In an era of transformation from the use of non-renewable resources to electric and hybrid cars, Australia is increasing its share to contribute in reducing carbon footprints.

Witnessing this change in Australia, the number of sales of electric cars has doubled during Q1 2019 to 1277 as compared to 670 in Q1 2018. On the other hand, a slight decrease is seen in the sale of petrol cars over the same tenure, marking 385,082 in Q1 2018 and 347,042 in Q1 2019.

As per the Electric Vehicle Council, Australia, the cost of fuel required to run a car is $1.50 per litre, however, the cost reduces to $0.33 per litre in case of an electric car. Taking from there, the future of electric cars is bound to boom in the country as predicted by the several analysts.

Australian vehicle market is anticipated to have more than 50% of electric cars by another decade.

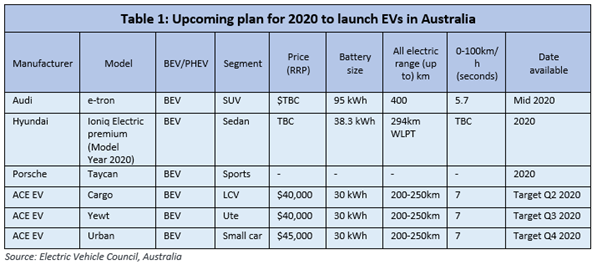

In Australian EV market in 2019, there are twenty two EVs available for customers, including nine battery electric vehicles (BEVs) and thirteen plug in hybrids (PHEVs). As per the plan there would be 31 EVs options available for customers in 2020.

2020 is expected to witness EVs standing at par with petrol vehicles in terms of upfront price and range, with the EV sales anticipated to expand rapidly. There are other factors which influence the increase in trend of EVs in Australia, such as availability of the model lying in the range of $60,000 as well as the quality.

On the policy front, Federal Government is under a process to prepare and launch National Strategy for Electric Vehicles for every state and region to follow, to be completed by 1H 2020.

The details of the new launch of EVs in Australia by different automotive manufacturers is explained in the table 1.

The booming EV market is creating huge demand potential for battery minerals including lithium, tantalum, cobalt, etc. Several Australian companies are making progress on mineral projects to tap the immense market opportunities offered by exponentially growing EV market.

Zooming the lens on Australia based mineral players - PLS, AJM, GXY

Pilbara Minerals Limited (ASX: PLS)

An ASX listed metals and mining company, Pilbara Minerals Limited (ASX: PLS) produces lithium and tantalum – critical elements of EV batteries, supporting an ecological energy future. PLS pioneers in owning 100 percent in Pilgangoora Project (Pilgangoora Lithium-Tantalum Project) The company was founded in 2005 and located in Colin Street, West Perth, Australia. considered within the top 200 companies in Australia (ASX200 index).

The company seems to be well positioned to benefit from the EV growth potential with interests in one of the biggest lithium mines on the planet – Pilgangoora.

With new strategic investor CATL – China’s largest battery manufacture of EVs and JV term sheet agreed with POSCO with board approvals expected this year, PLS seems to be ideally placed in the entire battery supply chain.

Announcement of New issue: On 16 December 2019, Pilbara issued 18,892,603 number of securities for options granted in pursuant to company’s Employee Award Plan.

Director’s change in securities: On 26 November 2019, Kenneth Edward Brinsden, CEO and Managing Director in Pilbara acquired ~4.2 million unlisted options and 0.58 million performance rights.

Stock Performance-

On 13 January 2020, the stock of PLS was trading at $ 0.345 (2:41 PM AEDT), moving upwards by 1.47%, with outstanding market shares of approximately 2.22 billion. The company had a market capitalisation of nearly $ 655.99 million, while the 52 weeks low and high price of the stock was noted at $ 0.250 and $ 0.885, respectively. The stock has delivered positive return of 30.77 percent in last one month.

Altura Mining Limited (ASX: AJM)

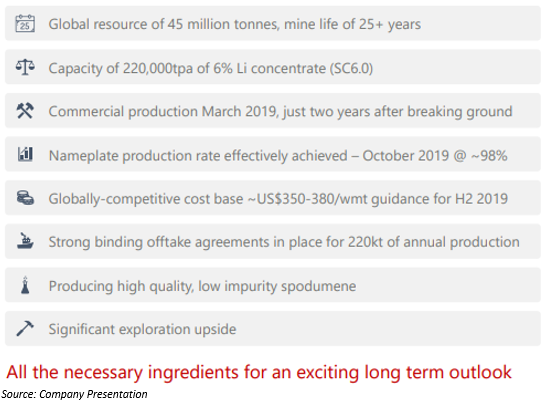

Australian based, Altura Mining Limited (ASX: AJM) is one of the global players of lithium market. It is engaged in lithium raw material supply, exploration and development activities. AJM has 13 subsidiaries with country of origin as Australia, Indonesia, Mauritius, Singapore and Philippines. Altura’s Pilgangoora Mine has manufactured its first lithium in July 2018, subsequently, in October 2018 they did their first sales. However, the commercial production was announced in March 2019.

Announcement of Change in Production: On 24 December 2019, Altura decided to have 94-hour shut down of its plant maintenance. As a consequent, this quarter production is expected to be approximately 45 – 50,000 wmt in total (instead of previous total of 53 – 57,000 wmt).

James Brown, MD mentioned that the shutdown would eventually lead to improvement in performance of plant in upcoming quarter.

Debt Refinancing: Altura is planning to refinance its current loan debt for which several discussions with potential investors have started.

Stock Performance-

On 13 January 2020, the stock of AJM was trading at $ 0.063, moving upwards by 1.613%, with outstanding market shares of approximately 2.48 billion (2:42 PM AEDT). The company had a market capitalisation of nearly $ 154 million, while the 52 weeks low and high price of the stock was noted at $ 0.047 and $ 0.175, respectively. The stock has delivered positive return of 28.88 percent in last five years, while over last one month it delivered 11.71% return.

Galaxy Resources Ltd (ASX: GXY)

An ASX listed metals and mining company, Galaxy Resources Ltd (ASX: GXY) operates in Australia, Canada and Argentina which are its source for brine assets and hard rock mines. GXY is the producer of tantalum and spodumene concentrate from its two vital plants namely, James Bay lithium pegmatite project and the Mt Cattlin mine, located in Canada and Australia respectively.

Announcement of Change in substantial holding: On 24 December 2019, GXY notified the market that it has changed its interest as a substantial holder in Lepidico Ltd (ASX: LPD). GXY has decreased its voting power from the previously held 9.35 percent to 8.095 percent to be effective from 23 December 2019.

Change in S&P/ASX 200 index: S&P Dow Jones announced certain changes in ASX indices to be effective from 23 December 2019. As per the release, Galaxy resources Ltd is removed from S&P/ASX 200 index and S&P/ASX All Australian 200 index.

Stock Performance-

On 13 January 2020, the stock of GXY was trading at $ 1.195, moving upwards by 3%, with outstanding market shares of approximately 409.48 million (2:41 PM AEDT). The company had a market capitalisation of nearly $ 409.48 million, while the 52 weeks low and high price of the stock was noted at $ 0.815 and $ 2.415, respectively. The stock has delivered positive return of 32.57 percent in last one month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.