By the closure of the market on 20 August 2019, the benchmark index S&P/ASX 200 Index closed at 6,467.4, up 1.19% from its previous close, while S&P/ASX 200 Information Technology (Sector) was up by 1.87% to 1,271.9. From 2 January 2019 till 20 August 2019, the S&P/ASX 200 Information Technology (Sector) has grown up by ~ 18.39% and S&P/ASX 200 by ~ 15%, highlighting that the IT sector outperformed the S&P/ASX 200 Index during the period.

Letâs see how the following five stocks operating in the IT sector are faring so far.

Infomedia Ltd

On 19 August 2019, Infomedia Ltd (ASX:IFM), a top global provider of SaaS solutions to the parts as well as service segments of the automotive industry, released its full-year results for the period ended 30 June 2019.

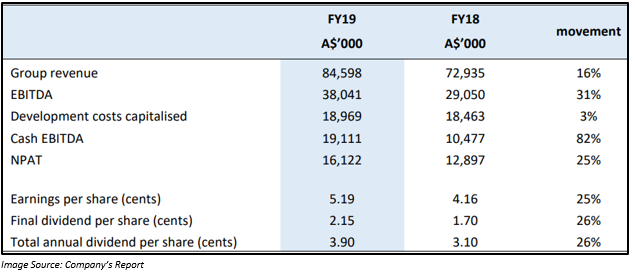

IFM reported an increase of 16% in revenue to $ 84.6 million in FY2019 as compared to the previous corresponding period (pcp). EBITDA increased by 31% on pcp to $ 38.04 million and cash EBITDA grew by 82% year-on-year to $ 19.1 million during the financial year 2019. Net profit after tax also increased by 25% to $ 16.1 million on pcp. The company unveiled an unfranked final dividend of 2.15 cents per share for FY19, which represents a 26% increase when compared with the previous yearâs dividend.

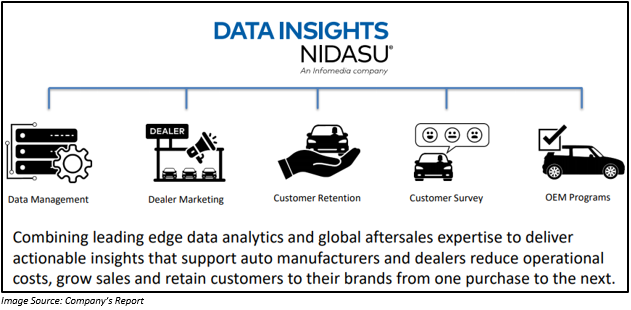

FY2019 was a period of delivering strong growth and continuous improvement in margins by the company. It reported growth in all regions, as well as products. During the period, Infomedia completed the roll out of the Nissan global electronic parts contract. The company not only extended the Nissan relationship, globally, but also sold more products to the existing relationships and moved into new markets. Moreover, it leveraged data insights beyond Australia with the acquisition and integration of data analytics provider Nidasu.

Outlook:

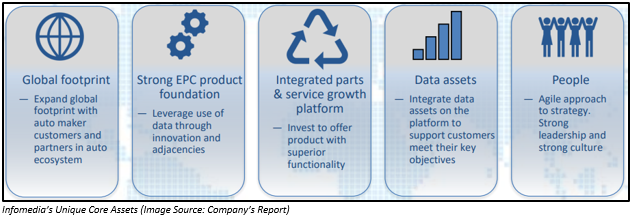

The company, with strong, global customer relationships and good momentum, expects to register double-digit growth in revenue as well as earnings. The company believes that it can continue with its current growth trajectory. At the same time, it would also make investments to take advantage of opportunities that arise from disruption in the automotive industry. According to the company, it can boost its business by leveraging its key assets to provide real value to its clients.

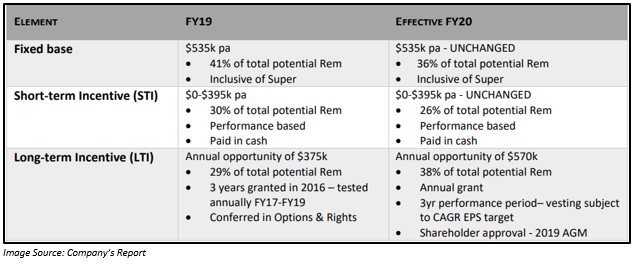

Meanwhile, Infomedia Ltd made an announcement, highlighting changes in the remuneration arrangements for CEO & MD Mr Jonathan Rubinsztein, effective from FY2020.

Stock Information:

On 20 August 2019, the closing price of the shares of IFM was A$ 2.040, up by 11.172% as compared to its last closing price. IFM has a market capitalisation of A$ 573.3 million with approximately 312.43 million outstanding shares, an annual dividend yield of 1.17% and a PE ratio of 35.36x.

Hansen Technologies Limited

Hansen Technologies Limited (ASX:HSN), engaged in the development, integration and support of billings systems software for the telecommunications and utility industries, recently on 16 August 2019 provided a market update related to holdings in the company.

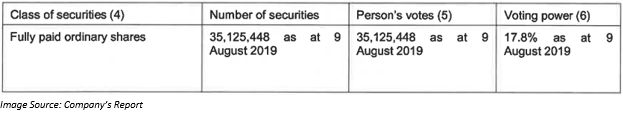

Mr David John Osborne became a substantial holder on 9 August 2019. He holds 35,125,448 shares of the company and has a 17.8% voting power.

