In Australia the majority of people have access to waste and recycling collection services and the infrastructure of waste and recycling generally follows population with maximum facilities located near to Australiaâs cities and larger towns. Near about 25% of Australiaâs recycling process involves plastics, metals, packaging and paper & cardboard.

According to a report published by the Australian government, Australia generated 67 million tonnes of waste per year in 2016-2017, sending 55% to recycling, 3% to energy recovery and 40% to disposal. Waste from households and council operations generates 21% of Australiaâs annual waste and 17% of the national recycling.

China announced some restrictions in 2017, on the import of recycled materials, which took effect on 31 December 2017 and 1 March 2018 and forbid the importation of 24 waste types with placing some strict contamination limits on others. Australia is one of the hundred countries affected by Chinaâs waste import restrictions, and its municipal-waste streams have been particularly impacted. At the time Chinaâs restrictions were announced, Australia exported approximately 1.3 million tonnes of recycled material to China, accounted for 4% of Australiaâs recyclable waste, which included 35% of its recyclable plastics and 30% of its recyclable cardboard and paper.

Municipal waste processing in Australia

The majority of Australiaâs municipal waste is collected in trucks that compress the material collected at the kerbside, delivering it to Materials Recovery Facilities (MRFs) and other types of infrastructure such as organics processing facilities.

A major issue for Materials Recovery Facilities in Australia is a lack of technical capacity to sort contaminated, co-mingled municipal waste materials to a standard of sorted outputs that meet stringent export specifications. Retrofitting of sorting infrastructure tends to be difficult and expensive, markets for processed materials fluctuate, and the nature of some commercial contracts has led to uncertainty over ongoing outlets for recovered materials.

- Recovery of paper and cardboard in Australia is comparatively high; the National Waste Report 2018 shows that nearly 60% of Australiaâs paper and cardboard waste is recycled. Most local government areas (LGAs) ~92%, provide infrastructure for kerbside collection of types of paper and cardboard waste

- Plastic material recovery in Australia is low; as per National Waste Report 2018 only 12% of Australiaâs plastics are recycled. 146 LGAs do not have any infrastructure for plastic waste collection from kerbside.

- Metals recovery and recycling rates are high in Australia, according to 2018 National Waste Report five million tonnes of metal wastes were recovered for recycling in Australia in 2016â17. This represents a total recovery rate of 90%, around a quarter of which was from municipal sources.

- Approximately 56% of glass packaging is recovered for recycling in Australia and the rate is considered to be reasonable given the low commodity value of glass per tonne as compared to plastic or cardboard, and the difficulty of recovery from mixed waste loads. A total 134 (24%) local government areas (LGAs) do not have any infrastructure to collect waste glass at the kerbside.

In Australia Municipal recycling infrastructure face many challenges-

- Improvement in the provision of kerbside municipal waste collection and recycling service

- Improvement in the processing and collection infrastructure for the processing of all kinds of waste.

- Collection and processing infrastructure improvement for betterment to process co-mingled waste.

Let us discuss one of the biggest waste management service providers in Australia-

Cleanaway Waste Management Limited (ASX:CWY)

An Australian based leader in sustainable, total waste management solutions Cleanaway Waste Management Limited (ASX:CWY) offers multiple solutions related to waste management to the customers. The company works in three segments- Solid Waste Services, Liquids & Health Services and Industrial Services. The company employs more than 5,900 employees and operating in more than 300 sites.

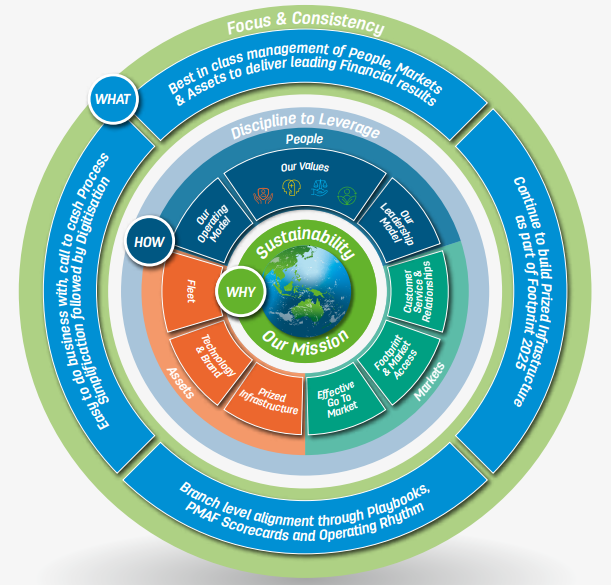

Source: Companyâs report

Fire at material recycling facility in Guildford-

According to an ASX update Cleanaway announced that its materials recycling facility was damaged as a result of the fire on 26 November 2019, the company is working with its customers and other suppliers to identify an alternative solution for the processing of materials which would have been processed at the facility if this incident had not happened.

Additionally, the company is planning to rebuild the site and would start processing for the recovery of the losses after the incident under the companyâs insurances.

After this incident, there would not be any material impact on the underlying EBITDA for the first half-year or the full year of the fiscal year 2020.

Acquisition of SKM recycling assets-

The company announced that Cleanaway had completed the acquisition of the SKM Recycling Group assets, after the announcement that Cleanaway is the successful bidder for SKMâs recycling assets.

Key highlights from the Financial year 2019- (year ended 30 June 2019)

- On a consolidated income statement basis, the companyâs net revenue was $2,283.1 million.

- Cleanaway reported an underlying EBITDA of $462 million, which is increased by 36% to pcp.

- Per share earnings of the company were increased by 7.1% to 6.0 cents.

- The net profit after tax (NPAT) of the company recorded to be $123.1 million up by 9% to pcp.

- Cleanawayâs all three operating segments recorded improved performance as compared to the pcp:

- From Solid Waste Services, the increase in net revenue, EBITDA and EBIT were recorded to increase by 23.0%, 23.5% and 28.1% respectively.

- From industrial & waste services, the net revenue, EBITDA and EBIT increased by 84.0%, 146.6% and 341.2% respectively.

- From liquid waste & health services, the net revenue, EBITDA and EBIT increased by 53.5%, 60.3% and 46.7% respectively.

- In the fiscal year 2019, the company completed a waste transfer station and resource recovery facility (in Sydney) having the license to process 300,000 tonnes of putrescible waste each year.

- In the fiscal year 2019, the company recovered more than 380,000 tonnes of paper and cardboard, over 15,500 tonnes of plastic and more than 25,000 tonnes of steel and aluminium.

- Cleanawayâs Melbourne based organics treatment facility decontaminates green and organic waste for valuable composting and it is diverting more than 100,000 tonnes of waste each year from landfill.

- The company completed the acquisition of a 50% interest in a new Resource Recovery Facility of ResourceCoâs which is situated in western Sydney.

Letâs now have a look at Cleanawayâs stock performance on ASX. With a market capitalisation of $4.35 billion the companyâs stock traded at $2.100 on 2 December 2019. The stock has an outstanding market share of 2.05 billion and has 52 weeks high price and 52 weeks low price of $2.525 and $1.535, respectively. The CWYâs stock has delivered a positive return of 29.27% on the year to date basis and a negative return of 4.93% in the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.