Highlights:

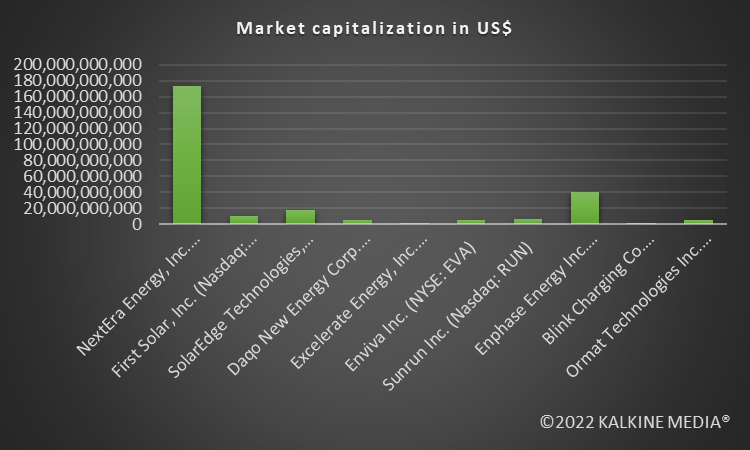

- NextEra Energy Inc. (NYSE:NEE) reported revenue of US$5,183 million in Q2 2022.

- SolarEdge Technologies, Inc. (NASDAQ:SEDG) has a market cap of US$16.44 billion.

- Enviva Inc. (NYSE:EVA) reported an adjusted EBITDA of US$39.5 million for Q2 2022.

After the US Senate passed the landmark energy and climate bill, it was praised by some experts as it is probably the biggest investment by any nation to fight climate change. Since then, dozens of renewable energy stocks have been gaining traction.

The bill is called the Inflation Reduction Act, and it allotted US$ 369 billion to renewable energy. The bill aims to increase clean energy output, reduce emissions by 40 per cent by 2030, and generate employment in the clean energy sector.

That said, we can look at the list of renewable energy stocks curated by Kalkine Media® and find out more about them in detail:

1. NextEra Energy, Inc. (NYSE:NEE)

NextEra has a capacity of 58 GW and has business operations in the US and Canada. The company is one of the largest utility companies worldwide. In 2022, NEE stock fell by five per cent. However, it leapt over eight per cent year over year.

In Q2 2022, NextEra's revenue was US$ 5,183 million. Meanwhile, the net income was US$ 1,380 million.

NextEra announced an annualized dividend rate of US$ 1.7 per unit, which is expected to be paid on September 15, 2022.

2. First Solar, Inc. (NASDAQ:FSLR)

First Solar manufactures solar panels and deals in utility-scale PV power plants. The company holds a market capitalization of US$ 10.43 billion.

In its second-quarter earnings of fiscal 2022, First Solar posted net sales of US$ 621 million compared to US$ 629 million in Q2 FY21. Its net income per diluted share in Q2 FY22 was US$ 0.52. Its net income per share in 2021 in the corresponding quarter was US$ 0.77.

3. SolarEdge Technologies, Inc. (NASDAQ:SEDG)

The Nasdaq-listed company, SolarEdge, manufactures and sells solar inverters and other related products, contributing to a green future.

In 2022, SESD stock surged 4.5 per cent. The US$ 16.44 billion market cap company, SolarEdge has earnings-per-share (EPS) of US$ 2.56.

In its second-quarter earnings results for fiscal 2022, reported on August 3, 2022, SolarEdge posted record revenues of US$ 772.8 million. The Gross margins of the reported quarter stood at 25.1 per cent.

SolarEdge CEO Zvi Lando said the company's record revenue in Q2 FY22 was driven by a growing demand for clean energy worldwide.

4. Daqo New Energy Corp. (NYSE:DQ)

NYSE-listed Daqo New Energy Corp. is a Chinese company that manufactures monocrystalline silicon and polysilicon, which are used in solar photovoltaic systems.

In Q2 2022, the company achieved a production volume of 35,326 MT of Polysilicon, compared to 31,383 MT in the previous quarter.

The polysilicon sales volume was 37,545 MT in Q2 2022, while it was 38,839 MT in Q1 2022.

Daqo reported a revenue of US$ 1,244.1 million in Q2 2022 compared to US$ 1,280.3 million in the first quarter of 2022.

5. Excelerate Energy, Inc. (NYSE:EE)

Excelerate Energy, Inc. provides global flexible liquefied natural gas (LNG) solutions. Excelerate Energy has a market cap of US$619.86 million.

A key player in the energy sector, Excelerate Energy announced a memorandum of understanding (MoU) for buying up to 1 billion cubic meters of regasified LNG annually over the next ten years by Bulgarian private supplier Overgas.

The share price of EE stock soared 15 per cent since last month. In its Q1 2022 results, announced on May 24, 2022, Excelerate Energy reported a net income of US$ 12.8 million. Its total revenue for the reported quarter was US$ 591.67 million compared to US$ 164.81 million.

