Highlights

- UK shares finally managed to surpass the yearly peaks on Friday, 15 October

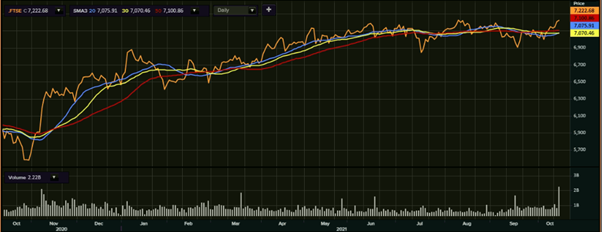

- FTSE 100 gained approximately 0.49% to register a new 52-week high of 7,242.73

- The mid-cap barometer FTSE 250 traded slightly higher

UK shares finally managed to surpass the yearly peaks on Friday, 15 October, with the benchmark FTSE 100 hitting a fresh 52-week high as investors accumulated heavyweight shares before the major round of corporate earnings starting next week. Shares of blue-chip companies including HSBC Holdings Plc (LON: HSBA), Royal Dutch Shell Plc (LON: RDSA) and BP Plc (LON: BP) provided a major boost to the index.

According to the London Stock Exchange, the headline FTSE 100 gained approximately 0.49% to register a new 52-week high of 7,242.73, surpassing the previous peak of 7,220.14 (achieved in August this year).

FTSE 100 (1-year performance)

Source: REFINITIV

The continuous buying momentum has led the index into the positive territory with the market participants awaiting an update on the July-September trading as all the businesses operated with the least possible restrictions during the quarter for the first time in the pandemic era.

Also Read | UK to ease visa rules for foreign HGV drivers: Can these 3 stocks gain?

A sharp focus will remain on the full year guidance and any indication on the upcoming quarters as enterprises continue to face the hardships of workforce limitedness, raw material shortage, rising inflation and supply chain troubles.

The mid-cap barometer FTSE 250 traded slightly higher as compared to FTSE 100 but the gains of all the major stock indices including the broader FTSE 350 and FTSE All Share were capped under 0.50%. At the day’s high of 22,969.99, FTSE 250 still trades 5.68% below its 52-week high of 24,353.85, achieved in September 2021. This shows the persisting weakness and lost confidence of investors with regard to the mid-cap shares, subsequently the medium-scale corporations.

Top global cues to watch out before ASX opens

Supplementing the rise, shares of HSBC Holdings, Royal Dutch Shell and BP lead the charge, partly offsetting the losses realised due to falling shares of AstraZeneca Plc (LON: AZN), Unilever Plc (LON: ULVR), Diageo (LON: DGE), GlaxoSmithKline Plc (LON: GSK) and Rio Tinto Plc (LON: RIO).

The stock of HSBC Holdings rose as much as 2.04% to an intraday high of GBX 434.70 from the previous closing of GBX 426, shares of Royal Dutch Shell jumped 1.58% to GBX 1,771.80 from last close of GBX 1,744.80, while the market price of BP shares advanced 1.87% to GBX 364.40 from the share price level of GBX 357.70 apiece.

Also Read | Royal Mail & Wincanton: 2 logistics stocks with over 70% return in a year

Investors’ optimism towards the London equities have improved in the recent past, though there is a room for considerable upsurge as the benchmark FTSE 100 still trades below the pre-pandemic highs. It would be eventful to watch the index breaching the pre-Covid peaks in the current year. The upcoming set of earnings, holiday season spending, effective resumption of holidays and leisure activities, resurrection of the supply chain system and moderating rate of inflation will remain the key drivers for the domestic equities in the near term.

A 5% correction in the FTSE 250 shows faltering confidence in the mid-caps for now as investors fear that the major repercussions of the acute staff shortages and malfunctioned supply chain and logistics systems will majorly trouble the medium-size corporations.

.jpg)