Highlights

- The ASX 200 benchmark index closed in the green today (November 22), gaining 42.00 points or 0.59% to end at 7,181.30 points.

- Over the last five days, the index has gained 0.56%, but is down 3.54% for the last year to date.

- Energy was the biggest gainer, advancing 2.68%, followed by materials, which ended 1.36% up.

The ASX 200 benchmark index closed in the green today (November 22), gaining 42.00 points or 0.59% to end at 7,181.30 points.

Key pointers from the ASX closing today

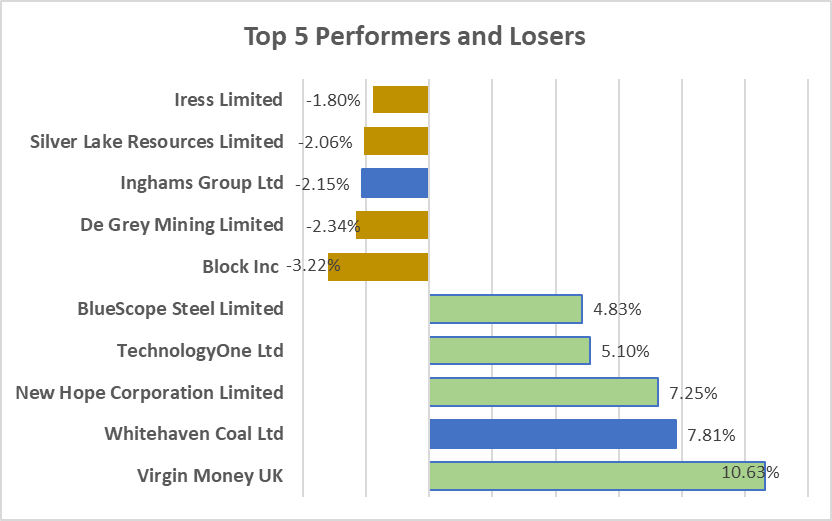

- Virgin Money UK (ASX:VUK) and Whitehaven Coal Ltd (ASX:WHC) gained the most on the index, moving ahead 10.63% and 7.81%, respectively.

- Block Inc (ASX:SQ2) and De Grey Mining Limited (ASX:DEG) fell 3.22% and 2.34% respectively.

- Over the last five days, the index has gained 0.56%, but is down 3.54% for the last year to date.

- Nine out of 11 sectors closed in green today.

- Energy was the biggest gainer, advancing 2.68%, followed by materials, which ended 1.36% up, while consumer staples fell 0.25%.

- The All-Ordinaries Index gained 0.56%.

Newsmakers

Arcadia Minerals (ASX:AM7): In an ASX filing, Arcadia Minerals said that the assays for the first hole that the company drilled at the Madube lithium pan inside its Bitterwasser project in Namibia have been received.

The drill hole produced a mineralised intersection measuring 9.6 metres with an average lithium grade of 605 parts per million (ppm).

Arizona Lithium (ASX:AZL): Arizona Lithium (AZL has formally begun work on a definitive feasibility study (DFS) for its Big Sandy project in Arizona.

The company claimed that it accelerated the start of the DFS as a consequence of "encouraging" findings from a scoping study for the project that was finished in October.

Image source: © 2022 Kalkine Media®

Data source- ASX website dated 22 November 2022

Bond yields

Australia’s 10-year Bond Yield stands at 3.61% as of 4.09 PM AEDT.

Global markets

Investors seemed keen to move past yesterday's China Covid concern as the ASX took in stride weaker leads from Wall Street and commodity markets. As new limitations in Beijing and other major cities weakened the prospects for global development, US markets slumped overnight.

The S&P 500 lost 0.39% to 3,949.94. The Dow Jones was 0.13% down to 33,700.28. The NASDAQ Composite decreased by 1.09% to 11,024.51, and the small-cap Russell 2000 fell by 0.57% to 1,839.14.

In Asia, Nikkei in Japan gained 0.69%, the Asia Dow was 0.11% up, Shanghai Composite in China increased by 0.58% while the Hang Seng in Hong Kong lost 0.69% at 4.12 PM AEDT.

Commodities markets

Crude Oil WTI was spotted trading at US$80.15/bbl, while brent was at US$87.66/bbl at 4.13 PM AEDT.

Gold was at US$1744.40 an ounce, copper was at US$3.59/Lbs, and iron ore was at US$97.50/T at 4.13 PM AEDT.