6. Enviva Inc. (NYSE:EVA)

Enviva is of the largest producers of industrial wood pellets and plays an important role in electricity production.

The US$ 4.58 billion market cap company, Enviva, paid a quarterly dividend of US$ 0.905. Enviva's adjusted EBITDA was US$ 39.5 million for Q2 2022 versus US$ 25.7 million for the corresponding quarter in 2021.

7. Sunrun Inc. (NASDAQ:RUN)

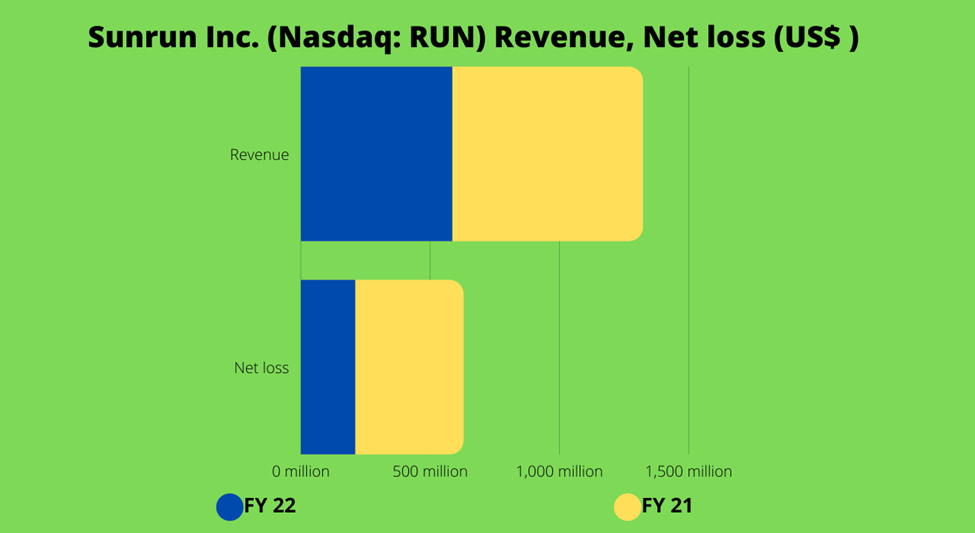

The US$ 6.69 billion market valuation company Sunrun Inc. offers solutions for residential solar energy systems in the US. It manufactures, designs, installs and sells solar energy systems to customers.

The San Francisco, California-based Sunrun added 34,403 customers in the second quarter of 2022. Its total number of customers is 724,177, which is a 21 per cent growth year-over-year.

Sunrun reported net assets of US$ 4.6 billion, including US$ 863 million in total cash, in its Q2 2022 earnings results announced on August 3, 2022.

The company’s revenue was US$ 584.58 million in Q2 2022 compared to US$ 735.96 million in Q2 2021.

Sunrun reported a net loss of US$ 209.75 million in Q2 2022, while in the same quarter the previous year, it was US$ 417.73 million. The RUN stock fell by 13 per cent in 2022.

Source: ©Kalkine Media®; © Canva Creative Studio via Canva.com

8. Enphase Energy Inc. (NASDAQ:ENPH)

Enphase Energy deals in the manufacturing and selling of solar micro-inverters. Catering to residential customers, it also develops energy generation monitoring software and products related to battery storage.

Fremont, California-based Enphase Energy has a market cap of US$ 39.71 billion.

The ENPH stock surged over 49 per cent year-over-over. While in the past month, shares of this solar technology company gained over 50 per cent.

In Q2, Enphase reported revenue of US$ 530.2 million. The company said it shipped 3,348,553 microinverters during the second quarter of 2022.

9. Blink Charging Co. (NASDAQ:BLNK)

The Miami Beach, Florida-based company Blink Charging provides fast-charging stations for EVs and networks for homes and businesses. It has a market cap of US$ 1.11 billion.

Blink reported a 339 per cent growth in Q1 2022 revenues to the US $9.8 million compared to US$ 2.2 million in Q1 2021.

On July 29, 2022, the company announced agreeing with ATHENA to charge the ZEVx electric conversion kits.

10. Ormat Technologies Inc. (NYSE:ORA)

Reno, Nevada-based Ormat Technologies is a global US company that provides renewable geothermal energy technology. The US$5.04 billion market cap company Ormat has built 190 power plants and installed over 3,200 MW so far.

Shares of Ormat gained close to 12 per cent in 2022. ORA stock soared over 14 per cent in the last month.

Ormat posted a revenue of US$ 169.1 million in Q2 FY22 compared to US$ 146.9 million in Q2 2021.

Bottom line:

Green investment or renewable energy is a major sector that intrigues investors big and small. As the world is waking up to a renewed zeal by nations and global enterprises to thwart global warming, renewable energy companies are believed to have growth potential. However, as the market is volatile, anything can happen. Hence, it is important to research before investing.