Summary

- CMA slapped fines of over £260 million on drug makers after investigations revealed NHS was overcharged close to a decade for hydrocortisone tablets.

- Prices of hydrocortisone increased by over 10,000 per cent over the years.

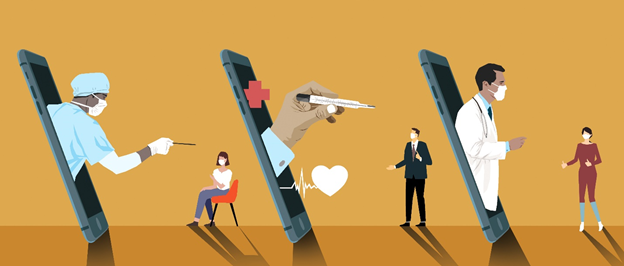

- Several citizens depend on hydrocortisone tablets for the treatment of adrenal insufficiency.

The Competition and Markets Authority (CMA) slapped fines over of £260 million on drug makers following investigations that revealed the NHS was overcharged for a period close to a decade for life-saving hydrocortisone tablets.

The competition watchdog has also found that the prices of hydrocortisone increased by over 10,000 per cent. Investigations revealed that potential rivals were bought off by pharmaceutical companies to avoid competition with drugs made by these companies, thus retaining the ability to increase prices.

Accord-UK and Auden Mckenzie took advantage of being the sole makers of hydrocortisone and increased its price, according to the CMA. Several citizens depend on hydrocortisone tablets for the treatment of adrenal insufficiency, including life-threatening conditions like Addison’s disease.

For one pack of 10 mg tablets, the price NHS had to pay increased from 70p in 2008 to £88 in 2016. In the same period, for the 20mg tablets, prices increased to £102.74 from £1.07 per pack. By 2016, NHS’ spend on hydrocortisone tablets rose to more than £80 million from £500,000 in 2008.

Copyright © 2021 Kalkine Media

Copyright © 2021 Kalkine Media

Here are 5 largest AIM-listed pharmaceutical stocks by market capitalisation and how the stocks reacted to the news:

Hutchmed (China) Limited (LON:HCM)

The shares of the drug manufacturing and selling company ended up by 0.55 per cent at GBX 544 on 15 July.

The shares of the company have a one-year return of 23.64 per cent with a market capitalisation of £4,590.47 million.

The company began its Phase-1 study of HMPL‑295, which can potentially address how to acquire resistance from upstream mechanisms like MEK, RAF, and RAS. This is the company’s first of the multiple prospective discoveries to address the RAS-MAPK pathway, first diagnosed in a patient on 2 July 2021.

MaxCyte Inc (LON:MXCT)

Shares of the US cell-based medicine manufacturing company ended down by 3.57 per cent at GBX 1,080 on 15 July.

The shares have a 379.41 per cent one-year return and a market capitalisation of £948.86 million.

The company recently signed a strategic platform licence with biotechnology company Celularity Inc. This would enable Celularity to get for use non-exclusive rights of a MaxCyte technology and platform. MaxCyte would be earning milestone payments related to the programme and licensing fees as part of the agreement.

Clinigen Group Plc (LON: CLIN)

The shares of the global pharmaceutical company ended lower by 1.82 per cent at GBX 594 on 15 July. The shares have a market capitalisation of £804.82 million.

For the year ended 30 June 2021, the company’s net revenue is expected to be £455 million, a 12 per cent increase on a constant currency basis. EBITDA is likely to be at £116 million, which is within the guidance range of £114-£117 million. For FY2022, the company expects its EBITDA to grow in double digits.

Silence Therapeutics Plc (LON:SLN)

Shares of the gene therapeutics technology company ended down by 1.47 per cent at GBX 605 on 15 July. The shares have a market capitalisation of £550.67 million and have given a one-year return of 44.34 per cent.

For the phase 1 trial of its SLN124 among healthy volunteers, data revealed that it was effective in bringing down plasma iron levels and was safe for use. Data also revealed that it has a long duration of action. In the ongoing Gemini II phase 1 study of SLN124, the company expects to study the effects on anemia in those with MDS and thalassemia, as well as a measure of the production of red blood cells.

Ergomed Plc (LON:ERGO)

Shares of the drug developer closed higher by 5.86 per cent at GBX 1,175 on 15 July.

The shares have a market capitalisation of £541.89 million and have a one-year return of 134.67 per cent.

The company recently announced that its PrimeVigilance business formed its new regional office and a legal entity in Japan which became operational from 26 April 2021 onwards. The company would be offering a complete range of pharmacovigilance services and is based out of Tokyo.