Highlights:

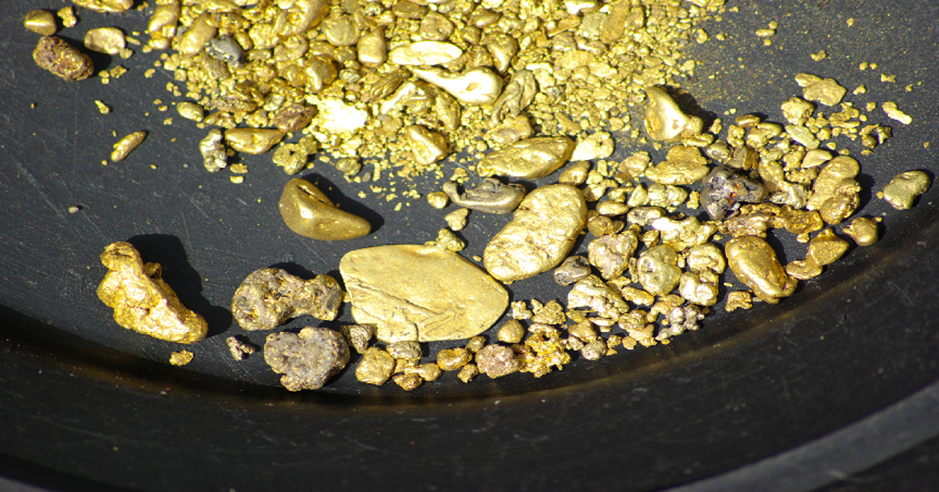

- Gold mining is very popular in Australia as its lands are home to rich deposits of gold.

- The gold mining is also one of the major contributors of Australia's economy.

Australia is host to rich and varied mineral deposits, with one of them being gold. The gold mining industry is considered the third largest commodity industry of Western Australia, following iron ore and petroleum, as per the Government of Western Australia. Gold mining is very popular in the country and contributes significantly to the country’s economy.

Here, we feature four ASX-listed gold mining companies and summarise their performance on the ASX: Northern Star Resources Limited (ASX:NST), Evolution Mining Limited (ASX:EVN), Newcrest Mining Limited (ASX:NCM), and Perseus Mining Limited (ASX:PRU).

Northern Star Resources Limited (ASX:NST)

Shares of Northern Star Resources Limited (ASX:NST) opened Thursday’s trading session on a strong note on the ASX. The company’s share price stood at AU$8.940 apiece after gaining 4.439% on the ASX, at 10:33 AM AEDT today.

Over the previous month, Northern Star’s share price has appreciated by almost 26% on the ASX. However, the company’s share price has declined by 4.39% in a year and by 5.10% on a year-to-date (YTD) basis (as of 10:33 AM AEDT today).

Northern Star Resources Limited is an Australia-based gold miner and gold producer with a market capitalisation of AU$9.92 billion at present. The company owns and operates some ‘world-class’ gold projects based on high-grade underground gold at a low cost.

Other than Australia, Northern Star’s gold also owns gold projects in highly prospective and low-sovereign-risk regions of North America. Some of the company’s gold projects are located in Jundee Kundana. NST also owns and operates the Central Tanami Project in Northern Territory and some other gold projects in Western Australia.

The company is led by a highly experienced management team, including Michael Chaney AO as the chairman, Stuart Tonkin as the CEO and managing director, and John Fitzgerald as the non-executive director.

Evolution Mining Limited (ASX:EVN)

Image source: © Bendicks | Megapixl.com

Evolution Mining Limited’s (ASX:EVN) shares were spotted trading in the green territory on Thursday morning. Its share price marked a gain of 4.499% on the ASX to AU$2.090 apiece at 10:39 AM AEDT today.

Evolution Mining’s share price has appreciated by 12.10% on the ASX in the last month. However, the company’s share price has fallen by 43.19% in a year and 48.90% on a YTD basis (as of 10:39 AM AEDT today).

Evolution Mining Limited is an Australian gold exploration and mining company founded in 2011. Evolution’s headquarters are in Sydney, Australia. However, the company operates through various gold mining projects across Australia and New Zealand.

Evolution specialises in identifying, exploring, mining, and developing gold projects. At present, the company owns and operates seven gold mines in Western Australia.

Some of the projects owned by Evolution Mining are Cowal in New South Wales, Pajingo, Mt Carlton, Cracow and Mt Rawdon in Queensland, and Mungari and Edna May.

Newcrest Mining Limited (ASX:NCM)

Newcrest Mining Limited’s (ASX:NCM) shares opened Thursday’s trading session on a positive note on the ASX. Its share price has marked a gain of 4.317% on the ASX to AU$18.120 apiece at 10:48 AM AEDT today.

Newcrest Mining’s share price has gone up by 13.07% on the ASX in the last month. In contrast, the company’s share price has fallen over 27% on the ASX in a year and 25.99% on a YTD basis (as of 10:48 AM AEDT today).

Established in 1990, Newcrest Mining Limited is an Australian explorer, developer, miner, and seller of gold and gold-copper concentrates. Apart from Australia, the company has presence in Indonesia and Côte d’Ivoire.

Newcrest owns and operates two significant gold and copper mines in Australia, Cadia East Ridgeway and Telfer Mine, in the Pilbara region, Western Australia. It is also the owner and operator of two gold mines in Papua New Guinea – Lihir and Hidden Valley – and one each in Côte d’Ivoire and Indonesia.

Newcrest has a market capitalisation of AU$15.52 billion..

Perseus Mining Limited (ASX:PRU)

Image source: © Bashta | Megapixl.com

Shares of African gold mining company Perseus Mining Limited (ASX:PRU) opened trading higher on the ASX on Thursday morning. Perseus’ share price rose by 3.501% to AU$1.847 apiece at 10:57 AM AEDT today.

Over the last month, Perseus’ share price has appreciated almost by 32% on the ASX. Furthermore, the company’s share price has gained by 12.62% on the ASX in a year and 11.94% on a YTD basis (as of 10:57 AM AEDT today).

Perseus Mining Limited began its journey as a junior explorer company, with operating tenements in Ghana and Côte d’Ivoire.

Soon after its establishment, Perseus secured the Ayanfuri exploration licences in Ghana in 2006. Followed by significant successful exploration work in Ghana, Perseus rapidly evolved from a junior exploration company to a developer and gold producer by 2012.

At present, Perseus holds several gold mines in Africa, such as the Sissingué Gold Mine in Côte d’Ivoire, Grumesa Gold Project, Yaoure Gold Project, and the Edikan Gold Mine in Ghana.

The S&P/ASX 200 Materials sector (INDEXASX:XMJ) was quoted at 15,929.9 points, up by 2.18% or 339.8 points, at 11:28 AM AEDT on the ASX today.