Highlights

- Indonesia Energy Corporation Limited (NYSE AMERICAN: INDO, INDO: US) is turning heads on the stock markets amid the prevailing market volatility helped by the Ukraine-Russia conflict.

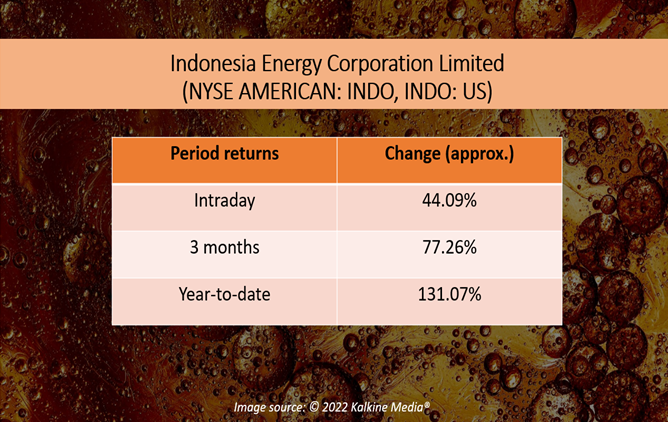

- Stocks of Indonesia Energy ballooned by about 44 per cent to close at US$ 6.47 per share on Tuesday, February 22, after clocking a day high of US$ 8.90 during the session.

- Last year in December, the energy company stated that Kruh 26 well on completion escalated its daily oil production rate by 50 per cent.

Indonesia Energy Corporation Limited (NYSE AMERICAN: INDO, INDO: US) is turning heads on the stock markets amid the prevailing market volatility helped by the Ukraine-Russia conflict.

Stocks of Indonesia Energy ballooned by about 44 per cent to close at US$ 6.47 per share on Tuesday, February 22, after clocking a day high of US$ 8.90 during the session.

Why could Indonesia Energy stock be trending?

Indonesia Energy is a Cayman Islands incorporated company with an oil and gas assets portfolio – the Kruh Block in Sumatra and the Citarum Block in Java in Indonesia. The Jakarta-based energy player currently has a market capitalization of over US$ 48 million and a price-to-cash flow (P/CF) ratio of 29.5.

Its most recent release came out on January 26, when the oil and gas firm said that it anticipates commencing drilling of two back-to-back new wells – Kruh 27 and Kruh 28, at Kruh Block within 30 days. It is targeting to produce about 450 barrels of oil per day on the completion of these two wells, expected to result in positive cash flow operation considering the current oil prices, said the firm.

Indonesia Energy, also known as IEC, added that it plans to start drilling a third new well – Kruh 29 onsite before the second quarter ends.

Last year in December, the energy company stated that Kruh 26 well on completion escalated its daily oil production rate by 50 per cent.

Also read: Why is Advanced Micro (AMD) stock trending?

Indonesia Energy financial performance

IEC generated US$ 1.98 million as total revenues in 2020 compared to US$ 4.18 million a year ago. The oil explorer and producer incurred a net loss of US$ 6.95 million in 2020 compared to US$ 1.67 million in 2019.

Indonesia Energy's performance in the stock market

INDO stock galloped by over 131 per cent year-to-date (YTD). The energy company saw about 88.2 million shares switching hands on Tuesday.

Currently, the oil stock is almost 148 per cent up from a 52-week low of US$ 2.61 apiece (January 26).

Bottomline

Indonesia Energy may draw some investor attention as it continues to tap exploration and drilling opportunities. Stock-wise, however, INDO stock appears to be highly volatile, meaning investors need to keep an eye on the latest updates that could affect the company's business.

Also read: HIVE & Hut 8 (HUT): 2 Canadian crypto stocks to bag in 2022

.png)