Highlights

- Some analysts fear that the Bank of Canada will have to hike the interest rates above 3%.

- To control the inflation, the central bank has risen interest rates in the past.

- Bank of Canada has previously cautioned that inflation will rise in future.

The inflation rate in Canada has likely reached its highest level in 40 years. According to reports, the inflation is predicted to rise 7.3 per cent in May from the previous year.

The report of Statistics Canada on inflation is due this week. If the predictions are true, this would be the strongest annual growth rate since 1983, virtually guaranteeing a 75-basis-point interest rate hike at the Bank of Canada's next meeting.

Also Read: 5 TSX uranium stocks to buy as demand for Canada supplies rise

The central bank has previously cautioned that inflation will rise in future. The Bank of Canada expects that due to the persistent pressures, it would most likely rise the interest rate between the higher side of 2 per cent to 3 per cent.

Some analysts fear that the central bank in Canada will have to hike the interest rates above three per cent to bring inflation under control.

Amid market volatility and rising inflation, investors could be worried about their investment portfolios. Hence, we have shortlisted three TSX-listed stocks that may help people diversify their portfolios.

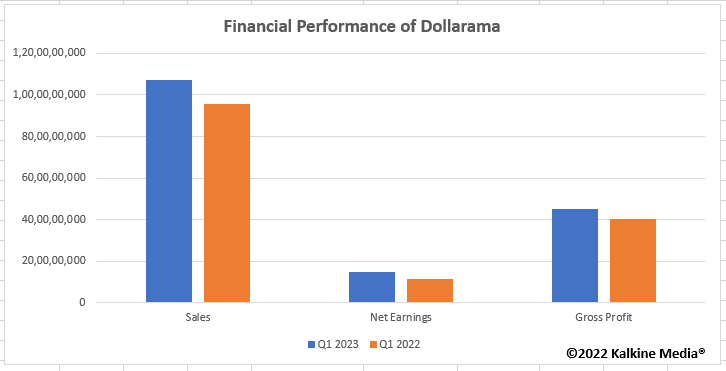

Dollarama Inc. (TSX:DOL)

Despite the biggest loss of the Toronto Stock Exchange (TSX) since 2020 on Friday, the DOL stock performed exceptionally well. The shares of Dollarama ended the trading session 2.2 per cent higher than the previous day and closed at C$ 71.99 per share.

Dollarama provides discounted products to its customers and is one of the largest retailers in Canada. Notably, the DOL stock showed a significant volume surge on Friday, and the price increase indicates that investors could be looking to buy and hold this stock.

On June 17, around 1.9 million DOL shares traded hands on the TSX, and its relative strength index (RSI) value was 52.65, which seems to be above the perceived neutral value of 50.

During inflation, customers could for discounted products to save money, and Dollarama could benefit from it by increasing its sales.

Boralex Inc. (TSX:BLX)

Boralex is a renewable energy power generation firm that develops, builds, and operates renewable energy power plants. Even during times of inflation and higher interest rates, people require utility companies' services as necessary.

After a continuous decline in the volume, the BLX stock recorded a surge in its price and volume on June 17. The volume increased to 555,480, and the price was up by 2.2 per cent and closed at C$ 41 apiece.

Notably, the RSI value of 51.3 indicates that the BLX stock is maintaining its position and is not being oversold or overbought amid increased volatility in the market.

Laurentian Bank of Canada (TSX:LB)

It is believed that when the interest rates are hiked, providers of financial services benefit from it. Hence, we have put Laurentian Bank on this list and on Friday, the LB stock had closed at C$ 39.07 per share after its price increased by about one per cent during the trading session.

In Q2 2022, Laurentian Bank's net income increased to C$ 59.5 million from C$ 53.1 million in Q2 2021. Meanwhile, the bank also increased its dividend by C$ 0.01 on its common shares.

Now, the bank will distribute a quarterly dividend of C$ 0.45 per share on August 1.

Also Read: DOL & FTS: 2 TSX stocks to buy as World Bank warns of stagflation

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.