Summary

- Base metals have been stealing the show from many risky commodities in the face of COVID-19 crisis.

- Notably, Copper has witnessed impeccable recovery since the onset of the second quarter of 2020.

- For the first time, Australia-based mineral exploration company Mount Burgess has updated about copper grades in holes KDD143 and KDD140 of its Kihabe Deposit.

- The company expects good continuity of copper mineralisation from further closer spaced drilling to add to the overall grade and value of the currently quoted Kihabe Resource, which comprises Zn/Pb/Ag grades as of now.

- Mount Burgess share price surged by 33.33 % to $ 0.012 on 7 August 2020.

Recovery in copper prices in the face of Global Virus Crisis is likely to be an impetus for the explorers and miners that are back in the saddle.

After facing supply disruptions owing to COVID-19, copper prices have finally climbed up the ladder. Copper near-month cash contract on the London Metal Exchange demonstrated levels of USD 4,617.5 per tonne (intraday low on 23 March 2020) to a high of USD 6,545 per tonne (on 13 July 2020). Copper traded at USD 6,678 as on 4 September 2020.

Leveraging the copper excitement is Mount Burgess Limited NL (ASX:MTB) that is currently developing the Kihabe and Nxuu Zinc/Lead/Silver/Germanium and Vanadium deposits in Botswana. For the first time, the Company has reported copper grades for two holes in the Kihabe Deposit. A potentially commercial metal, copper could represent additional credits for this deposit.

ALSO READ: Scan Through Mount Burgess’ Remarkable June Quarter Performance

New Copper Grades from Kihabe

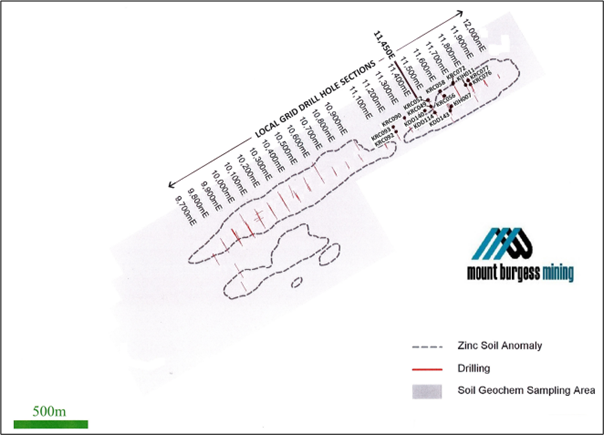

In the NE sector of the Kihabe Deposit between Sections 11,200E and 11,800E, around 15 drilled holes have intersected potentially commercial copper grades (within 600 m strike length). Copper intersections from 13 of these drill holes were previously reported by Mount Burgess between 2003 and 2008, besides Zn/Pb/Ag grades.

For the first time, the Company has reported copper grades for holes KDD143 and KDD140, where only Zn/Pb/Ag grades were initially reported.

Location of drill holes with Copper at Kihabe (Source: MTB’s ASX Update, 7 Sept 2020)

The holes have mainly been drilled on 100 m drill section spacings. However, KDD140 was drilled on a 50 m drill section spacing.

In the past, the focus on the Kihabe resource was on Zn/Pb/Ag and the resource estimate only included these values. Consequently, none of these copper intersections have been included in the Kihabe resource estimate currently quoted under the 2004 JORC Code.

The Kihabe Resource (estimated under the 2004 JORC Code) amounts to 14.4 million tonnes at a Zn/Pb/Ag Zinc equivalent grade of 2.84%, applying a 1.5% Zinc equivalent low-cut grade.

Significance of Copper Grades & Mineralisation

Besides zinc, lead and silver, the presence of other potentially commercial metals has been acknowledged within the Kihabe Deposit mineralised domains, for instance- vanadium, germanium, and copper. Interestingly, all these metals represent additional credits for this deposit.

Mount Burgess believes that good continuity of copper mineralisation, if revealed, may add to the overall grade and value of the currently quoted Kihabe Resource. To determine the continuity of copper mineralisation between drill sections, further closer spaced drilling will be required as per the company.

MTB Share Price Momentum Under the Spotlight

MTB surged by 33% on the ASX to $ 0.012 on 7 September 2020, after its update on copper zones was released to the market.

Previously, on 25 August 2020, when the Company unveiled its review of two high grade silver zones at Kihabe, the stock had soared by 33%!

For the exciting silver zones insight, DO READ: Mount Burgess Soars 33% on ASX Following Review of High-Grade Silver Zones at Kihabe

MTB has delivered whopping returns of 800% in the past one month, with strong YTD return of 350% as on 4 September 2020.