Summary

- Shareholding activities enable small investors to know the investments decisions of sophisticated investors in the market.

- ECP Asset Management has acquired a 5.15% stake in Corporate Travel Management, which is targeting break-even backed by a revival in domestic travel across its markets.

- Wilson Asset Management has increased its stake in Infomedia, which has reaffirmed its FY20 guidance of double-digit growth in revenue and profits and raised capital.

Companies listed on the ASX must disclose changes in substantial holding, which allows market participants to review the shareholding changes in the company. Most of the times, it will enable small investors to check who are investing large sums in companies.

Corporate Travel Management Limited (ASX:CTD)

In 1994, Corporate Travel Management was established in Brisbane, Australia. It has grown to become a world-renowned travel management company. CTD provides travel solutions for a range of travel needs, including corporate, leisure, loyalty, leisure, events, and wholesale.

Yesterday, CTD reported that ECP Asset Management had acquired a 5.15% stake in the company, acquiring around 5.61 million shares. ECP bought shares in the company on 6 June 2020.

Earlier this month, Mitsubishi UFJ Financial Group, Inc. saw its stake reduced to 6.62% from 8.07%. The reduced stake of Mitsubishi UFJ Financial Group is due to security lending agreements agreed with various parties through a broker. These transactions were undertaken between 28 May 2020 to 2 June 2020.

In early May, the company reported that it continues to have a strong liquidity position and bankers of the business have agreed to waive financial covenants for the calendar year 2020. CTD, with its bankers, also agreed to remove COVID-19 from MAE definition.

Further, financial covenants would be for the period ending 30 June 2021, which would be based on the performance of 2HFY21. The company’s facility term maturity will expire in August 2022, same as earlier. However, the total facility was lowered by £25 million to £100 million.

Subsequently, the company delivered a presentation at the Macquarie Australia Conference. It was noted that the company has a capital-light business model as more than 70% of its costs are people related with a small physical footprint.

Pre COVID-19, domestic travel revenues constituted 60% of total revenues, with 75% of domestic transactions being online through CTD’s proprietary booking tools. CTD said that most of the clients pay through credit cards, especially SME businesses.

Since 1 April, the company has reduced cost base to $10-12 million from $26-27 million in the pre-COVID-19 period. This was achieved temporary stand-downs, salary reductions, shorter working hours, Government policies, and lower capital expenditure.

Now CTD has a low break-even, enabling the business to return to profitability with a slight revival in domestic demand. A resumption in ANZ domestic, UK/USA domestic, Greater China and Trans-Tasman travel is needed for the business to reach break-even or profitability.

On 10 June 2020, CTD last traded at $14.610, up by 2.887% from the previous close. It has a market capitalisation of approximately $1.55 billion, with around 109 million shares outstanding. On a YTD basis, the stock is down by 31.23%, and up by 50.11% over the past three months.

Infomedia Ltd (ASX:IFM)

Founded in 1987, Infomedia is a developer of SaaS systems used in the parts and services segments of the automobile industry. It provides online parts selling systems, service selling systems, publications, data analysis and information systems. IFM’ services and products are used in over 186 countries.

As per ASX-filings, since early May, Wilson Asset Management Group has been buying shares of Infomedia through its portfolios. And the last sale by the group’s portfolios occurred on 1 May 2020. Collectively, the asset manager now holds a 6.42% stake in the company with around 24.03 million shares.

IFM reported that Viburnum Funds reduced its stake to 10.93% from 12.9% according to exchange filing on 5 June 2020. And, a day earlier, Victorian Superannuation Fund notified that it holds 5.01% stake in the company with 18.75 million shares.

In April, the company announced capital raising plans. In May, it raised a total of ~$83.9 million after completing the Share Purchase Plan. Earlier, Infomedia completed a placement of around $70 million to institutional investors.

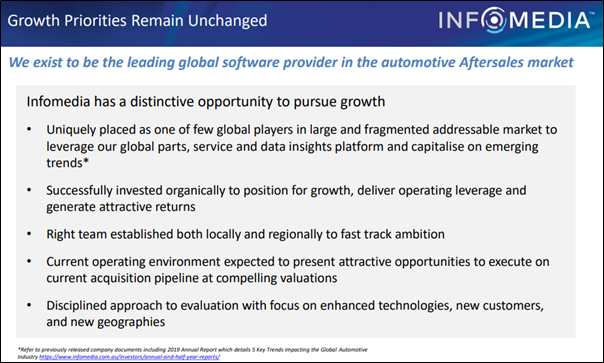

CEO of the company, Jonathan Rubinsztein noted that COVID-19 provides an opportunity for the business to accelerate growth strategy through acquisitions of complementary businesses in the sector, which would enable to access new customers and geographies. He said that fresh capital would allow the business to acquire value accretive business that would arise in the current environment.

Source: IFM Capital Raising Presentation, April 2020

In addition to acquisition opportunities, the capital would allow the business to develop organic parts, data insights and service as well as investments in product innovation.

In the period ended 31 March 2020, the business performed consistent with the management expectations. It was having a cash balance of $15.2 million at the end of the period after paying interim dividend and deferred consideration related to a previous acquisition.

Infomedia also reaffirmed its guidance for the FY20. It expects to deliver double digit growth in revenue and profit. Revenue is expected to be in the range of $93 million to $95 million and NPAT in the range of $18 million to $19 million, depicting a growth of 10-12% and 12-18%, respectively, both over the previous year.

On COVID-19, it was said that the automotive industry has been undergoing stress prior to the crisis as well. And the automobile industry players are looking to diversify revenue to improve profitability from sources other than automobile sales.

Although car sales were impacted due to lockdowns implemented by the Governments, aftermarket segment was regarded as an essential service, and technology would continue to improve profitability, productivity, and customer retention.

On 10 June 2020, IFM last traded at $1.720, down by 1.714% from the previous close. It has a market capitalisation of approximately $655.3 million, with around 374.46 million shares outstanding. On a YTD basis, the stock is down by 15.87%, and up by 10.76% over the past month.

NOTE: $ denotes Australian Dollar unless stated otherwise.