Volt Resources Limited (ASX:VRC) is a metals and mining sector player engaged in the exploration and development of graphite deposits. Currently, the company is primarily focused on developing its 100%-owned Bunyu Graphite Project located in Tanzania, that is characterised by a well-established mining and services industry, political stability, as well as a stable economy. Besides, Volt Resources also keeps exploring for additional prospective assets across the world.

Briefly Understanding The Bunyu Project

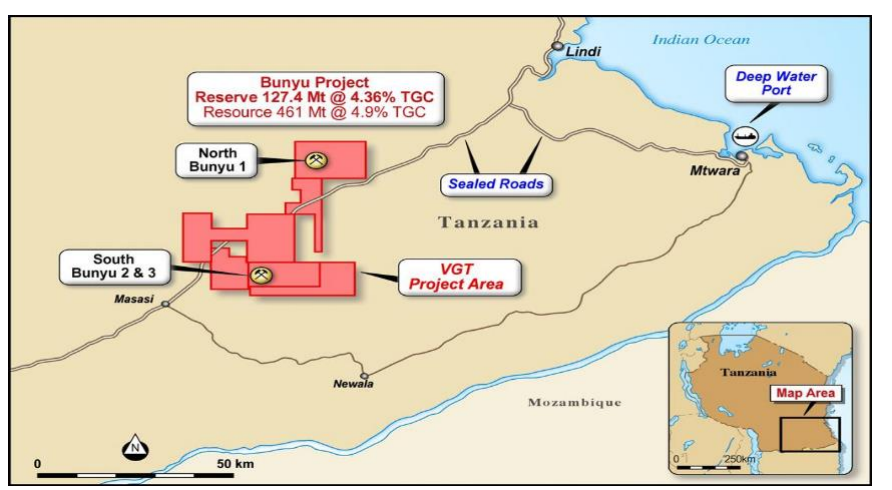

The Bunyu Graphite Project has critical infrastructure in vicinity such as sealed roads and easy access to the deep-water port of Mtwara (140 km away).

Project Location & Infrastructure (Source: Company Presentation)

The project is being developed in two stages for which the Pre-Feasibility Study (PFS) was completed in December 2016. The PFS confirmed the robust technical and financial viability of the project with a Mineral Resource Estimate (JORC 2012 compliant) of 461Mt @ 4.9% TGC, being the largest graphite Mineral Resource across Tanzania.

Thereafter, in July 2018, Volt Resources completed the Feasibility Study (FS) into the development of Stage 1. More on the outcomes of PFS and Feasibility Study may be READ here.

The Stage 1 involves building a graphite mine and processing facility with a capacity of 20,000- 24,000 tpa in Tanzania with planned exports to the United States, China and other lucrative markets. The development incorporates building significant amount of infrastructure, utilities and mine work that will deliver material benefits to the subsequent development of the significantly larger Stage 2 expansion project at Bunyu, including the site access road, plant laydown area, waste dumps, stockpile areas, tailings storage facility, open pit development and mining, accommodation village and water supply.

Stage 1 would analyse the market appetite for the graphite products with the production scheduled to begin by Q3 2020 with first cash-flows expected from H2 2020. Stage 2 would be developed to serve the forecasted surge in demand for coarse flake graphite in the expandable graphite market and as well as flake size products for battery anode material. In addition, there are other evolving industrial uses for micro carbon products. Production for Stage 2 is forecast at 170,000 to 200,000 tonnes of graphite per annum.

To date, Volt Resources has achieved various headways concerning the Bunyu Graphite Project. The company has been consistently advancing funding initiatives for Stage 1 to reach the targeted funding of USD 40 million including USD 31.8 million of development cost and USD 3.5 million for resettlement compensation.

