Summary

- The shale oil boom placed the US in No.1 position in crude oil production in 2018.

- The United States saved around US$309 billion in trade deficit in 2019, which would have lost in the absence of shale oil.

- The US oil industry is anticipating a strong and stringent climate policy, which can make shale oil drilling a history.

US Energy Secretary Dan Brouillette has hinted towards an aggressive climate policy by the government. He has stated that ESG movements are growing strong and can push the Congress for a change in policy in shale oil.

During the Shale Insight Conference in late September 2020, the Energy Secretary noted that the shale revolution ended the US dependency for energy on other countries. The shale oil boom made the manufacturing industry competitive again.

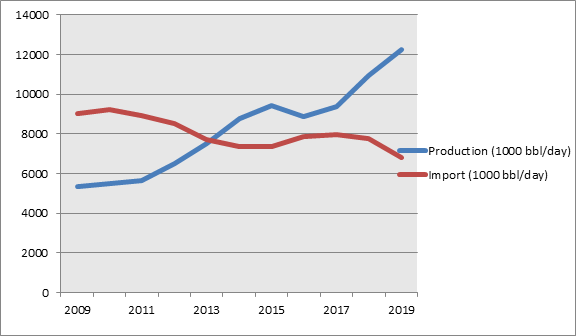

US Production Vs Import for Period 2009-19 (Data Source: EIA)

Read More: Oil prices jump with hope of rising demand

From the chart of the US domestic production versus import of crude oil (mentioned above), it is evident that the US shale oil has considerably reduced the import bill of the country. The Energy Secretary further highlighted that shale oil had saved US$309 billion in the trade deficit for 2019.

Is the Congress going to penalise the success which shale oil brought to the US energy security?

Mr Dan Brouillette on being asked about the future of shale oil, stated that there is a possibility of an aggressive climate policy. He cited the ESG activists, who are constantly protesting against fossil fuel.

He further stated that the industry has to wait and see what the new administration has in its mind for shale oil. But he indicated that once the rules become stricter, the investment money might dry up for the industry.

Why ESG Activists are Against Shale Oil

Shale is a type of rock which has high porosity and lesser permeability. Porosity is nothing but the porous space between the grains of the rock which has void space. Oil, gas or water are stored in these void spaces of the rocks.

Image Source: © Kalkine Group 2020

Permeability is the interconnection of the pores in the rock. The more connected the pores are, the easier will be the movement. Shale is known to have lesser permeability, i.e., fluids will have difficulty in movement, so a special type of drilling method is employed to produce the hydrocarbons stored in shale formations.

The oil & gas companies employ hydraulic fracturing or simply fracking to produce shale oil or gas.

Hydraulic fracturing operation requires a lot of water, and there is a pretty good chance that the chemicals used during the operation may pollute the aquifer or the groundwater.

The ESG activists are protesting against the use of such high volume of water for the fracturing job. Also, there are reports that earthquakes are triggered due to the fracturing in Europe and the US.

Implications of Shale Oil Ban

- US may become a net importer of crude oil.

- The supply cut from the US shale production will increase the demand.

- The crude oil industry may go back to the price range of the 2012-13 level.

- More investment in the renewable energy sector as the government may bring more reforms to the industry.