Highlights

- Technology integration to carry out and improve financial services is known as fintech.

- The mobile/ smartphone internet revolution has driven the fintech sector's growth.

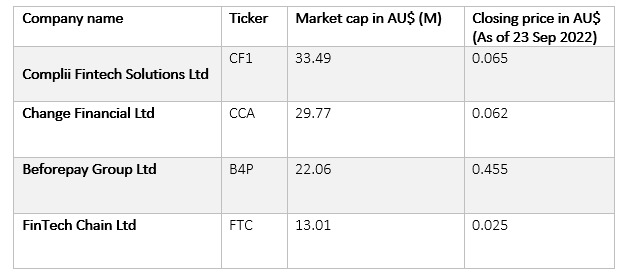

- FTC, CCA, B4P and CF1 are some of the ASX-listed midcap companies from the fintech space

Financial technology (Fintech) refers to the use of technology to improve and facilitate financial services. The sector helps people and businesses better manage their financial processes through specialised applications or software based on phones or the web.

The technology has shown massive growth since the mobile/ smartphone internet revolution. It has helped in saving a lot of time and effort to visit banks and institutions for performing monetary transactions such as applying for credit, making, or receiving payment, applying for ATM cards, opening a bank account etc.

On this note, we at Kalkine Media® will discuss some of the small-cap fintech stocks from Australia and their latest updates.

Complii Fintech Solutions Ltd (ASX:CF1)

Complii FinTech Solutions, an ASX-listed digital platform company, offers end-to-end software-as-a-service (SaaS)-based technology solutions for financial Services.

During FY22, the company delivered a profit of AU$114,937 compared to a loss of AU$4,194,240 in FY21. The company's annual revenue grew 327% in FY22 versus FY21.

Change Financial Ltd (ASX:CCA)

Change Financial Limited, a global fintech and payments-as-a-service (PaaS) provider, aims to simplify payment experiences globally and be a leading PaaS provider through simple, flexible & fast to market technology.

In the financial year 2022, the company's Payments as a service, Vertexon platform reported a 61% revenue increment, whereas Paysim's revenue went up by 39% for the payment testing platform. Overall, the company's FY22 revenue increased by 31.7% compared to the previous corresponding period.

Beforepay Group Ltd (ASX:B4P)

Beforepay Group offers fintech services through applications based on smartphones and browser. Following are the FY22 highlights of Beforepay Group:

- Pay Advances of AU$327.3 million, up by 252%

- Positive net transaction margin at 1.1%

- Net transaction loss down to 2.4%

- 69% growth in active users

- 89% growth in earnings before interest, taxes, depreciation, and amortisation (EBITDA), excluding one-off and/or significant items

FinTech Chain Ltd (ASX:FTC)

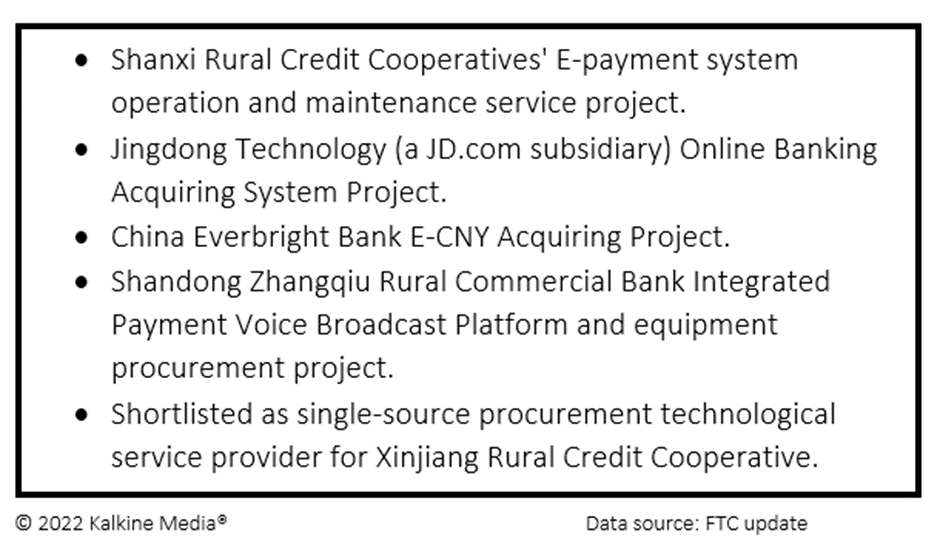

FinTech Chain offers financial technology services. The company bagged the following tenders in the quarter ended 30 June 2022: