In this article, we will look at the latest developments of five stocks across different sectors.

ClearVue Technologies Limited (ASX:CPV)

ClearVue Technologies Limited provides solutions related to solar energy, which includes making integrated photovoltaic for buildings, glass, building surfaces, thin-film photovoltaic cells and panels to provide renewable energy. The company incorporates Solar PV cells at the edges of an Insulated Glass Unit (IGU), which has patented proprietary nano and microparticles. These IGUs are used in the windows & between the glass.

Signed OEM Agreements in Different Parts of the World During December Quarter

The company announced on 19 December 2019 that it had signed an OEM Manufacturing Agreement with Jiangsu YY Windows and Curtain Wall System Co. Ltd in China. As part of the agreement, YY Windows will become ClearVue’s OEM manufacturer. YY Windows will develop finished windows products for the company as well as its licensed distributors.

Highlights from ClearVue’s Quarterly Activity Report for the period ended 31 December 2019

During the December quarter, ClearVue appointed Full Treasure Engineering Limited as CPV’s exclusive licensed distributor for the Hong Kong and Macau SARs of the People’s Republic of China in Hong Kong. The company also completed the certification testing of the International Electrotechnical Commission (IEC), which has paved the way to sell the ClearVue solar PV IGU product in Europe and many other international markets.

Also, ClearVue had signed OEM Supply Agreement with BeyondPV of Taiwan in the quarter. Further, the company and ROOTS Sustainable Agricultural Technologies Limited had entered into a Collaboration Agreement for exploring the opportunities for complementary sales.

ClearVue had a cash balance of ~$1.8 million as of 31 December 2019.

Stock Performance

CPV’s stock last traded at $0.160 on 10 February 2020, in line with the previous close. The company had returns of 6.67% and -23.81% in the last three months and last six months, respectively.

Los Cerros Limited (ASX:LCL)

Los Cerros Limited engages in the discovery and mining of gold and silver deposits. The company was formed through the merger of Metminco Ltd and Andes Resources Limited in August 2019.

Completion of Mollocas sale

On 10 February 2020, Los Cerros announced the completion of Mollacas project in a deal worth $1.3 million. The entire amount was paid in cash, further strengthening the company’s balance sheet.

Intent to raise funds, explore Chuscal prospect

On 05 February 2020, Los Cerros announced that it had received binding obligations to raise ~$2.1 million (before costs) through the placement of 52.5 million fully paid ordinary shares at an issue price of $0.04 per share. The company will also raise funds through share purchase plan (“SPP”) at the same issue price.

The placement is planned to take place in two tranches, and the company needs the shareholder approval at the General Meeting expected to take place in March 2020. The funds raised will be used to develop the Quinchia project, including Tesorito, Chuscal and Miraflores.

In 2020, the company plans to drill the Chuscal prospect after 3D modelling and geochemical profiling work. LCL stock was placed in trading halt till 5 February 2020 at the request of the company as the company announced that it has transferred the titles related to Mollacas project in Chile to Agricola Bauza Limited and has sold the mining titles to Minera Santa Isabel Limitada. The process of transferring the sale proceeds of approximately US$1.0M to Los Cerros had started that time. However, this announcement had not lifted the company’s trading halt.

Stock Performance

LCL’s stock last traded at $0.040 on 10 February 2020, an increase of 2.564% compared to the previous close. The company had returns of -58.51 % and -51.25% in the last three months and last six months, respectively.

MMJ Group Holdings Limited (ASX:MMJ)

MMJ Group Holdings Limited, formerly known as MMJ PhytoTech Limited, makes investments in multiple sectors related to cannabis, including healthcare, equipment, retail and infrastructure, among others.

Signed a secured loan agreement with Harvest One Cannabis Inc

On 14 January 2020, the company had signed a secured loan agreement with Harvest One Cannabis Inc. (HVT) worth C$2 million at an interest of 15% per annum. MMJ holds a 26% stake in HVT.

Stock Performance

MMJ’s stock last traded at $0.125 on 10 February 2020, in line with the previous close. The company had returns of -35.90 % and -53.70% in the last three months and last six months, respectively.

Novatti Group Limited (ASX:NOV)

Novatti Group Limited offers global software technology, payment services, and utility billing, and is a leader in digital banking.

Signed non-binding MOU with Rent.com.au:

On 07 February 2020, the company signed a non-binding MOU with Rent.com.au for the redevelopment of the rental payments’ platform, RentPay, to be offered to both tenants and agents. The platform will also offer administrative support for agents, that will include automated missed-payment communications apart from providing the tenants with the rental payments and value-added marketplace services.

The company plans to negotiate and sign binding agreements within one month. Moreover, as per this agreement, NOV will get $250,000 for accessing its full technology offering, including Alipay and WeChat payments, and an agreement must be signed for ongoing, multi-year paid processing services on commercial terms, which will further strengthen NOV’s core business.

Further, NOV will acquire 2.5% of RentPay for $250,000 and the company will have an option to increase this investment to 10% afterwards. As per the agreement, NOV will get ongoing fees for rendering transaction services, which will depend upon the taking of the service, after the company’s platform goes into service.

Stock Performance

NOV’s stock last traded at $0.190 on 10 February 2020, a decline of 2.564% compared to the previous close. The company had returns of 5.41 % and 14.71% in the last three months and last six months, respectively.

Saracen Mineral Holdings Limited (ASX:SAR)

Saracen Mineral Holdings Limited focuses on the production and exploration of gold and other minerals.

Sold 10.5% stake in Red 5 Limited

The company has recently sold the 10.5% stake in Red 5 Limited in a deal worth ~$39 million through a bookbuild process at A30c per share. The company will use the proceeds of the sale for the payment of a debt that the company had taken for acquiring a 50 per cent share of the Kalgoorlie Super Pit.

In the December quarter, the company had produced 120,127oz of gold at AISC of $1,098/oz and sold 117,575oz of gold at an average sale price of $2,034/oz. Moreover, the company expects group production to be more than 500koz in FY 2020 and group production guidance to be more than 600koz in FY 2021.

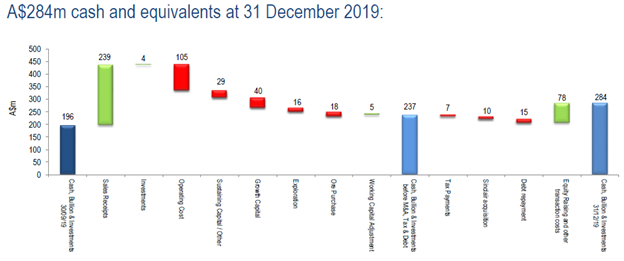

Cashflows (source: Company Reports)

Stock Performance

SAR’s stock last traded at $4.130 on 10 February 2020, an increase of 1.975% compared to the previous close. The company had returns of 11.00 % and -10.81% in the last three months and last six months, respectively.