Summary

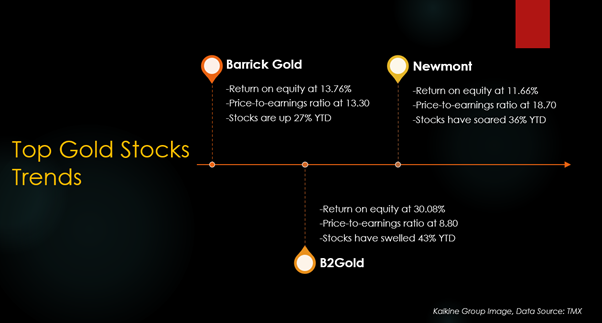

- Barrick stocks deliver a positive return on equity (ROE) of 13.76 per cent

- Barrick scrips’ 10-day average trading volume is 5.61 million units.

- Newmont announced a quarterly cash dividend of US$0.40 per stock for the third quarter of 2020, a surge of 60 per cent quarter-over-quarter.

- US-based Newmont stocks have rebounded by 40 per cent since the March market crash.

- B2Gold stocks have increased by over 43 per cent in value year-to-date.

The gold prices touched US$ 1,818.90 on Tuesday, crossing its highest level in a week. The yellow metal has held well despite the shifting moods in the market as investors begin investing in riskier stocks on the back of positive COVID-19 vaccine news.

Leading Canadian indices climbed on the back of rising gold price and pharma companies’ positive updates on COVID-19 vaccine candidates. These developments are raising hopes of a revival from the pandemic-induced economic slump.

Popular gold stocks such as Barrick Gold, Newmont and B2Gold has continued to maintain their momentum and have remained investors’ darlings. Let us have a closer look at these gold stocks:

Barrick’s year-to-date stock performance shows nearly 27 per cent growth. In the last six months, this gold stock has declined by 20 per cent. But it has rebounded by 42 per cent since its March lows.

The precious metal company’s current market cap stands at C$ 54.87 billion, and its earnings per share (EPS) is C$ 2.24. The price-to-earnings (P/E) ratio is 13.30, and price-to-cashflow (P/CF) ratio is 8.80. The stock delivers a positive return on equity (ROE) and a positive return on assets (ROA) at 13.76 per cent and 6.56 per cent, respectively. Its price-to-book (P/B) ratio is 1.851, and the debt to equity ratio is 0.23, as per data on TMX Money.

The gold stock made it to TMX’s Top Volume companies, a list of stocks across the TSX and TSXV that have the largest volumes in the past 10 days. Its 10-day average stock trading volume is 5.61 million units.

The yellow metal company pays its stockholders a quarterly cash dividend of US$ 0.09 per share. It holds a current dividend yield of 1.532 per cent. Its three-year dividend growth is 20.21, as per the TMX portal.

In the third quarter of 2020, Barrick Gold’s operating cash flow was US$ 1.9 billion, an increase of 80 per cent quarter-on-quarter. Debt net of cash slid by 71 per cent to US$ 417 million, compared to US$ 1.4 billion in Q2 2020.

Newmont Corp (TSX:NGT)

The US-based gold company is the world’s largest gold producer, as per its TMX profile.

Its Board of Directors approved a quarterly cash dividend of US$ 0.40 per common share for the third quarter of 2020, a surge of 60 per cent compared to the previous quarterly dividend of US$ 0.25 per stock. It holds a current dividend yield of 2.71 per cent.

Newmont’s year-to-date stock performance scrips indicate a 36 per cent rise. The giant gold producer’s stock has added marginal growth of 3 per cent in the last six months. The metal stock is trading over 40 per cent up since the March gold-crash.

The largest gold company’s current market cap stands at C$ 62.59 billion, and its present EPS stands at C$ 5.07. Its price-to-book (P/B) ratio is 2.124, and the debt to equity ratio is 0.30. Its P/E ratio is 18.70, and its P/CF ratio is 10.80. The stock offers a positive return on equity (ROE) and a positive return on assets (ROA) at 11.66 per cent and 6.32 per cent, respectively, as per the TMX website.

In the third quarter of 2020, the metal company reported US$ 1.6 billion of cash generated from continuing operations and US$ 1.3 billion of Free Cash Flow.

The US-based company posted consolidated cash of US$ 4.8 billion and US$ 7.8 billion of liquidity.

During the third quarter, the company entered exploration joint ventures with Colombian Agnico Eagle Mines Limited and Canadian Kirkland Lake Gold Inc. (TSX:KL).

B2Gold Corp. (TSX:BTO)

The gold mining company distributed a quarterly cash dividend of US$ 0.04 per share.

The Vancouver-based precious metal company stocks have gained over 43 per cent in value year-to-date. In the last six months, stocks of B2Gold have slightly increased by 5 per cent. The gold stock is moving 94 per cent higher than March lows.

Yellow metal miner’s current market cap is C$ 7.79 billion, and its present EPS is C$ 0.83. Its price-to-earnings (P/E) ratio is 8.80, and the P/CF ratio stands at 6.50. The stock offers a positive ROE and a positive ROA at 30.08 per cent and 21.93 per cent, respectively. Its price-to-book (P/B) ratio is 2.457, and the debt to equity ratio is 0.02, according to the TMX portal.

This Canadian gold stock also made it to TMX’s Top Volume companies stocklist. Its current 10-day average stock trading volume is 4.22 million units.

The company registered consolidated cash flow generated by operating activities from its three functional mines of US$ 301 million in the third quarter of 2020, a significant surge of 79 per cent compared to Q3 2019.

B2Gold posted a consolidated gold production of 263,813 ounces in Q3 2020. The company recorded a quarterly consolidated gold revenue of US$ 487 million, a rise of 57 per cent against Q3 2019.