How to Find Value Stocks on ASX

Value Stock: Value stock is a stock that has a good future prospect of growth and trades at a lower price relative to its fundamentals. It is most likely to come from a mature company with stable dividends but is temporarily in a bad condition. Hence, the investor wants to profit on market inefficiencies since the intrinsic value of the security doesnât match the market value. ASX may be trading at high but this doesnât mean undervalued stock are difficult to find.

How to value a stock: Before buying a stock, it is important to learn that the intrinsic value of the stock may or may not be the same as the current market value. Thus, it is important to incorporate all the market information to value a security. P/E ratio is one of the most followed metrics to relatively value a stock. The lower P/E ratio indicates that the company may be undervalued. Investors while valuing a stock must also take into consideration the qualitative factors such as a company's economic condition, competitive advantage and intangible assets.

Let us have a close look at some value stocks.

Challenger Limited

Investment management firm, Challenger Limited (ASX: CGF) is divided into two operating segments of Life and Fund Management. The Life segment is serviced by the distribution, product and marketing team responsible for the appropriate distribution of Lifeâs product. The Fund Management segment focuses on the retirement saving phase of the superannuation system by providing products with higher investment returns.

Recently Challenger made several announcements regarding the change in substantial holdings.

- On 3 October 2019, the company unveiled to have ceased to be a substantial holder in IRESS Limited.

- On 2 October 2019, CGF announced that it ceased to be a substantial holder in Southern Cross Media Group Limited.

- Additionally, the company made a change in its substantial holding in Capitol Health Limited, due to which its voting power increased from 9.27% to 10.29%.

- Moreover, CGF became an initial substantial holder in Steadfast Group Limited.

The company is scheduled to hold its annual general meeting on 31 October 2019.

Final 2019 Dividend Re-Investment Plan: The company, on 20 September 2019, announced that the issue price under the Dividend Reinvestment Plan for the final 2019 dividend is $7.0372 each share. New ordinary shares of the company will be issued targeted towards meeting the DRP requirements.

Dividend: Recently Challenger also gave an update to an ordinary fully paid dividend announced to the market on 18 September 2019. The dividend amount of $0.18 per share for the six-month period ended 30 June 2019 was scheduled for payment on 25 September 2019.

Stock Performance: The stock closed the dayâs trading at $6.930 on 4 October 2019, which is close to its 52-week low of $6.220. The stock performance went down by 14.09% in the past 6 months but managed to increase by 6.76% in the last 30 days with a PE Ratio of 13.65x and annual dividend yield of 5.11%.

Premier Investments Limited

Premier Investments Limited (ASX:PMV) operates several speciality retail fashion chains with markets in Australia, New Zealand, Asia and Europe.

Dividend Distribution: The company announced an ordinary fully paid dividend of 37 cents per share due to the continued strength of Balance Sheet and strong performance of Premier Retail on 20 September 2019 which is to be paid on 15 November 2019.

FY19 Financial Performance (as at 30 June 2019)

- During the year, NPAT of the group increased by 27.7% from FY18 to $106.8 million.

- Sales for the year went up by 7.5%, wherein LFL Sales contributed to the increase in performance by 4.7% on a constant currency basis and apparel sales by 6.9%. There was a record of online sales of $148.2 million growing to 13.4% and Peter Alexander sales of $247.8 million.

Strong Cash Flow and Balance Sheet

- Net cash generated for the year went up by $30.1 million or 32.3% on FY18 to $123.3 million, leaving the cash in hand of $190.3 million at end of FY19.

- Balance sheet at end of FY19 shows investment in associate entity as $238.7 million, whereas the market value of this investment at the end of FY19 was $691.7 million.

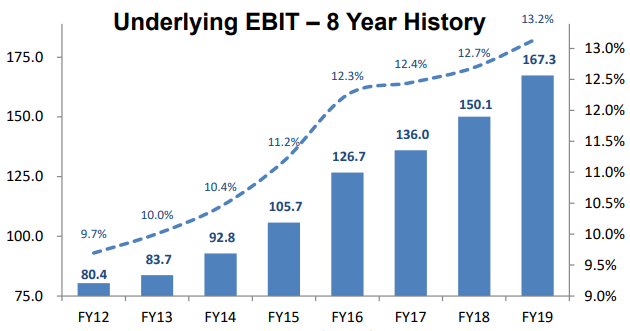

Business Achievements: Premier Retail delivered 8 consecutive years of EBIT growth, where the underlying EBIT margin to sales went up by 47 bps on FY18.

(Financial Snapshot Source: Investorâs Presentation)

Stock Performance: The stock of PMV last traded at $18.85 on 4 October 2019 which is close to its 52-week high of $20.120. The performance of the stock return was of +30.93% on YTD basis and 28.87% in the past 30 days. The market cap of the company is $2.99bn earning an annual dividend yield of 3.71%.

Lovisa Holdings Limited

Lovisa Holdings Limited (ASX: LOV) is engaged in the business of retail sale of fashion jewellery and accessories. The company is now trading at 390 stores in 15 countries.

Dividends: The company announced an ordinary fully paid dividend of AUD 0.015 per share on 22 August 2019 which is to be paid on 24 October 2019.

FY19 Financial Performance (as at 30 June 2019)

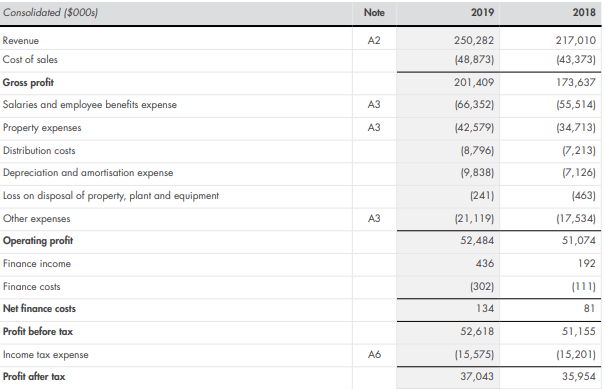

- For the year ended 30 June 2019 the Group reported a net profit after tax of $37.0 million following same store sales being down 0.5% and the addition of net 64 stores across the globe. This was also assisted by an increase in gross margin on the back of tight inventory management and the stronger USD hedge rate during the period.

- The Groupâs reported a revenue of $250.3m, being a 15.3% increase on the prior year with comparable sales being down 0.5% across the Group. The offshore expansion continued during the year with the addition of a net 64 stores across the Group, comprising of 70 new stores including new stores in France and the USA, offset by 6 stores closed.

Earnings before interest and tax (EBIT) was $52.5m being a 2.8% increase on EBIT from the prior year. Financing costs were positive during the year following strong cash flow and debt facilities remaining undrawn for much of the year.

(Snapshot Source: Companyâs Annual Report)

Cash Flow: The Groupâs net cash flow from operating activities increased by $8.3m during the year to $68.9m. Capital expenditure of $24.1m relates predominately to new store openings and refurbishments of current stores upon lease renewal.

Stock Performance: The LOV stock last traded at $12.820 on 4 October 2019, which is very close to its 52-week high of $13.430, earning an annual dividend yield of 2.62%. The stock return was +35.48% in the past 6 months period.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_06_19_2025_05_49_07_385844.jpg)