David John Osborne and Leone Catherine Osborne have a direct interest in 386,335 shares of the company and has an indirect interest in the remaining 34,739,113 shares as one of the Executors of the Estate of the late Yvonne Irene Hansen and Andrew Hansen as the Director of Othonna Pty Limited and beneficiary of the Hansen Property Trust.

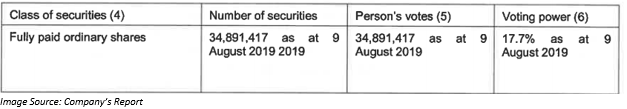

On 16 August 2019, the company also made an announcement stating that Bruce Geoffrey Adams holds 34,891,417 fully paid ordinary shares of the company as at 9 August 2019 and has a 17.7% voting power. He has a direct interest in 152,304 shares of the company and has an indirect interest in 34,739,113 shares of the company as one of the Executors of the Estate.

Stock Information:

By the end of the trading session on 20 August 2019, the closing price of the shares of HSN was A$ 3.990, up by 0.504% as compared to its last closing price. HSN has a market capitalisation of A$ 784.73 million with approximately 197.66 million outstanding shares, an annual dividend yield of 1.51% and a PE ratio of 32.54x.

EML Payments Limited

Information technology sector player, EML Payments Limited (ASX:EML), which provides its clients with more control, transparency as well as flexibility over their payment processes, on 29 July 2019, made an announcement related to the acquisition of the remaining 25.14% minority interest holding in PerfectCard DAC as per the terms and conditions.

The Central Bank of Ireland gave a thumbs up to EML to acquire the remaining stake. With this acquisition, EML would become the owner of PerfectCard. The deal related to the acquisition was completed on 25 July 2019, at a total consideration of A$ 4.7 million in cash.

Stock Information:

By the end of the trading session on 20 August 2019, the closing price of the shares of EML was A$ 3.120, up by 4% as compared to its last closing price. EML has a market capitalisation of A$ 755.53 million and approximately 251.84 million outstanding shares and a PE ratio of 267.86x.

Gentrack Group Limited

Gentrack Group Limited (ASX: GTK), a provider of deeply embedded and mission critical software solutions, on 25 July 2019, provided a revised outlook for the financial year ending 30 September 2019. The company expects its FY2019 EBITDA to be in the range of NZ$ 27 million and NZ$ 28 million. The range represents a drop in EBITDA from an earlier guidance for the financial year 2019. The decrease in expected FY19 EBITDA can be attributed to delays in customer projects as well as contracts along with the risk of bad debts in the United Kingdom. According to the company, these delays are majorly related to customer resourcing. Moreover, these delays do not indicate that the projects concerned are at risk.

The company also reported to have a strong pipeline of opportunities in its utilities and airports markets, aiding GTK in achieving its long-term goals.

Stock Information:

By the end of the trading session on 20 August 2019, the closing price of the shares of GTK was A$ 5.370, up by 2.677% as compared to its last closing price. GTK has a market capitalisation of A$ 515.91 million with approximately 98.64 million outstanding shares and an annual dividend of 2.48%.

Life360, Inc.

San Francisco-based Life360, Inc. (ASX: 360), which operates a platform for busy families in order to bring them closer to better know, communicate with and protect their loved ones, made an ASX announcement on 8 August 2019, according to which the company would release 48,351,492 CDIs and 62,158 unquoted share options from voluntary escrow on 23 August 2019. The release of CDIs would be quoted as per Listing Rule 2.8.2.

On 31 July 2019, the company provided its quarterly business update for the period ended June 2019. The company reported an increase of 2.5 million in its global Monthly Active User (MAU) base to 23.1 million in the quarter ended June 2019. The US MAU base reached 12.7 million on 30 June 2019, representing a Y-O-Y growth of 66%. Paying Circles, which includes Life360 Plus and Driver Protect, reported an increase of 60% year-on-year to 696,000 at 30 June 2019.

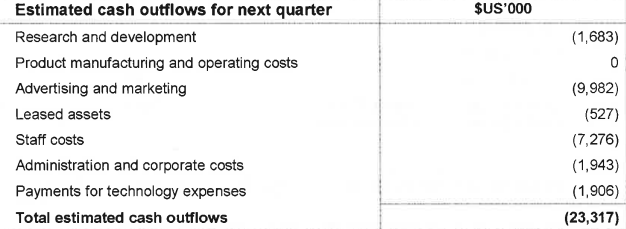

Revenue generated in the six-month duration to June 2019 stood at US$ 24.6 million, representing a 114% y-o-y growth rate. The auto insurance lead generation partnership of the company with Allstate delivered more than $ 1.0 million in revenue during the June quarter. The company had cash of US$ 78.7 million at the end of June 2019, reflecting IPO proceeds along with the repayment of term debt. Estimated cash outflow in the September 2019 quarter is US$ 23.317 million.

Image Source: Companyâs Report

Stock Information:

By the end of the trading session on 20 August 2019, the closing price of the shares of 360 was A$ 3.250, down by 3.274% as compared to its last closing price. 360 has a market capitalisation of A$ 489.08 million and approximately 145.56 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.