Highlights

- VR8 has announced three non-binding Memorandums of Understanding (MOUs) for vanadium offtake, totalling 12ktpa of V2O5 flake supply. This exceeds the planned Phase 1 production capacity of approximately 11ktpa at its world-class Steelpoortdrift Vanadium Project (Steelpoortdrift).

- Debt funding process has continued to advance, with due diligence from a major European Bank scheduled to commence during this quarter.

- Production of high-purity 99.5% V2O5 is now on the ocmpany’s development roadmap, after integrating modifications into the front-end-engineering-design (FEED).

- Discussions ongoing with a pipeline of interested parties to secure binding offtake agreements, including parties which are considered tier-1 by VR8.

Vanadium Resources Limited (ASX: VR8; DAX: TR3) has made significant progress with its Steelpoortdrift Vanadium Project in South Africa during Q2 CY2024, which includes both the Steelpoortdrift Mine and Concentrator, as well as the Tweefontein Salt Roast Leach (SRL) operation. Here is a breakdown of VR8’s recent progress.

Offtake MOUs Secure 12ktpa V2O5 Supply

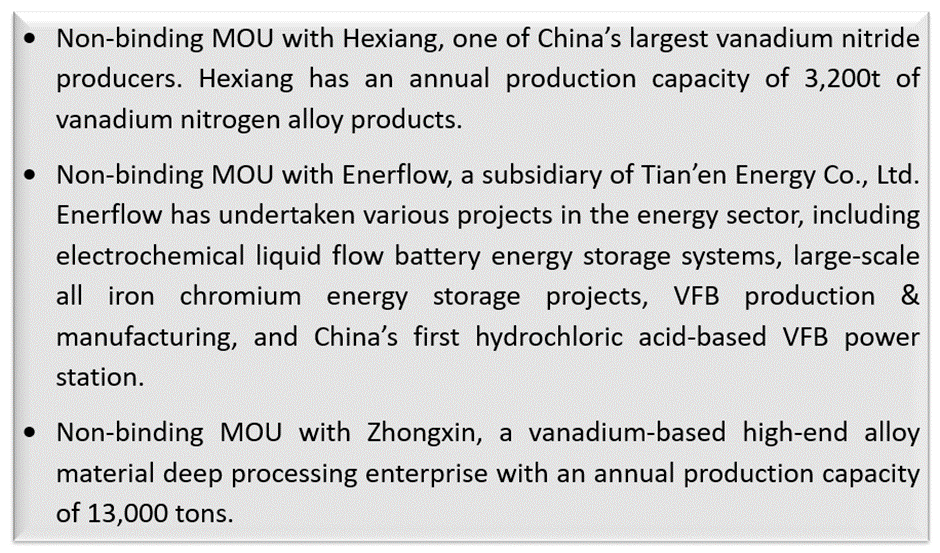

During the quarter, VR8 advanced its offtake and strategic equity process, announcing three offtake MOUs for the supply of 4,000 tpa of V2O5 flake each over five years. Each MOU includes an option to extend for an additional five years.

Data source: Company update

Together, these MOUs total supply of 12ktpa of V2O5 for the first five years of Steelpoortdrift’s mine life, exceeding the project’s planned Phase 1 production of approximately 11ktpa. According to the company, demand for its vanadium offtake remains strong, and future offtake agreements will be prioritised based on favourable funding options, strategic equity for construction, and other value-added factors from potential partners.

Chinese Vanadium Industry Roadshow

Key members of the VR8 board and management team also participated in a two-week "Chinese Vanadium Industry Roadshow" in China. This visit aimed to boost offtake and strategic equity interest in the project through high-level meetings with potential partners. During the visit, the VR8 team noted that China is expecting to see increasing demand for Vanadium Flow Batteries (VFBs) over the next 3-5 years. To capture this growth, VR8 is planning to produce high-purity 99.5% V2O5 (suitable for the VFB market), alongside 98% V2O5 (suitable for the steel market).

Advancing Debt Funding Process

In parallel to the ongoing strategic equity and offtake process, VR8 is also making progress with its debt funding process, with due diligence by a major European bank set to begin during Q3 CY2024. This due diligence includes site visits and reviews by independent consultants.

According to VR8, Steelpoortdrift’s projected bottom quartile global operating cost position has garnered positive attention from potential debt financiers. Debt funding will depend on strategic and corporate equity, and discussions remain ongoing with interested parties. While VR8 has noted that it cannot guarantee securing funding within any particular timeframe, it remains confident in its offtake and funding strategy for the project.

Tenders for EPC Workstreams This Quarter

VR8 plans to issue tender packages for each engineering, procurement, and construction (EPC) workstream this quarter to obtain updated capital and operating cost estimates from engineering firms. Following this, EPC/EPCM contracts will be implemented to ensure that selected firms or equipment manufacturers have the expertise, experience, and capability to meet performance guarantees and liquidated damages requirements.

Environmental Authorisation

VR8 also formalised the Environmental Authorisation (EA) for the Salt Roast Leach plant at Tweefontein during the quarter. The EA for the mine and concentrator plant at Steelpoortdrift is expected to be finalised during Q3 CY2024.

The progress made by Vanadium Resources during the June quarter highlights its strategic advancement in securing key offtake agreements and progressing with funding and project milestones. Strong demand for vanadium from China, as demonstrated by recently announced MOUs, reflects Steelpoortdrift’s development potential. Additionally, ongoing discussions with interested parties across China, Japan, Korea, North America, and Europe further enhance VR8’s prospects for securing binding offtake agreements, which are expected to support construction financing for Steelpoortdrift.

As of the end of the June 2024 quarter, VR8 and its subsidiaries had total cash and cash equivalents amounting to AU$1,915,030.

VR8 shares last traded at AU$ 0.049 on 2 August 2024.