Highlights

- The ASX 200 benchmark index closed up today (31 October), gaining 77.80 points or 1.15% to end at 6,863.50 points.

- Over the last five days, the index has gained 1.24%, but is down 7.81% for the last year to date.

- Consumer Discretionary was the biggest gainer, advancing 2.73% followed by IT which ended 2.60% up, energy sector, however, went down 0.44%.

The ASX 200 benchmark index closed in green today (31 October), gaining 77.80 points or 1.15% to end at 6,863.50 points.

Key pointers from ASX close today

- The ASX 200 benchmark index closed up today (31 October), gaining 77.80 points or 1.15% to end at 6,863.50 points.

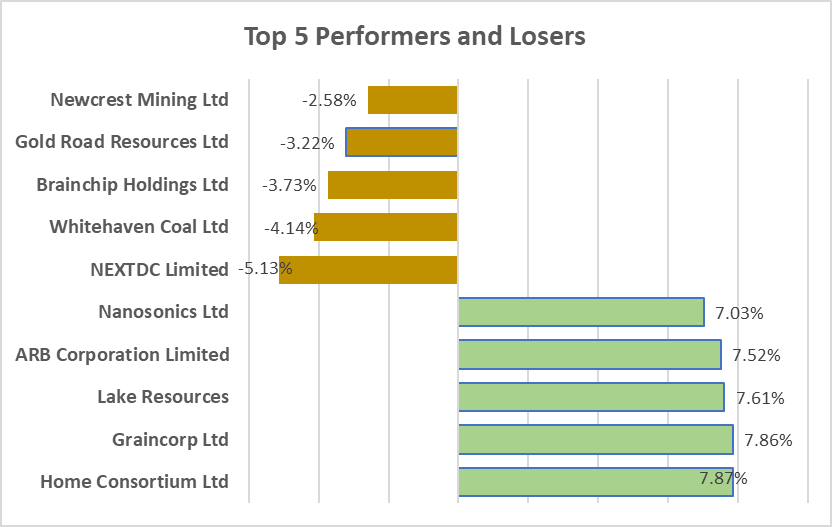

- Home Consortium Ltd (ASX:HMC) and Graincorp Ltd (ASX:GNC) gained the most on the index, moving ahead 7.87% and 7.86% respectively.

- NEXTDC LIMITED (ASX:NXT) and Whitehaven Coal Ltd (ASX:WHC) fell 5.13% and 4.14% respectively.

- Over the last five days, the index has gained 1.24%, but is down 7.81% for the last year to date.

- 10 out of 11 sectors closed in green today.

- Consumer Discretionary was the biggest gainer, advancing 2.73% followed by IT which ended 2.60% up, energy sector, however, went down 0.44%.

- The All-Ordinaries Index gained 1.17%.

Newsmakers

Culpeo Minerals (ASX:CPO): At its Lana Corina property in Chile, Culpeo Minerals has discovered 250 metres of visible copper sulphide mineralization in the first hole of its phase-two drilling campaign, the company said in an ASX filing today (31 October).

Mineralisation was found between 150 and 400 metres; the core is currently being sampled, and the results should be available in three to four weeks, added the company's announcement.

Meanwhile, shares of Culpeo Minerals closed trading flat at AU$0.11 each today.

West Cobar Metals (ASX:WC1): The Salazar rare earth elements clay project in Western Australia has officially been acquired by West Cobar Metals, according to the company’s statement in ASX.

The project includes granted tenements on non-agricultural undeveloped state land, mentioned the company's ASX statement.

Meanwhile, shares of West Cobar Metals closed trading flat at AU$0.18 per share today.

Image source: © 2022 Kalkine Media®

Data source- ASX website dated 31 October 2022

Bond yield

Australia’s 10-year Bond Yield stands at 3.76% as of 4.45 PM AEDT.

In global markets

On Friday, October 28, Wall Street indices ended the session higher as gains in the general market outweighed losses in the mega-cap technology stocks.

The S&P 500 rose 2.46% to 3,901.06. The Dow Jones was up 2.59% to 32,861.80. The NASDAQ Composite added 2.87% to 11,102.45, and the small-cap Russell 2000 rose 2.25% to 1,846.92.

In Asia, Nikkei in Japan increased by 1.66%, the Hang Seng in Hong Kong improved 0.047%, the Asia Dow gained 0.39% while Shanghai Composite in China decreased by 0.70% at 4.55 PM AEDT.

In commodities markets

Crude Oil WTI was spotted trading at US$87.27/bbl while Brent Oil was at US$94.90/bbl at 4.56 PM AEDT.

Gold was at US$1641.64 an ounce, copper was at US$3.43/Lbs and iron ore was at US$84.00/T at 4.56 PM AEDT.