Highlights

Polarean Imaging's revenue surged significantly, reflecting strong market acceptance.

Strategic cost management has extended cash runway into 2026, bolstering financial stability.

The company is set to capture a large share of the medical imaging market, aided by ongoing advancements

The medical imaging sector is an integral part of healthcare, offering diagnostic solutions that are essential for improved patient care. Companies in this space, FTSE 100 including Polarean Imaging PLC, have become key players in advancing medical technology, with a growing focus on creating more effective imaging tools. Polarean, listed on the LSE under the ticker (LSE:POLX), is part of the growing momentum in medical imaging. Amid various challenges, including evolving funding landscapes, Polarean continues to push the boundaries of medical imaging, solidifying its position in the market.

Revenue Growth Amid Challenges

Polarean Imaging PLC has demonstrated remarkable financial growth, with a sharp increase in revenue for the year. Despite challenges within the US academic funding space, the company's innovative solutions in medical imaging have contributed to impressive revenue numbers. This growth reflects not only the increasing demand for advanced medical imaging technology but also the company’s ability to adapt and thrive in a fluctuating economic environment. Although there were some delays in order fulfillment during the first quarter, the overall market response to Polarean’s products remains positive, underscoring the strength of its position in the sector.

Financial Management and Cost Reduction Efforts

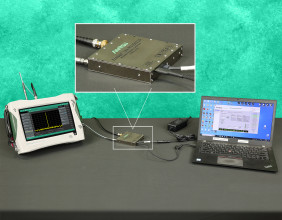

Polarean has also effectively managed its financial resources. A key highlight for the company was its reduction in clinical trial expenses following feedback from the US Food and Drug Administration. The trial, which is aimed at enhancing gas exchange imaging technology, is now expected to cost significantly less than originally planned. This cost-saving measure ensures that the company remains well-capitalized, with its cash runway extending into the second quarter of 2026. Polarean’s careful financial planning provides a foundation for continued operational stability and sustainable growth.

Strategic Position in the Market

The company’s commercial efforts are starting to yield positive results. Polarean's imaging products are becoming increasingly recognized in academic institutions and healthcare settings. With rising demand for cutting-edge imaging solutions, the company is in a strong position to capture additional market share. Polarean has set its revenue targets for the year, indicating a confident outlook for the second half. Even with ongoing pressure from funding constraints, the company's commercial strategy remains focused on driving growth in the coming months.

Polarean’s proactive strategies in managing funding challenges, such as the reduction in clinical trial costs, have positioned the company favorably within the medical imaging market. With its solid commercial team and continued focus on innovation, the company is well-placed to maintain its growth trajectory in an ever-evolving market.

Market Sentiment and Industry Impact

The broader implications of Polarean's achievements go beyond the company's specific financial results. As the medical imaging industry faces constant advancements and challenges, companies like Polarean serve as examples of how adaptability and technological innovation can fuel progress in the sector. With its efficient cost management strategies and cutting-edge imaging technology, Polarean sets a benchmark for the industry.

The developments within the medical imaging space, especially in the field of gas exchange imaging, highlight a broader trend toward improving diagnostic accuracy and patient care. As Polarean continues to innovate, its role in shaping the future of medical imaging remains significant, offering new standards for medical technology and diagnostic solutions.