EML Payments Limited (ASX: EML) announced that it has inked an eight-year agreement with publicly listed employee management company, Smartgroup Corporation Limited, to be their provider of branded General-Purpose Reloadable card programs for payout of Salary Packaging benefits. The news sent the stock price to jump up by 6.25% in a day-trade to close at $2.550 on 24 May 2019.

Once at full potential, EML expects to earn between $4 - $8 million revenue per annum from the incremental volumes in this contract, provided there are no adverse changes in market conditions.

Smargroup is one of the existing clients of EML, who joined hands with the company back in 2017. The revolutionary EML Salary Packaging technology solution allows customers to have multiple benefit accounts funding a single card managed by a virtual wallet.

Products and solutions offered by EML (Source: EML AGM Presentation)

Products and solutions offered by EML (Source: EML AGM Presentation)

The disruptive technology of EML allows salary sacrifice participants to no longer carry a number of cards, rather just have one for every benefit account. EML currently manages ~50,000 benefit accounts of Smartgroup. EML also provides Salary Packaging cardholders access to:

- a Merchant Coalition program that delivers savings at more than 5,000 merchants which generate savings of approx. $5 per month on average to participants;

- an innovative End of FBT Year Non-Reloadable program allowing participants to efficiently expend unused funds prior to 31 March annually;

- an innovative end of employment Non-Reloadable program allowing participants to efficiently expend unused funds prior to ending their employment; and

- access to both physical cards and EMLs mobile payments capability to access their funds.

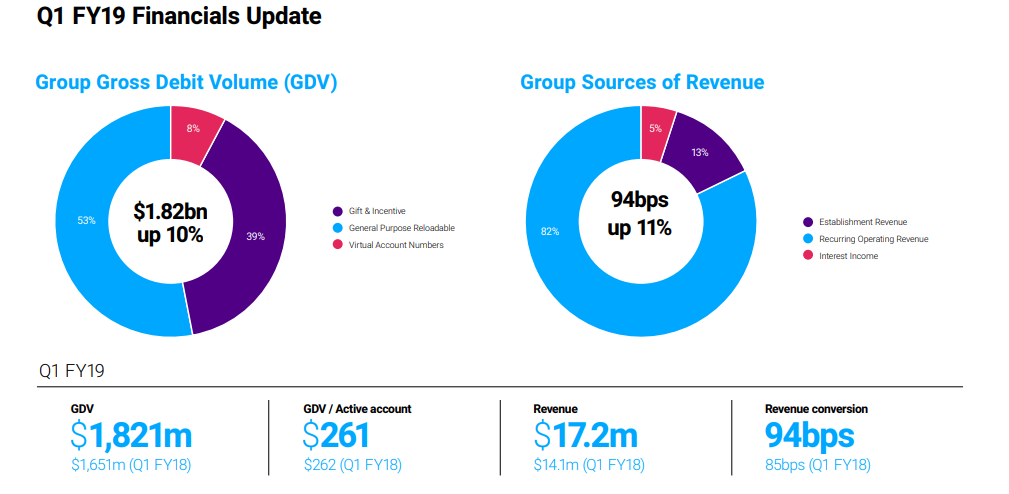

Q1 FY19 Financial Update of EML (Source: EML AGM Presentation)

Q1 FY19 Financial Update of EML (Source: EML AGM Presentation)

The revenue model of the company is primarily based on the revenue generated from a monthly transaction fee per benefit account. It also derives revenues from other streams including interest, Forex Fees, transaction fees on Non-Reloadable cards sold and breakage.

ASX-listed EML is a leading payment solutions provider to the Salary Packaging industry with over 160,000 benefit accounts already in the market. Following this contract, EML expects to provide services to more than 260,000 benefit accounts by April 2022 and total annual Gross Debit Volume for this vertical is expected to be approximately $2 billion once the transition is complete.

The companyâs portfolio includes innovative financial technology to offer mobile, virtual and physical card solutions to some of the largest corporate brands around the world. It ensures highly secure and efficient payment processing to its clients while helping them improve customer service and increase brand loyalty. EML is currently processing billions of dollars in payments each year and operates across 21 countries in Europe, North America and Australia.

EML Global Presence (Source: EML AGM Presentation)

EML closed at a price to earnings multiple of 214.290x with a market capitalisation of $600.61 million. Over the past 12 months, the stock has witnessed a positive price change of 83.21% including an upside of 53.35% recorded in the past three months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.