Summary

- Spot gold prices crossed US$ 2,073 per ounce-mark as investors lapped up the safe asset amid unprecedented pandemic crisis.

- The pandemic has caused Canadian economy to plunge into recession of unseen depths with nation’s GDP plunging by 11.5 per cent in second quarter of 2020, the sharpest dip since 1961.

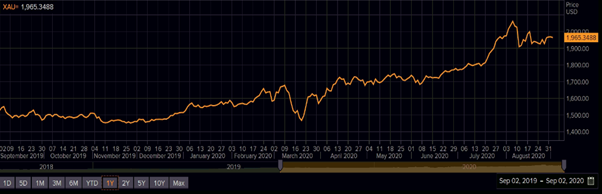

- In these volatile market conditions, investors turned to gold, which caused the price of the precious metal to increase by nearly 30% in six months.

- This rally has led to a surge in the gold stock prices of companies like Barrick Gold, Newmont Corporation and Kirkland Gold.

The record surge in bullion prices led has to investors switching their bets from finance and real estate to gold and other metals. Spot gold prices touched an all-time high of US$ 2,073 per ounce on 7 August 2020, as investors lapped up the safe asset in the face of economic recession caused by the COVID pandemic. As per multiple forecasts, this could be just the beginning of an extended rally and gold prices may surge up to US$ 3000. The S&P/TSX Global Gold Index has advanced by 45.65 per cent year-to-date. This golden rally has led to a massive surge in the stock prices of gold companies including Barrick Gold, Newmont Corporation and Kirkland Gold.

The pandemic has caused the Canadian economy to plunge into recession of unseen depths. The economy contracted by over 11 per cent in April, making it the deepest recession on record. It dragged the Canadian GDP by 11.5 per cent in second quarter of 2020, the sharpest dip since 1961.

To keep the economy afloat, Canada’s central bank – the Bank of Canada – has kept the interest rates near zero. Meanwhile, the federal government has been pumping in billions of stimulus money to cushion the fall of the markets and high unemployment figures.

Under these conditions, investors turned to the precious metal– a hard, safe, strategic and mainstream asset. The gold price has increased nearly 30 per cent in last six months.

(One-Year Price Chart for Gold/ Source: Refinitiv, Thomson Reuters)

Let’s take a look at three trending hot gold stocks on the Toronto Stock Exchange (TSX):

Barrick Gold Corporation (TSX:ABX)

Barrick has long been an investors’ favorite, riding on the back of strong balance sheets, low debt, consistent dividend payouts, and low production costs. Its stocks have surged by over 58 per cent this year, as investors actively sought out safe assets amid pandemic-caused economic downturn. In the last three months, this hot gold stock advanced by 13 per cent.

Berkshire Hathaway, the group owned by American investor Warren Buffett, has added Barrick Gold Corp to its portfolio. The day (August 17) the group announced this news in the market, the company’s stocks jumped by 12 per cent, causing a gold rally on the TSX.

In its second quarter 2020 earnings, Barrick’s revenue grew to US$ 3 billion, up from US$ 2 billion in Q2 2019. Free cash flow surged over 840 per cent year-over-year while net earnings increased by US$ 163 million YoY to touch US$ 357. The company’s net debt also declined by 25 per cent in Q2 2020. The gold company distributed a quarterly dividend of US$ 0.08 per share.

The C$ 68.7 billion-gold company is a long-term player that has weathered tough market circumstance including the dotcom bubble of 2000s and 2007-08 financial crisis.

Its current dividend yield is 1.11 per cent. The price-to-earnings (P/E) ratio is 35.70, while the price-to-book (P/B) ratio is 2.37. It has 23.41 per cent Return on Equity and 14.13 per cent Return on Assets.

Newmont Corporation (TSX:NGT)

Current Stock Price: C$ 85.80

Newmont’s stocks have surged by over 52 per cent this year, riding along with the markets’ gold rally. In the last three months, the shares of the company advanced over 16 per cent.

In its second quarter of 2020, the world largest gold producer reported a 5 percent quarter-over-quarter revenue increase to US$ 2.3 billion. Free cash flow in Q2 2020 also increased to US$ 388 million.

Newmont announced quarterly dividends of US$ 0.25 and holds a current dividend yield of 1.53 per cent. Its current market market cap is C$ 68 billion and has a P/E ratio of 13.9 and P/B ratio of 2.43. Its current Return on Equity is 18.9 per cent while Return on Assets 10.17 per cent.

The company recently announced joint strategic alliance with Kirkland Lake Gold Ltd to explore the Timmins properties and Holt Complex in Ontario.

Kirkland Lake Gold Ltd (TSX:NGT)

Current Stock Price: C$ 67.76

In the second quarter of 2020, Kirkland Lake Gold’s revenues more than doubled, rising to US$ 581 million from US$ 281.3 million in Q2 2019. Its net earnings grew to US$ 150.2 million in Q2 2020, up from US$ 104.2 million a year-ago. The company reported a cash balance of US$ 537.4 million at the end of the second quarter, with no debt.

From operational perspective, total gold production surged by around 54% year over year at 329,770 ounces in the second quarter of 2020.

Kirkland Lake declared a quarterly dividend of US$ 0.125 per share. Its current market capitalization is C$ 18.6 billion and has P/E ratio of 17.3. The P/B ratio stands at 3.01 while price-to-cash flow ratio is 12.3. Its current Return on Equity is 22.6 per cent while Return on Assets 16.75 per cent. It dividend yield is 0.98 per cent.

Kirkland stocks are up by over 18 per cent this year. The scrips have yielded nearly 32 per cent returns in three months.