Highlights

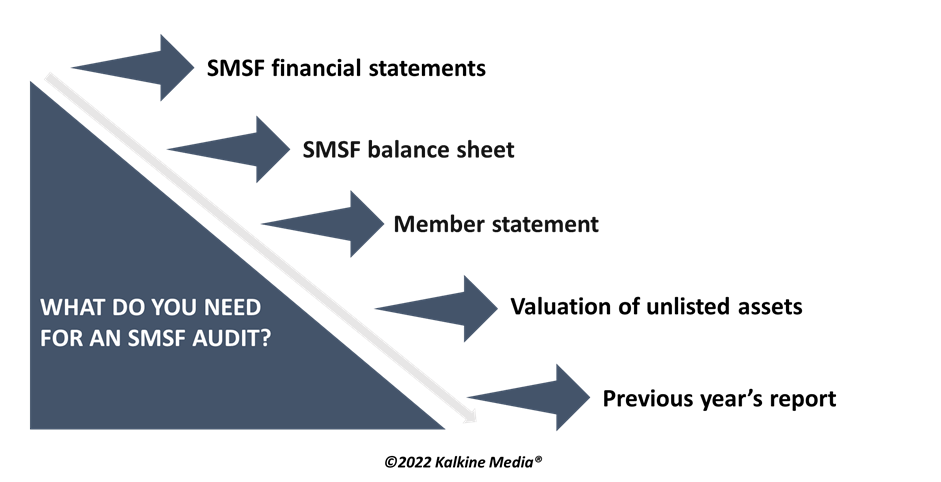

- SMSF audits happen yearly; thus, the first thing you need is an accurate financial statement of all the transactions regarding your SMSF in the year.

- All assets in the balance sheet must be in the fund’s name and listed on the current value.

- During the audit, one must submit the SMSF member statement.

- Proper valuation needs to be done for unlisted assets.

- You will need to provide your previous year’s SMSF audit report with the signed financials to the present auditor.

Self-managed super funds are gaining significant traction globally. They are like funds that companies collate, and the difference is that individuals manage SMSF. So, there are two sides to the coin- on the one hand, managing the funds independently gives more freedom in dealing with funds. While on the other hand, one is entirely responsible for the audits, compliances, and other legal and technical matters.

GOOD SECTION: SMSFs Experiencing Elevated Costs: What Investors Need To Know

Understandably, handing SMSF could be challenging, and people may get cold feet when the audit is nearby. Thus, hiring a finance and investment specialist while dealing with SMSF is always recommended if one doesn’t have the optimum financial and legal knowledge.

However, if you are someone who wants the matter entirely in your hands, then no worries; it may be challenging but not impossible. Here is a complete guide on how you should plan for an SMSF audit.

MUST-READ: How do I start my self-managed super fund (SMSF)?

How to plan for an SMSF audit?

Prepare SMSF financial statement: SMSF audits happen yearly; thus, the first thing you need is an accurate financial statement of all the transactions regarding your SMSF in the year. The auditor may ask for further documentation, so be extra prepared.

SMSF balance sheet: The next thing you need to show in the audit is your balance sheet. All the assets in the balance sheet must be in the fund’s name and listed on the current value. One should follow Australian Taxation Office (ATO) guidelines while valuing the assets.

Member statement: During the audit, one must submit the SMSF member statement. The report includes information about the share distribution of earnings, payments made, per member contribution, tax payable and individual fund balances at retirement.

Valuation of unlisted assets: Many times, SMSFs hold unlisted assets. Unlisted assets are audited with higher scrutiny. Thus, proper valuation needs to be done for unlisted assets. While auditing the unlisted assets, the auditor would look at the financial statements of the unlisted trust, independent valuations of such assets, and a unit price of the recent trade of the asset.

Previous year’s report: You will need to provide your previous year’s SMSF audit report with the signed financials to the present auditor. That is proof that the contribution is timely made to the fund, taxes are paid duly, and all the investments are right in place.

INTERESTING READ: Can I use MySuper to buy a house & buy shares with SMSF?

There are several other guidelines as well, which keep evolving with time. However, the above ones are the most critical steps to follow if one has the audit right on the doorsteps. The entire list of guidelines can be studied on the ATO website (for Australian citizens).