Penny Stocks are the stocks belonging to small companies. These Stocks trades at less than $ 1 on ASX. In the US markets, these are also referred as micro-cap or nano-cap stocks. The Australian Securities and Investments Commission (ASIC) governs penny stocks trading in Australia, to facilitate healthy trading and to keep investors interest.

Relatively lower market capitalisation of penny stock companies to other small-cap players attracts investors, as the probability of penny stocks doubling up in the shortest time frame is high, against the companies with larger market cap. Therefore, investors looking for investing in companies having high growth prospects often end up investing in Penny Stocks.

With S&P/ASX 200 Healthcare sectoral index climbing up the charts this year, investors are closely monitoring penny stocks in the respective domain. Let us look at 4 stocks in the related space

Sigma Healthcare Limited (ASX: SIG)

Sigma Healthcare Limited, worldâs leading pharmaceutical wholesaler and distributor, has been removed from S&P/ASX 200 Index by S&P Dow Jones Indices on 6 September 2019, as a part of Quarterly Rebalance of the S&P/ASX Indices for the month of September.

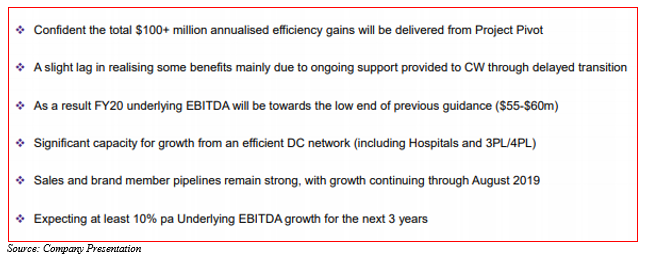

Business Transformation Program on track

The company recently released an update on its Business Transformation Strategy. Sigmaâs Project Pivot is currently undergoing major changes which in due course materially re-structure Companyâs ongoing business operations. Consequently, Sigma downgrades prospects in FY2019/2020.

In ASX release dated 5 September 2019, Sigma announced that it's Business Transformation program is progressing well as a result of continued growth in revenue. The Company made significant efforts in executing this transformation program properly to bring efficiency gains of $100+ million annually. An annualized cost of $33million have already being removed from the business after actions by the Company including layoffs, organizational realignment, and improved integration; subsequent profits will be released in 2H20 and later.

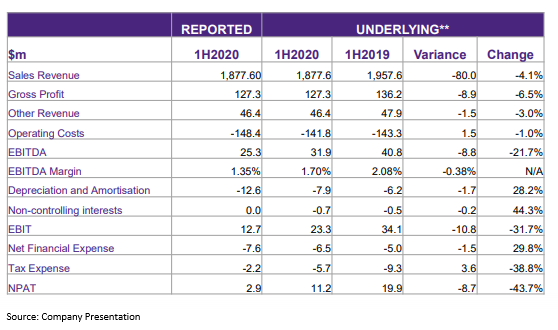

1H20 Financial Performance

The company recorded a 19.8% dip in reported EBITDA to $25.3 million for 1H20 in comparison to 1H19, indicating the net impact of one-off restructuring, counterbalanced by outstanding payment settlements and lease account standard changes. Underlying EBTIDA remained at $31.9 million, showing a dip of 21.7 %. The ongoing revenue (excluding CW and Hep-C) for the half-year was up by 6.9%.

Investments and Growth

A growth of 7.8% was realized by the Companyâs Pharmacy Brands persistent with previous year. For 1H20, Sigmaâs Hospitals reflected a strong growth in Western Australia and Victorian markets; market share grew by 8% with sales up by 23% (excluding Hep-C). As per the company, Hospital pharmacy markets, third party, and fourth-party logistics will remain important growth areas. Capital investment in competent infrastructure is in progress with the Distribution Centres (DC) based in QLD and WA being fully operational with the operations at new DC in SA and NSW in pipeline.

Capital management

High dividend payout ratios were maintained with 1.0 cents per share interim dividend (fully franked) to be paid on 4 October 2019 and recorded on 20 September 2019 with Ex-dividend on 19 September 2019, equating underlying NPAT payout ratio to 95%.

Outlook for FY2020

Stock Performance

Sigmaâs shares are trading at $0.590, down by 1.67 % by the close of market trading on on 6 September 2019 with a positive YTD return of 8.93%.

