Investing.com -- Apple (NASDAQ:AAPL) has announced plans to invest $500 billion in the U.S. over the next four years, marking its largest-ever domestic investment.

The initiative will focus on artificial intelligence, silicon engineering, and advanced manufacturing, creating around 20,000 new jobs across multiple states, with the vast majority focused on R&D, silicon engineering, software development, and AI and machine learning.

“We are bullish on the future of American innovation, and we’re proud to build on our long-standing U.S. investments with this $500 billion commitment,” said Apple CEO Tim Cook.

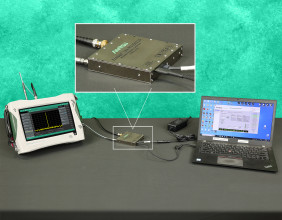

As part of the investment, Apple will open a new manufacturing facility in Houston, Texas, dedicated to producing servers for Apple Intelligence, the company’s AI-powered personal assistant system.

The 250,000-square-foot facility is expected to open in 2026 and will create thousands of jobs. The new AI servers will power Private Cloud Compute, Apple’s secure AI cloud processing system.

Apple is also doubling its U.S. Advanced Manufacturing Fund to $10 billion, supporting domestic manufacturing and chip production. The iPhone maker said a significant portion will go toward silicon production at TSMC’s Fab 21 facility in Arizona, where Apple is the largest customer.

Additionally, Apple will launch a Manufacturing Academy in Detroit, partnering with universities such as Michigan State to train businesses and workers in AI-driven smart manufacturing techniques.

The investment also includes expanding Apple’s R&D centers nationwide, with a focus on custom silicon, AI, and machine learning.

The company’s investments will expand data center capacity in North Carolina, Iowa, Oregon, Arizona, and Nevada to support its growing AI infrastructure.

Wedbush described the move by Apple as strategic, as the company continues “diversifying its manufacturing strategy in both the US and globally while also playing well into Trump’s US investment theme given the $500 billion Project Stargate announced earlier this year.

“Cook continues to prove that he is 10% politician and 90% CEO and times like this he will be using his strong ties globally to make sure its smoother waters for Cupertino ahead despite the market agita around AAPL’s growth initiatives with Trump heading down the tariff threat path,” added the firm.