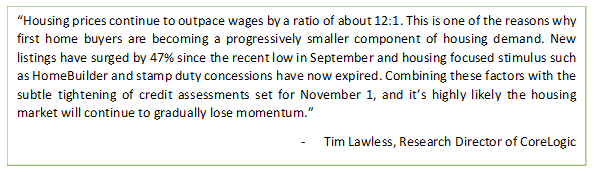

There are indications that the Australian property market might cool down are coming because of an increase in the supply (47,000 new property listings within four weeks), deteriorating affordability and removal of government support.

Source: CoreLogic announcement, 1 November 2021

How is interest rate pushing the prices of the Australian real-estate market?

Interest rates are at present at their lowest in 5,000 years globally. The households are taking advantage of the same in fear of missing the opportunity to bag the lowest interests’ rates.

Moreover, inflation is rising across countries, affecting the money market. The same has been witnessed in Australia as well. However, in order to control the rising cost of living, if RBA raises the interest rate to an extreme level, then the existing borrowers will be affected extremely and the economy will tank.

Can foreign buyers be blamed for the rising prices of Australian property?

The sale of Australian property to foreign buyers is significantly affected by the restrictions imposed due to the COVID-19 breakout. The Foreign Investment Review Board survey indicated that international property purchase has dropped and has hit a record low. The residential real-estate sale dropped from 40,141 in 2016 to 7,056 in 2021.

CoreLogic supports the same as Tim Lawless stated that demand has fallen significantly over the past 6 years.

The Aussie property market is still lucrative for foreign investors as it extends a sense of security and certainty among investors. The international investors are waiting for the cross-borders restrictions to ease up.

Therefore, in the current scenario, it can be said that foreign investors cannot be blamed for the inflated dwelling costs in the property market of Australia.

Who is most affected by the increasing prices of property?

At present, AU$9 trillion worth of property is owned by Australians, and an extra trillion has been added in just 5 months. It is interesting to know that Australians owe approximately AU$2 trillion to the banks and 60% of the total loan amount is invested in residential real estate.

The total debt amount is around $2 trillion and the valuation of property is $9 trillion, and these numbers look safe bet. But the issue comes into the picture with the fact that debt is skewed to younger Australians. Younger Australians are in debt and the speed at which debt has increased is significant.

Moreover, middle-class buyers are affected by the rising prices as they are struggling to save the funds for making the purchase. Inequality think-tank per capita’s executive director, Emma Watson highlighted that the Australian employers’ salary has not increased for good since a decade but the property is facing acceleration in the context of prices. Thus, there is little to no hope that averaged income individual can purchase a property.

What do experts have to say about the Australian real-estate business?

As per the experts, the Australian property market may observe a significant rise in value with the opening of the borders. In October, 38 economists and experts presented their opinion as a part of the Finder RBA Cash Rate Survey. The survey results indicated that the experts opined that property prices in Melbourne will rise by 9% in the next year. The cost of houses in Brisbane will also rise by 8% by 2022.

Presently, the price rise is driven by the local investors and owner-occupiers, but in 2022, with the opening of international borders, the oversee investors will further trigger housing prices.

Bottom Line

The Australian Property market is on an upward trajectory and is expected that the rise will get steeper once international borders opens, as per the experts. At present, there are signs of a possible price reduction in housing prices due to increased supply and worsening pricing conditions. However, with APRA and RBA regulating the monetary side of the market, it will be interesting to see how the property market will perform after the removal of COVID-19 related restrictions.

_06_19_2025_05_49_07_385844.jpg)