Delivering about 1000% stock return in the last ten years is a big achievement! Isnât it? But who has made it possible? None other than California-headquartered tech giant, Altium Limited (ASX: ALU) that develops software for designing electronic products. The companyâs flagship product is recognized for quality in native 3D PCB Computer Aided Design.

Altium gets more than 50% of the revenue through the subscription of its services. Geographically, the company gets 48% of the revenue from the Americas, 32% from Europe, 14% from emerging markets and 7% from the Asia Pacific.

Delivered Strong Financial Performance in FY19

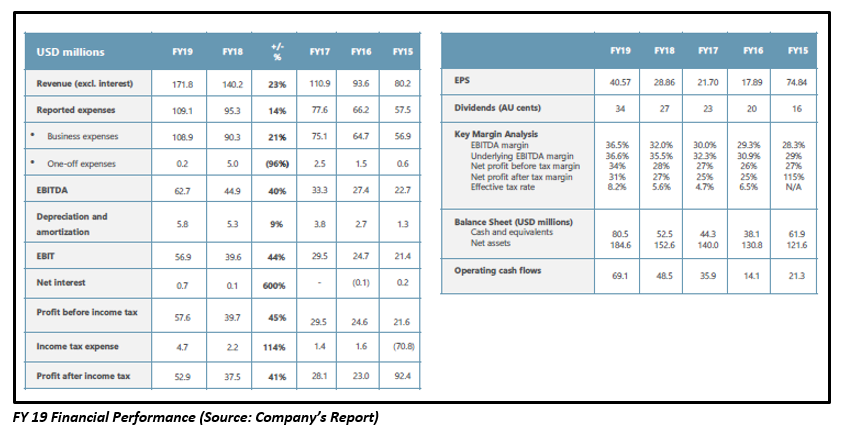

In FY 19, Altium has reported 23% growth in the total revenue to USD 171.8 million, 45% increase in profit before tax to USD 57.6 million and 41% growth in Earnings per share (EPS) to 40.57 cents. Moreover, the EBITDA margin expanded to 36.5% in FY19 from 32% in FY18.

During FY19, there was a 13% increase in the subscription base, taking subscription pool to more than 43,600 subscribers.

Geographically, China contributed the excellent growth in revenue, recording more than 37% revenue growth. US and EMEA also continued to deliver strong performances with the revenue growth of 14% and 15%, respectively.

Segment wise, Board and Systems posted a revenue growth to USD 126.8 million, Octopartâs revenue grew by 49%, while there was a 37% rise in the TASKING revenue.

The company generated a 42% increase in the operating cash flow to USD 69.1 million.

2020 Targets

ALU sets up its strategic targets well ahead as the target for fiscal 2020 was set in 2016. The company has targeted to generate a total revenue of USD 200 million and deliver pure PCB revenue of USD 150 million by 2020. Further, the company aims to achieve the leadership in PCB market through expanding sales capacity, increasing the geographical reach, aggressive growth of demand of new cloud platform Altium 365 and changing the mindset to âuser experience and productivityâ.

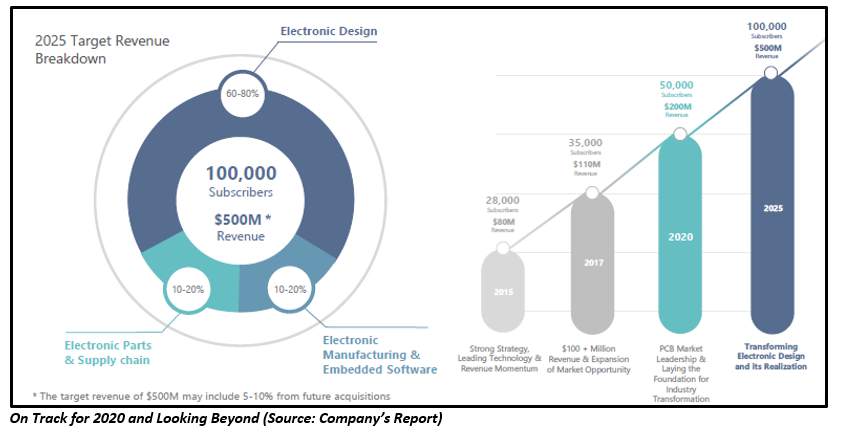

The company is also aiming to expand the addressable market beyond PCB to systems design. Moreover, ALU has set long term target to achieve combined revenue growth and EBITDA margin of at least 50% each year (Rule of 50). The company has set the goal to achieve 100,000 subscribers mark and deliver USD 500 million in revenue by 2025. Additionally, the company has recently released Altium Designer 20 which it anticipates becoming a âgame-changerâ for PCB design.

Steps Taken to Achieve Market Dominance

The company mentioned that PCB market dominance can be attained if it reaches the target of 100,000 subscribers by 2025. For this, the company has made a strategic plan of using brand advertising, enhancing the efficiency of the transactional sales model along with the use of business intelligence, analytics and automation, accelerate licence adoption, systematized promotional campaigns and adoption of a new cloud platform, Altium 365.

Apart from Altium 365, the companyâs product development team is working on to build Altium software that can be adopted for the next level of PCB design. As a result, the company has also released Altium Designer 20, which the company expects to be a âgame-changerâ for PCB design as it has faster and easier routing capability, allows the users to design high density and high-speed boards and consist of choices for multi-board assemblies.

Moreover, the company has signed a strategic partnership with Dassault Systemes for achieving market leadership, market dominance and industry transformation. The partnership:

- Provides strong endorsement of Altium PCB technology for market leadership.

- Allows Altium to penetrate into the very high-end of the industry like to passenger aircraft manufacturers and automotive companies for market dominance.

- Pave the way for integration of Altium ECAD technology onto the Dassault â3D Experienceâ platform for industry transformation.

Both the companiesâ R&D teams have already conducted successful series of âtest flightsâ with customers.

Expects to Exceed its 2020 target

Altium is confident of exceeding its 2020 target of delivering the revenue of USD 200 million and achieving the EBITDA margin of 37% (excluding the positive impact of the new leasing standard). The company will do so through its organic growth.

It has set a goal to achieve 100,000 subscribers & USD 500 million revenue by 2025, in which 60-80% is expected to come from Electronic Design, 10-20% is expected to come from Electronic Parts & Supply Chain, and another 10-20% is expected to come from Electronic Manufacturing & Embedded Software.

The company therefore anticipates attaining the halfway mark of 50,000 by 2020. For full-year FY20, the company expects its revenue to be skewed to the second half, though the costs are approximately distributed equally between the halves of the year. The FY20 revenue is expected to be in the range of USD 205 million to USD 215 million and EBITDA margin is expected to be in the range of 37% to 38% (excluding the positive impact of the new leasing standard).

Stock Performance: ALU closed the trading session at $35.610 on 9th December 2019. Moreover, ALU stock has risen 14.87% in one month. The stock has delivered a YTD return of 66.6 per cent and 1-Year return of 67.3 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.