Summary

- With the Australian economy’s recent recovery coupled with the property boom throughout much of the country, the big four banks should be seriously considered as viable options for investors.

- Although a rift in iron ore trading between China and Australia could eventuate someday, it probably won’t be within the next five or ten years, meaning that iron ore is a viable investment.

- One of the great advantages of investing in shares instead of property is low initial down payment cost.

- While shares are perhaps not as stable as real estate, cryptocurrency is highly volatile and should be approached with extreme caution.

As the Australian economy slowly begins to gain traction again, having endured a recession that saw the COVID-19 pandemic ravage many businesses across the country, people are searching for ways to invest their money and take advantage of a recovering economy on an upswing.

Source: © Sadeq68 | Megapixl.com

However, the question is where to invest that money and what type of investment will offer the best returns? Shares? Real estate? Commodities? Cryptocurrency?

Although not as stable as real estate, the stock market has offered decent returns over time. As we head into a post-COVID-19 economy, we’ll examine whether investing money in stocks is still the way to go.

Banks are performing strongly

With the Australian economy’s recent recovery coupled with the property boom throughout much of the country, the big four banks should be seriously considered as viable options for investors.

Of the four major banks, Westpac (ASX:WBC) has had the best year-to-date growing ~37%. The second-best performer, ANZ (ASX:ANZ) has also enjoyed a healthy growth of 256.74%. Meanwhile, National Australia Bank Limited (ASX:NAB) has grown ~20%, with Commonwealth (ASX:CBA) achieving a growth of 22.41% (as of 4 June 2021).

The Big 4 Australian banks have performed strongly in the ASX in 2021 (Source: © Rummess | Megapixl.com)

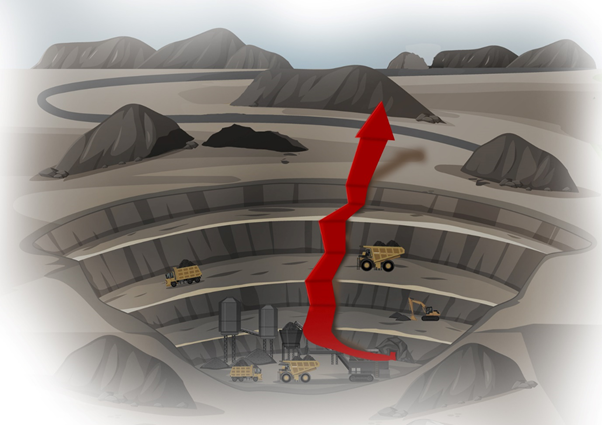

Or iron ore?

The performance of iron ore largely depends on Chinese demand, and with rising geopolitical tensions between the US and China, this could have significant ramifications for Australia’s trade with China.

Given the political differences, China may look elsewhere for iron ore. The problem for China, however, lies in its lack of other options. Vale SA in Brazil is an option, but the distance between the two countries poses a problem for importation. Furthermore, Brazil’s political stance is also at odds with China.

India has a thriving steel industry, but given the devastating effects of the coronavirus, it may be a while before India gets the virus under control. China really can’t afford to waste time, given its massive debt burden.

So, although a rift in iron ore trading between China and Australia could eventuate someday, it probably won’t be within the next five or ten years, meaning that iron ore is a viable investment.

Iron ore prices moving north (Source: Copyright © 2021 Kalkine Media)

Investing in shares

One of the significant advantages of investing in shares instead of property is the low initial down payment cost. To add to that, shares offer much fewer ongoing costs, whereas property investors are subject to property taxes and strata fees.

Furthermore, shares are easier to purchase and sell off when compared to real estate, where the owner has to go through a painful selling process that can take months or even years.

While property across Australia is experiencing a boom, the downside is the high price of real estate should one choose to invest in a house or apartment. Shares, on the other hand, require minimal put down in comparison.

Founder and CEO of online investment adviser Stockspot, Chris Brycki, said it’s likely shares will offer a better return than real estate over the next ten years.

The average rental yield in major cities like Sydney and Melbourne is currently just under three per cent. If we compare this to the five per cent yield in the Australian share market, it is clear stocks are the more superior investment.

Shares versus Property Return

A report released by the ASX found Australian shares averaged an 8.8% p.a return over the 20 years to 2017, while Australian residential property averaged 10.2% p.a. Of course, it should be noted that this period included a historic boom in Australian property prices.

Another essential thing to consider when deciding on whether shares are a better investment option than the property is property typically requires a large amount of money. The advantage of shares is that the investor can invest with just a small amount of capital.

Source: © Feverpitched | Megapixl.com

Shares or Cryptocurrency?

As a result of the Covid-19 pandemic, the lockdown period saw a host of people looking to supplement lost income with a booming cryptocurrency market.

Bitcoin – the world’s largest cryptocurrency – experienced a major boom beginning the year at approximately US$30,000 and shooting to a record high of US$65,000 in April.

There are no shares that could offer that sort of return. However, the end of April saw a massive drop for Bitcoin as it crashed throughout most of May to where it currently stands at just below US$40,000.

Source: © Chakisatelier | Megapixl.com

The takeaway here is that while shares are perhaps not as stable as real estate, cryptocurrency is highly volatile and should be approached with extreme caution.