Summary

- The SPDR® S&P® Retail ETF (XRT:US, NYSE: XRT) has gained over 36 per cent in 2021.

- This ETF provides exposure to the S&P TMI index that consists of sub-industries such as retail, food, apparel, automotive, computer and electronic, supermarkets, drug stores etc.

- The fund has a market cap of over US$30 billion with 94 holdings.

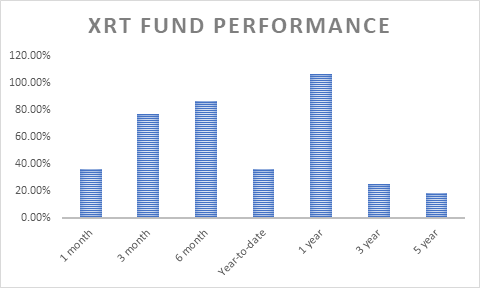

The SPDR® S&P® Retail ETF (XRT:US, NYSE: XRT), a popular exchange traded fund (ETF), has advanced by a massive 107 per cent in the last one year, overcoming the pandemic-related challenges.

In 2021 alone, the fund has swelled by over 36 per cent.

This retail ETF provides exposure to the S&P Total Market Index (TMI) index, which comprises several sub-industries including (but not limited to) food and apparel, automotive, hardware, computer and electronic, supermarkets, drug stores etc.

SPDR® S&P® Retail ETF (XRT:US, NYSE: XRT)

The fund has been on the rise ever since Joe Biden started emerging as a front runner of US Presidency. After he assumed office, Biden signed a number of executive orders to support the ailing industries impacted by COVID-19 pandemic, including the US$ 1.9-trillion stimulus plan.

The XRT EFT, which has an exposure to this sector, gained as retail stocks started improving on account of the stimulus.

Each fund unit is currently trading at US$80 (As of market close on Monday, February 15).

The fund has a market cap of U$30,904.52 million with 94 holdings. The Price to Book Ratio is 15.44 per cent.

Its current dividend yield is 0.81 per cent.

The top holdings include (as of Feb 1, 2021) GameStop Corp. Class A, Magnite Inc., Overstock.com Inc., Blink Charging Co, RealReal Inc., Children's Place Inc., Signet Jewelers Limited, Designer Brands Inc. Class A, Rent-A-Center Inc, CarParts.com Inc.

Internet and direct marketing retail has the highest weightage on the fund at 24.46 per cent, followed by automotive retail at 17.76 per cent and apparel retail at 17.29 per cent.

It is currently trading at US$ 80.01 per unit.

The EFT was impacted by recent Reddit short squeeze, which pushed the value of GameStop new heights. When the gaming company’s stock surged, the ETF also briefly went up.