Highlights

- Tether is a broad ecosystem that contains multiple fiat currency-pegged stablecoins, including the USDT token

- USDT holds dominance with respect to the trading volume thanks to its use in trading cryptocurrencies

- Popularity of USDT does not mean security against risks, and the fall of stablecoin TerraUSD proves this

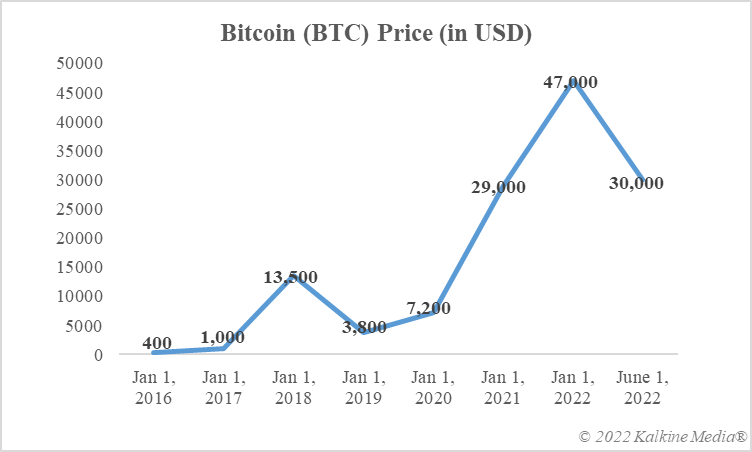

Bitcoin (BTC) is arguably the most popular cryptocurrency asset across the world. The reasons are BTC being the first blockchain-based currency and its supremacy in terms of market capitalisation. But the world of cryptocurrencies is filled with a very large number of assets, which belong to different categories like native tokens, meme coins, and stablecoins. In the last category, Tether’s USDT token is the biggest in terms of market cap.

What makes Tether’s USDT one of the biggest assets in the cryptoverse? Is this stablecoin similar to BTC or altcoins like ETH and DOGE? First, it can be wrong to consider that Tether is only about USDT, which is explained later in this article. Second, the utility of USDT is different from that of BTC and ETH. Let us explore the reasons behind Tether’s popularity.

USDT’s trading volume

Even though USDT ranks below BTC and ETH in terms of market cap, it wins in terms of the trading volume. Data compiled by CoinMarketCap clearly points toward USDT’s trade dominance. On all days, the stablecoin tops the chart regarding the 24-hour trading volume, with BTC ranking a close second. But why does USDT have such a high trading volume? The reason is the stablecoin’s use in trading cryptocurrencies, including BTC. Since USDT is pegged to the US dollar, many traders keep their holdings in USDT instead of converting cryptocurrencies to fiat currency after all trades.

By this measure, USDT’s utility is as a facilitator in the crypto world and not as a speculative asset. Also, because the token is meant to maintain the price of US$1 at all times, it makes little sense to use it as a speculative asset. But enthusiasts must also know that even stablecoins are risky, something that was proven when the TerraUSD project collapsed completely in May 2022. Terra's fall also triggered losses in BTC and other cryptoassets.

Data provided by CoinMarketCap.com

Tether’s ecosystem

Besides USDT, Tether has released other tokens like a euro-pegged stablecoin and a gold-pegged stablecoin. That said, other tokens in the ecosystem have yet to attain the same popularity as USDT. It can be said that since USDT is pegged to the most powerful fiat currency across the world, the stablecoin has found the most backing. Other popular USDT-pegged stablecoins include USDC and Binance USD, but they rank below USDT in market cap.

Bottom line

Tether is popular because its USDT stablecoin commands the highest 24-hour trading volume. But popularity does not automatically mean protection against any failure. Whether Tether holds adequate reserves in cash and cash equivalents to back the value of all USDT tokens is a subject of controversy. TerraUSD, a popular stablecoin project, crashed in May this year, and the price of one token reached almost zero.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.