Highlights

- PeopleIN seeking expansion, has agreed to acquire FIP Group Holdings Pty Ltd (FIP).

- Post the acquisition announcement, PPE share price has risen by more than 9%.

- FIP claims to be a leading staffing company under the PALM scheme, having a robust growth potential.

Workforce management solutions company, PeopleIN Limited (ASX:PPE), has inked an agreement to acquire all the shares in FIP Group Holdings Pty Ltd (FIP). Belonging to the same industry, FIP is also a workforce solutions business. It lists amongst the largest providers of staff to the Australian food sector.

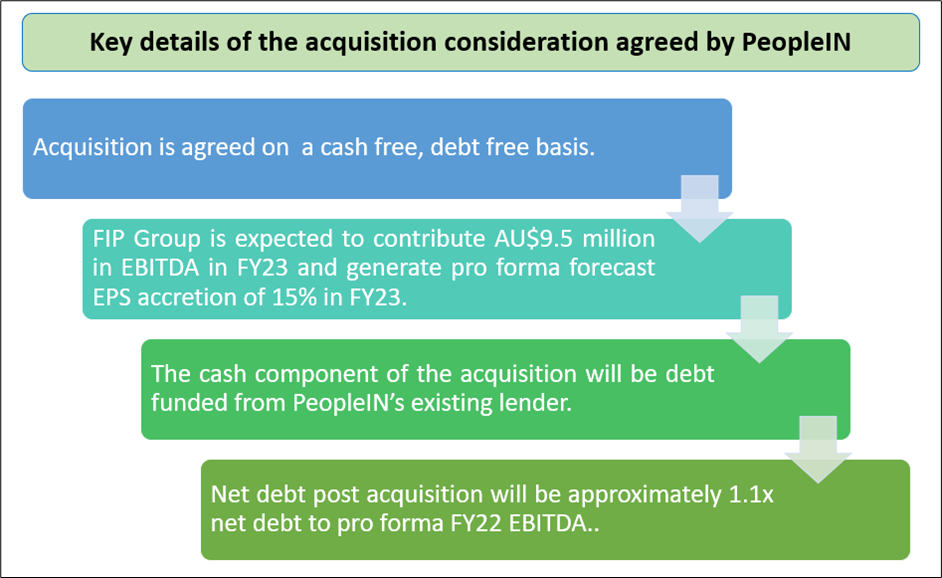

The acquisition has been agreed at an upfront consideration of AU$45 million.

Meanwhile on the ASX, share price of PPE is quoted 9.717% up at AU$3.500 apiece at 11:00 AM AEST. In the last five trading days, the share price has gained 7.69%. However, it has lost 4.89% in a month’s trade and has lowered by 12.50% in past six months.

Key highlights of PeopleIN Limited’s acquisition agreement

PeopleIN has agreed to acquire 100% shares in the FIP Group Holdings Pty Ltd (FIP).

Image Source-© 2022 Kalkine Media ®, Source-ASX announcement

- As per the agreement, Brad Seagrott, the CEO of Food Industry People Group, will be joining the executive leadership group of PeopleIN.

- However, the transaction is subject to certain conditions and will probably be completed by mid-June.

How will the acquisition benefit PeopleIN?

PeopleIN and FIP will be working towards accelerating business growth by sharing customers and expanding geographically. The acquisition of FIP will increase PeopleIN’s participation in the food sector. It will strengthen PeopleIN’s position to become the largest ASX-listed recruitment and staffing business within Australia.

In the past five years, PeopleIN claims to have generated significant shareholder value. It has reportedly recorded an earnings per share (EPS) compound annual growth rate (CAGR) of 27%. PeopleIN focuses on providing its services in Australian economic sectors that have significant and growing demand for employees. These sectors feature health and community care, technology, food, mining and others.

Management Commentary

In the words of Ross Thompson, CEO, PeopleIN:

Image Source-© 2022 Kalkine Media ®, Source-ASX announcement

More about FIP’s business

Established in 2006, Food Industry People (FIP) boasts of being a national leader in workforce solutions under the PALM (Pacific Australia Labour Mobility) Scheme. FIP workers are employed on a fixed term basis for the duration of their visas. They are assigned directly to a host employer for the duration of their stay. FIP also provides a dedicated pastoral care program that helps workers with accommodation, transport, healthcare and connecting them with local community services.

Bottom line

The food supply chain is essential and the outlook for the Australian food sector is robust. The PALM Scheme, in which FIP claims itself to be a leader, helps fill labour gaps in this sector. Adding to this, new ongoing free trade agreements are driving exports growth. Also, there are forecasts of economic recovery post the COVID-19 pandemic. This recovery is expected to boost the demand for Australian food in the international markets in next five years. Moreover, the new Labor Government has outlined a few policies to increase uptake and expansion of the PALM Scheme. In this backdrop, while PeopleIN’s acquisition of FIP appears noteworthy, how much it can benefit, will only be known with time.

More from ASX – ARB, BKW, ADH: These ASX 300 Shares Hit Their 52-Week Lows Yesterday