LONDON, March 27, 2024 /PRNewswire/ -- New research from Omdia has revealed that the global semiconductor supply chain is forecasted to reach approximately $600 billion by 2024, having navigated through strategic inventory adjustments in recent quarters. Encouragingly, the semiconductor industry anticipates a promising trajectory as enterprises increasingly harness generative AI capabilities, propelling fresh demand throughout the supply chain. The news comes as Omdia analysts prepare to present insights at Omdia's Taiwan Technology Conference taking place in Taipei on April 17 and 18, 2024.

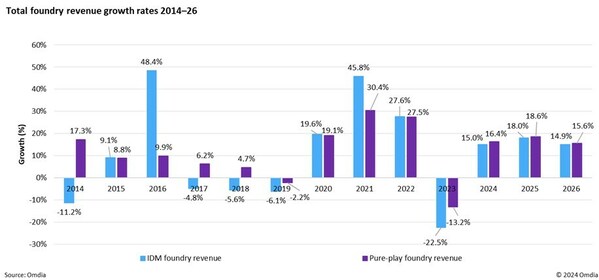

Since 2023, the global semiconductor industry has strategically adjusted inventories owing to the macroeconomic headwinds that have caused softer than expected demand and slower inventory adjustment. Simon Chen, Principal Analyst at Omdia, will share insights into the industry's resilience in managing inventory levels and revenue in 2024. As an integral part of the semiconductor supply chain, the pureplay foundry industry echoed the underlying tones of the semiconductor supply chain. Omdia forecasts that the pureplay foundry industry will grow by approximately 16% in 2024, due to gradual demand recovery and inventory completion from more and more applications.

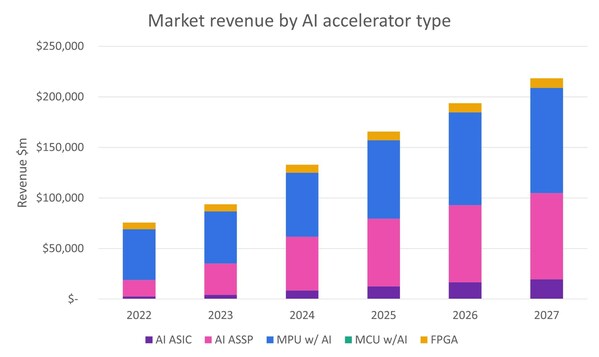

Notably, recent advancements in generative AI technology have spurred significant interest among major tech players and enterprises, sparking heightened demand for AI chips. Omdia's research will explore key questions on the future landscape of AI acceleration technologies, beyond GPU dominance, and sheds light on the current and future competitive dynamics in the AI space at the upcoming Taiwan Technology Conference.

Omdia Senior Analyst, Claire Wen, comments "NVIDIA currently dominates the AI accelerator market, particularly for cloud and data center deployments. Concurrently, major hyperscale cloud service providers like Google, Amazon, and Microsoft are developing their own AI Application Specific Integrated Circuits (ASICs) to enhance cost-efficiency and performance tailored to their unique AI workloads. Moreover, there's a notable rise in edge AI adoption, particularly in AI PCs and smartphones, facilitated by the availability of compact AI models enabling offline AI application execution. Qualcomm is notably making strides in the AI PC market, leveraging its extensive experience in AI capabilities from the smartphone domain."

Senior professionals from the display, consumer electronics and semiconductor industries are set to converge at the highly anticipated Omdia Taiwan Technology Conference from April 17-18, 2024, in Taipei, Taiwan where Simon and Claire and a host of Omdia analysts will present Omdia's latest semiconductors research. Register here for your place.

ABOUT OMDIA

Omdia, part of Informa Tech, is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Fasiha Khan: [email protected]