Highlights

- The S&P/ASX200 hit a new 52-week low on Wednesday

- The year-to-date, one-year, and three-year returns of the S&P/ASX200 Health Care stand at 14.76%, -14.71% and 4.94%, respectively

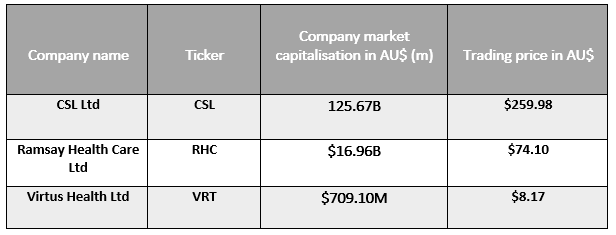

- CSL, Ramsay, and Virtus are some stocks from the ASX healthcare sector that have sustained well in times of the economic upheaval

The S&P/ASX200 is up 0.50% today. The index has lost 5.50% in the last five days and sits 1.03% above its 52-week low. The index hit a new 52-week low on Wednesday.

As of 15 June 2022, the S&P/ASX 200 Healthcare, the benchmark of the ASX healthcare sector, also dropped 1.52%. Currently, its year-to-date, one-year, and three-year returns stand at -14.76%, -14.71% and 4.94%, respectively.

The stock market has witnessed many downfalls starting from the COVID-19 pandemic in 2020 to recent economic crises of 2022. However, some stocks have been always performing well despite heavy economic turmoil and uncertainties. This article will talk about such three stocks from ASX healthcare that have been performing well for last three years despite harsh economic conditions.

Data source: ASX as of 16 June

Related read: What’s going wrong for global economy?

CSL Limited (ASX:CSL)

CSL Limited, Australia’s top biotechnology company, reported a 92.55% revenue growth in three years. It also has a good net profit margin of nearly 23%. In the last three years, the company provided its investors with an almost 23% price return.

In the half-year ended 31 December 2021, the company reported a net profit after tax of US$1.76 billion. During the same period, its revenue increased 4% on a constant currency (cc) basis. The company’s business segment, Seqirus, specialising in Influenza vaccines, delivered revenue growth of 17% at CC.

Outlook – In FY22, the company’s net profit after tax is predicted to be nearly US$2.15 billion to US$2.25 billion at CC.

Do read: CSL to ACL: How top 10 ASX All Ords healthcare stocks are faring?

Ramsay Health Care Limited (ASX:RHC)

Ramsay is a multinational healthcare provider and hospital network operating across Australia, Europe and Asia.

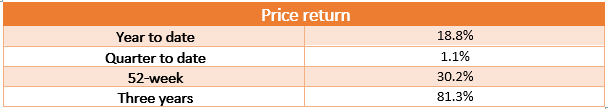

The company has been sustaining excellently amid the economic turmoil and has provided a price return of nearly 3.7%, 13.8%, 15.4% and 3.4% on a year-to-date, quarter-to-date, last 52 weeks, and previous three years basis.

In the quarter ended 31 Mar 2022, Ramsay Health Care Group’s total revenue and earnings before interest and taxes (EBIT) increased 5.7% and declined 23%, respectively.

However, the company’s business in the UK, including recently acquired Elysium, performed quite well in the quarter with a nearly 40% increment in total revenue compared to pcp.

Virtus Health Limited (ASX:VRT)

Virtus Health provides assisted reproductive technology, specialist pathology and day hospital services. The company has good fundamentals, providing lucrative price returns to its shareholders. Let us have a look:

- Five years average dividend yield – 6.7%

- Three years of historical growth in revenue – 45.12%

Data source: Refinitiv as of 16 June

In the half year ended 31 December 2021, the company’s revenue for the Australian segment increased 1.8%; however, its EBITDA was down 21%. Similarly, in the international segment, the company’s EBITDA declined by nearly AU$1.5 million compared to pcp.

Also read: ICR, PCK, CDX: How are these ASX telehealth stocks faring?