Painchek Limited (ASX: PCK)

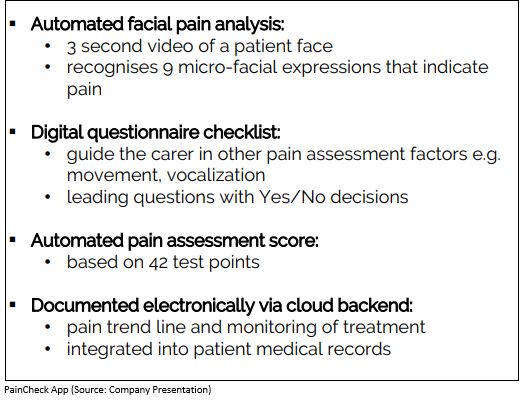

Paincheck Limited is a health care company dealing in intelligent assessment of pain, via PainChek®, worldâs first smart phone-based, clinically validated, regulatory cleared, pain assessment tool that utilizes machine learning approach to measure pain levels in real time and automatically updates the information in the cloud. Using artificial intelligence, the App recognizes the facial micro-expressions and identify, calculate and monitor pain in adults.

Recent Recruitment

The Company recently appointed Mr. Pete Shergill, as the Head of Business Development in United Kingdom, laying foundation in UK market.

Operational Review

- The Pain Assessment App is in use by more than 150 Aged care homes with people having dementia and cognitive impairment.

- A grant of A$5M to enable PainChek® App, in Australian Aged Care Facilities has been committed by Australian Federal Government, earlier in 2019.

- Distribution Agreement was signed between PCK and Person Centred Software, a globally leading software provider catering to the needs of old aged people, by virtue of which the company stepped into UK market.

- Most recently, the Company established Singapore regulatory clearance and marked its first entry into Singapore markets for PainChek®.

- The Company was also recently granted US Patent for PainChek®

- PainChek® further underwent a collaboration with Childrenâs Research Institute (MCRI) to broaden its activities in Infant care.

Financial Review

On 28 August 2019, PainChek Limited released preliminary annual report for the year ended 30 June 2019. Some highlights of its Financial Review are as follows:

Including the income tax benefit realized, the total loss of the Group for FY2019, was $3,262,418 in contrast to $4,810,532 for the year 2018. The results as on 30 June 2019 are as follows:

- The expenditure on Research & Development amounted to $1,894,53 when compared with $1,699,292 (FY2018).

- A noncash Share based payments to Directors and employees accounted for $112,911 as compared to $345,172 (FY2018).

- Administration & Commercial costs of $1,486,446 was recorded as compared to $1,198,311 (FY2018).

- No License acquisition fees for FY201,9 while an expenditure of $1,709,510 (non-cash $1,312,500) occurred in FY2018.

Stock Performance: PainChekâs shares are trading at $0.265 by the close of trading on on 6 September 2019, up by 1.92% with a remarkable positive YTD return of 534.15%.

MedAdvisor Limited (ASX: MDR)

MedAdvisor Limited is an e-healthcare software developer, engaged in addressing the global problem of medication non-adherence by making medication manageable to improve health outcomes in patients. The company also helps pharmacists to extend their services by digitization, generating revenues and saving time by streamlining delivery of medicines.

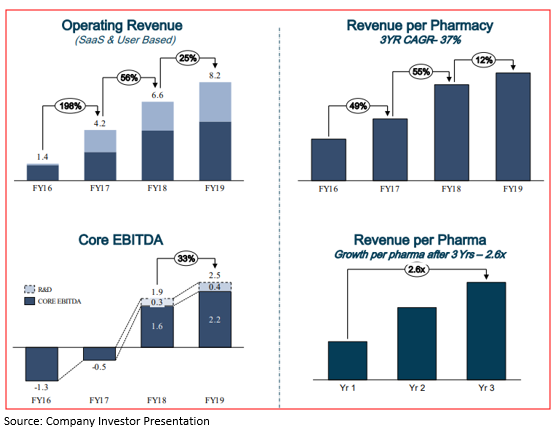

MedAdvisor released Investor Presentation for the fiscal year 2019, on 5 Septmeber. A remarkable development determined by high revenues and core EBTIDA has been observed by the Company in the FY 2019.

