Highlights

- Ukraine could raise funds in cryptos in the wake of the war with Russia

- Ethereum’s token ETH and Solana’s SOL have lost heavily during the quarter

- A new cryptocurrency, APE token, became instantly popular after its launch

The first quarter of this year was a mixed bag for the crypto verse. Prices of crypto assets have always remained unpredictable, with even the one with the largest market cap, Bitcoin (BTC), not immune to wide-ranging price fluctuations. But the first quarter’s mixed bag was about something else.

On one hand, these assets seemingly helped the war-torn nation Ukraine to raise funds. The country has accepted donations in Bitcoin, Ether, and multiple other assets. On the other hand, critics doubled down on their disapproval of blockchain-based digital currencies, with Senator Elizabeth Warren announcing a bill to sanction crypto firms that work with sanctioned Russian entities.

That said, and amid many cryptos losing value as compared to their price on January 1, a few assets dominated headlines in the first quarter. Though these too manifested price fluctuations, they make for a close watch for the remainder of the year.

Waves (WAVES)

With a multi-billion-dollar market cap, WAVES is one of the top 50 assets on the CoinMarketCap list. The project includes a blockchain network, which like Ethereum and Solana offers a platform to develop decentralized apps (DApps) and execute smart contracts.

Also read: YFI crypto gains: Can Yearn Finance stay unaffected by Ronin DeFi hack?

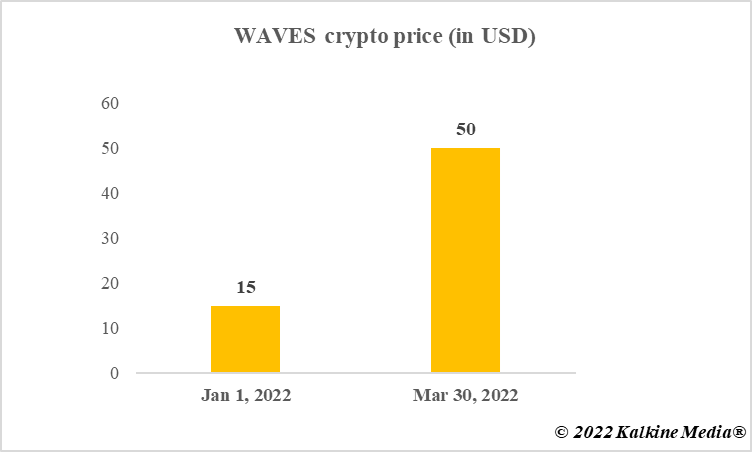

It also includes an in-house decentralized exchange (DEX), Waves DEX, that enables trading in assets like Bitcoin. The blockchain is said to be using a modified form of proof-of-stake (PoS) consensus. The token started the year at a price tag of nearly US$15 and then entered a deeply bullish phase from the beginning of March, with the price breaching US$50 by the end of the month.

Data provided by CoinMarketCap.com

ApeCoin (APE)

A very new entrant in the world of cryptos, ApeCoin has links with the popular Bored Ape Yacht Club (BAYC) NFT project. It is said to be a part of the APE ecosystem and was launched as an ERC-20 coin in mid-March 2022.

Also read: UFO Gaming & Starlink (STARL): 2 dirt cheap metaverse tokens

It soon dominated headlines as the price soared heavily. However, during the remainder of the month, APE token’s performance was subdued. It is also a multi-billion-dollar market cap token, and in no time has made the cut to the top 50 assets.

Bottom line

ETH lost heavily in the first quarter and so did many other tokens, including BNB and SOL. But cryptos are popular and the above two are among the ones that have dominated headline so far this year. Risks in cryptos prevail, no matter the popularity.

Also read: Ronin Network hacking: What is Ronin bridge & its RON token?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.