Summary

- Countrywide Plc had reported a contraction in revenue of 28.0% during H1 FY20.

- The loss of the Company from continued operations was £40.1 million during H1 FY20.

- The Company had agreed on the recommended cash offer of approximately £134 million from Connells Limited on 31 December 2020.

- The net debt to EBITDA stood at 2.1x as on 30 June 2020.

Countrywide Plc is the UK based company that provides real estate services. The Company had various reportable business segments like Sales, Lettings, B2B, financial services and other services.

Countrywide Plc (LON:CWD) is the LSE listed real estate services stock. Based on 1-year performance, shares of CWD have generated a return of 15.24%. Shares of CWD were down by close to 0.15% from the last closing price (as on 05 January 2021, before the market close at 10:20 AM GMT).

Business Model

The Company provides agency services and lettings services. Countrywide estate agency network consists of over 63 well-known brands. The Company has around thousands of properties listed with the agents. Countrywide residential lettings provide a wide variety of lettings services to landlords and tenants covering the entire UK. The Company has over 600 offices in the UK and 74,500 properties under its management. Some of the key brands of the Company is shown below -

(Source: Company website)

Recent News

On 31 December 2020, the Board updated that they have accepted the conditions of a recommended cash offer of approximately £134.4 million from Connells Limited. As per the terms of the agreement, each Countrywide shareholder will receive 395 pence in cash for a share. Connells Limited and Countrywide are two UK’s most prominent estate groups.

Connells had made an earlier offer of 250 pence per share in early November 2020. Later the bid was increased to 325 pence per share in early December 2020. Countrywide has 651 branches, and Connells Group has 581 branches in total. This transaction will merge 60 popular brands of Countrywide with 25 well-known brands of Connells. The transaction will be proceeded by way of a court-sanctioned arrangement between Connells and the Countrywide Shareholders. It is expected to reach completion by Q1 FY21.

On 24 November 2020, the Company announced that Peter Long had resigned from the position of Executive Chairman and retired from the role of director of the Company effective from the same day. The Company had also updated regarding the appointment of Philip Bowcock as the interim CEO with an immediate effect.

On 22 October 2020, the Company had updated a capital raising of £90 million as a proposed recapitalisation of the business. The transaction would be underwritten by private equity investor, Alchemy Partners.

Financial Highlights (for six months ended on 30 June 2020 as on 22 October 2020)

(Source: Company result)

- The Company had reported 28% contraction in revenues from its continued operations from £241.6 million for H1 FY19 to £173.8 million during H1 FY20 ended on 30 June 2020.

- Similarly, the adjusted EBITDA also declined by 23% to £14.9 million during H1 FY20, while it was £19.2 million for the equivalent period of the prior year. The EBITDA margin during H1 FY20 was 8.5% compared to 7.9% achieved during H1 FY19.

- The Company had incurred fixed costs of £4.6 million due to unutilised premises and vehicles of employees in full during the lockdown period.

- The Company had decided to provide furlough support to its 78% of employees under Government’s Coronavirus Job Retention (“CJR”) Scheme.

- The loss of the Company from continued operations was £40.1 million during H1 FY20.

- Regarding its financial position, the Company had managed to reduce its net debt from £82.9 million during H1 FY19 to £47.3 million for H1 FY20.

- The net debt to EBITDA stood at 2.1x as on 30 June 2020.

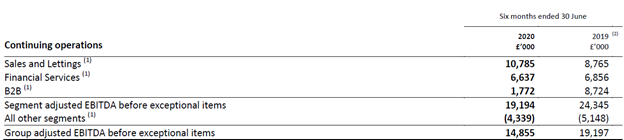

Segmental Performance Update

(Source: Company result)

- The adjusted EBITDA for sales and lettings business segment continued to be profitable for H1 FY20 and demonstrated a surge of nearly 23% from £8.8 million during H1 FY19 to £10.8 million during H1 FY20. The revenues across sales and lettings business segment were declined by 33% and 11% year-on-year basis during H1 FY20 with lettings business impacted by the loss of £8.0 million in tenant fees.

- The financial services business segment adjusted EBITDA went down by 3% to £6.6 million for H1 FY20. The financial services income was reduced to £29 million during H1 FY20 although implementation of CJR had resulted in decent adjusted EBITDA.

- The adjusted EBITDA for B2B business segment also went down to £1.8 million for H1 FY20 due to restrictions on conducting physical valuations. The valuations taken by the Company during the lockdown period represented just 36% of volumes over the equivalent period in 2019.

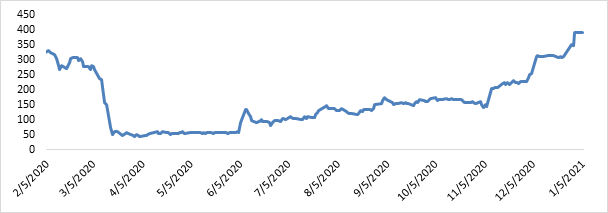

Share Price Performance Analysis of Countrywide Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of Countrywide Plc were trading at GBX 391.20 and were down by close to 0.15% against the previous closing price as on 05 January 2021, (before the market close at 10:20 AM GMT). CWD’s 52-week High and Low were GBX 395.00 and GBX 38.60, respectively. Countrywide Plc had a market capitalization of around £197.78 million.

Business Outlook

The Company was unable to provide proper financial guidance for FY20 ended on 31 December 2020 due to heightened level of uncertainties caused by Covid-19 pandemic. The Company had demonstrated decent trading performance reflected by its several key performance indicators. The business is driven by the stamp duty holiday initiative taken by the UK Government for properties up to £500,000. The Company remained cautiously confident regarding the potential long term impacts of Covid-19 pandemic.