Highlights:

- American Tower’s operating revenue in Q3 2022 was US$ 2,671.5 million.

- Prologis’ net earnings per diluted share of the company in Q3 2022 were US$ 1.36.

- American Tower has a dividend yield of 2.811 per cent.

The economic headwinds impacted the real estate sector in 2022 like all other sectors. The slump in the industry is understandable due to rising interest rates by the Central Bank, a dip in demand, and a shortage of supply in new housing last year. So far, the market seems normal in 2023, but it is too early to predict anything.

In this article, we look at two US real estate stocks and their recent activities, financials, etc., in the past quarter:

American Tower Corporation (NYSE:AMT)

American Tower has more than 220,000 cell towers across the US, Latin America, Africa, and Europe. The company also has and operates 25 data centers functioning in eight US markets after it bought CoreSite. With a dividend yield of 2.811 per cent, the American Tower board of directors approved a quarterly dividend of US$ 1.56 per share to be paid to shareholders on February 2, 2023.

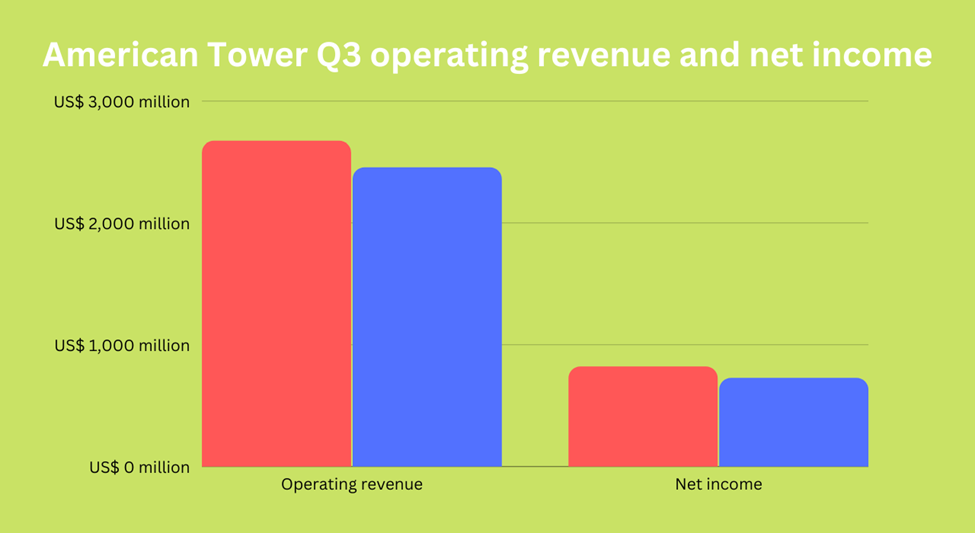

The total operating revenues of American Tower in the three months that ended September 30, 2022, was US$ 2,672 million, up eight per cent year-over-year (YoY).

The net income of the company in the reported quarter in 2022 was US$ 820 million, representing an increase of 12.9 per cent YoY. The AMT stock gained more than 4.76 per cent YTD.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Prologis Inc. (NYSE:PLD)

Formed in June 2011 as a merger between AMB Property and Prologis Trust, the company is engaged in developing, acquiring, and operating about one billion square feet of industrial and logistic spaces worldwide. The company launched two major EV charging points as part of its Prologis Mobility platform on November 15, 2022.

In the third quarter of 2022, the rental revenues of Prologis were US$ 1.15 billion compared to US$ 1.03 billion in the year-ago quarter.

The company's net earnings per diluted share in Q3 2022 were US$ 1.36 against US$ 0.97 in Q3 2021.

The PLD stock rose 2.95 per cent YTD.

Bottom line

Investors should not go overboard when the market is in turmoil and put their money on stocks only after thorough analysis.