Financial highlights are as follows:

- 25% growth on total Operating Revenue of $8.2m; the total revenue recognized was $9.2 million.

- Out of Annual recurring revenue from SaaS, Operating revenue comprises 60%.

- TRevenues recognized by various user-based activities like Health Program revenue, SMS fees, and any other transaction fees, amounted to 40%.

- Significant increase of 48%, in revenues from pharmaceutical sector sponsored Health Programs was realized, corresponding to $1 million for FY2019.

- Stable High gross margins at 88% with lucrative core business.

- As on 30 June 2019, MedAdvisor Limited held $4.5 million cash.

Stock Performance: MedAdvisorâs shares are trading at $0.049 by the close of trading on on 6 September 2019, with a positive YTD return of 51.52%.

Osprey Medical (ASX: OSP)

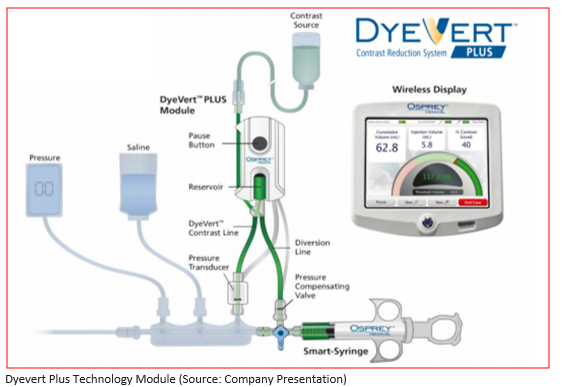

Osprey Medical is a health care company focused on revolutionizing chronic kidney disease treatment with novel DyeVert⢠technology of FDA-cleared, TGA-cleared and CE-Mark approved products, comprising of DyeVertâ¢, DyeVert⢠Plus and DyeVert⢠Plus EZ.

Ospreyâs Innovative Technologies

Contrast Inducted Acute Kidney Injury (CI-AKI) is a life-threatening disease caused by the harmful side effects of X-ray dyes used in imaging procedures for heart/legs, ~30% of all patients are at risk. For contrast Dye reduction in patients undertaking angiography, an FDA cleared device named DyeVert⢠is used by the company, without affecting quality of image. Over 40% average dye reduction achieved using this technology.

Hospital Cost Impact:

Most CI-AKI procedures result in poor outcome that increases the Hospital costs for patients, which is approximately US$1.7bn per year due to an increased length of stay, 30-day readmissions & bundled payment risk at hospitals. Above and beyond, AKI results in increased mortality rate in patients and most likely, these patients are discharged to non-home facilities.

Ospreyâs positive acceptance in the market:

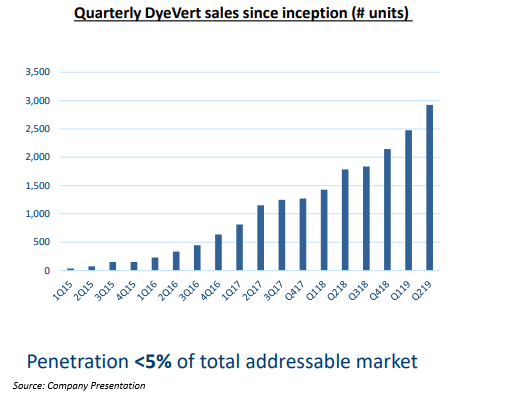

Significant acceleration in unit sales (63%) in Q2 2019 has been achieved by the company in contrast to Q2 2018 (as depicted below); hospital purchasing year over year increased by 19%, with a remarkable growth of 53% in revenues in Q2 2019 compared to Q2 2018.

Market Prospects

In US & WA, DyeVert plus and DyeTect has market opportunity of 3.2 m & 3.5 m procedures per year respectively; the total US addressable market worth is US$1.65 billion with minimal penetration to date.

GPO Strategy

The Group Purchasing Organisations strategy, implemented by Osprey in FY18 represents largest networks of hospitals and health care providers in the US with largest global healthcare databases. The company noted GPO-based unit sales growth of 162% in 2Q FY19 with respect to 1,741 units in pcp, and US DyeVert sales mix of 67% compared to 39% in pcp.

Stock Performance: OSP was trading at $0.049, down by 2% by the close of trading on on 6 September 2019 with a negative YTD return of 51.52%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.