Highlights

- Smith & Wesson (NASDAQ:SWBI) plans to announce earnings on March 6

- Previous quarter EPS reached 0.11 with revenue of 129.70 million

- Quarterly dividend of 0.13, yielding 4.79 percent

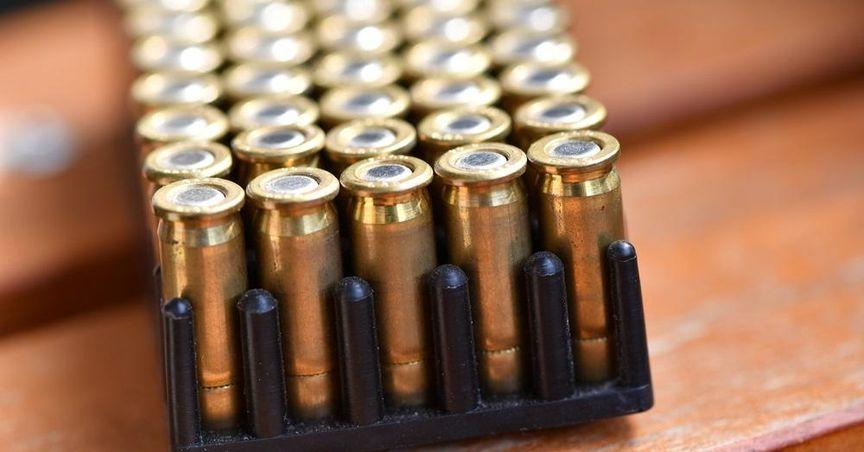

Smith & Wesson (NASDAQ:SWBI) operates within the firearms sector, offering handguns, long guns, and related products for commercial, law enforcement, and military applications. The brand portfolio includes M&P, Thompson/Center Arms, and Gemtech. Its broad range of items covers a variety of consumer and professional markets, positioning the company as a familiar name in firearm manufacturing.

Financial Performance

A new earnings statement is set to be unveiled on March 6. Earlier information showed the company achieved an EPS of 0.11 during its last reported quarter, while a figure of 0.17 had been presented earlier in official documentation. Quarterly revenue reached 129.70 million, marking an increase of more than three percent compared to the same period in the prior year. The upcoming release is expected to include an EPS figure of 0.02 and revenue of around 119.46 million. These numbers will offer further clarity on the effectiveness of recent operational strategies in the firearms market. Observers will examine whether the company has managed inventory, production, and distribution efficiently in light of changing consumer preferences.

Stock Details

Shares opened near the 10 range, and the organization’s market capitalization stands around 477.87 million. The price-to-earnings ratio hovers in the teens, providing a glimpse into how the stock is currently priced relative to earnings. A beta of slightly above one shows moderate movement in line with broader market trends. The company’s debt-to-equity ratio is at 0.36, while a quick ratio of around 1.43 and a current ratio near 3.97 highlight short-term and mid-term liquidity. Over a recent twelve-month span, share prices have traveled between the 9 range and the 18 range, with a 50-day simple moving average close to 10 and a 200-day simple moving average around 12.

Dividend Overview

A quarterly dividend of 0.13 was issued on January 2 to shareholders of record as of December 19. On an annualized basis, that equals 0.52, translating to a yield of nearly five percent. The dividend payout ratio is at 66.67 percent, reflecting the percentage of earnings allocated to shareholders. This level of payout may interest individuals seeking consistent dividend income from a firearms-oriented company.

Corporate Focus

Smith & Wesson Brands, Inc. functions as a holding entity that manages various firearm-related businesses. Under this umbrella, products include pistols, revolvers, rifles, and accessories such as suppressors and handcuffs. Through its long-established presence, the company seeks to maintain a robust portfolio of offerings for different market segments.