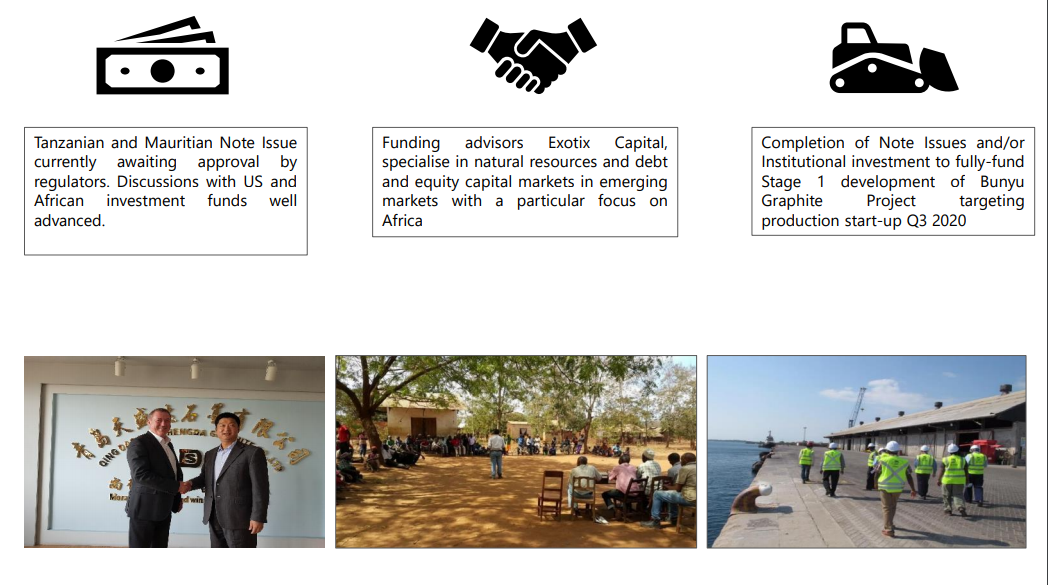

Funding Secured/ Initiatives Underway

Volt Resourcesâ Stage 1 Funding Strategy (Source: Company Presentation)

- In October 2018, Volt Resources announced to have appointed Exotix Capital as the funding advisor to carry out a Tanzanian Note Issue for raising funds for Stage 1 through the issue of a Prospectus to potential investors in East Africa by companyâs wholly-owned subsidiary Volt Graphite Tanzania plc (VGT).

The issue of the Prospectus to investors required the approval of Tanzaniaâs corporate regulator the Capital Markets and Securities Authority (CMSA). In addition, the Notes are to be listed on the Dar es Salaam Stock Exchange (DSE) which required the approval of the DSE. The DSE approval was received and announced to the market on 13 December 2018 while Volt Resources was engaged in discussions and exchange of correspondence with the CMSA.

In parallel, the company has also been progressing with alternative funding options including, but not limited to a Note Issue and Listing on the Stock Exchange of Mauritius (SEM) using the same Tanzanian Note Prospectus, and discussions continue with North America and Asia-based institutions via Exotix Capital to obtain access to a much larger pool of investors.

- In January 2019, the company secured a six-month funding facility of AUD 1.3 million from RiverFort Global Capital Limited and Yorkville Advisors Global, LP, with a Face Value of AUD 1,500,000 (Maturity: 14 September 2019).

- In May 2019, company Directors, Mr Kabunga and Mr Hunt, provided AUD 50,000 each in short-term working capital financing totalling AUD 100,000 (Repayable: 15 July 2019).

- On 24 June 2019, Volt Resources announced the receipt of USD 1 million in working capital funding via placement of 20,845,714 shares at 2.1 cents each, raising USD 300,000 and a USD 700,000 loan facility entered into with Mr Lars Bader, a Europe-based high net worth investor, who would also be issued 25,536,000 options (Exercise price: AUD 0.04; Maturity: 18 months).

- In the latest quarterly report for the three months to 30 June 2019, the company updated that the approval process for the Note Issue is approaching the final stages as in-country discussions and meeting progress with the Tanzanian Government. In addition, a draft prospectus concerning the proposed Bond Issue and listing on the SEM, is in the final stages of preparation.

- On 26 August 2019, Volt informed to have raised AUD 1,299,000 via an oversubscribed Share Purchase Plan and a further AUD 350,000 through a top-up placement to sophisticated and professional investors. The Lead Manager and Underwriter to the SPP was Patersons Securities, which also led the Placement.

The funds raised would support in mitigating short-term debt and move forward development initiatives while also providing for general working capital.

Offtake Agreements in Place

Binding Offtakes

- Volt signed its first binding offtake agreement with US-based Nano Graphene Inc for 1ktpa of product for a term of 5 years in 2017.

- In August 2018, a second binding sales agreement was executed with China-based integrated graphite processor and distributor, Qingdao Tianshengda Graphite Ltd. (Tianshengda) for 9 ktpa of flake graphite product over 5 years.

- Furthermore, in late August 2018, VGT signed a cooperation agreement with one of Chinaâs largest graphite companies, HAIDA Graphite.

Non-Binding offtake & Co-operation Agreements

- CNBMGM, Chinaâs largest building materials group (net assets of USD 79 billion): 10,000 -15,000tpa flake graphite concentrate with expandable focused product offtake, construction support and financing.

- Guangxing Electrical Materials, one of Chinaâs largest graphite processors and distributor: 5,000tpa flake graphite concentrate, value add graphite products, mainly expandable graphite.

- Aoyu Graphite, China-based leading graphite groups: 10,000-20,000tpa flake graphite concentrate with battery anode material processing and product offtake.

Stock Performance

The VRC stock settled the market trading on 3 September 2019 at AUD 0.012 with ~ 1.36 million shares traded. VRC has a market capitalisation of ~ AUD 19.26 million.

Disclaimer This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.