US stocks closed lower on Tuesday, May 31, after an extended weekend break for the Memorial Day festivities as traders turned their attention to President Joe Biden’s talks with Federal Reserve Chairman Jerome Powell on inflation.

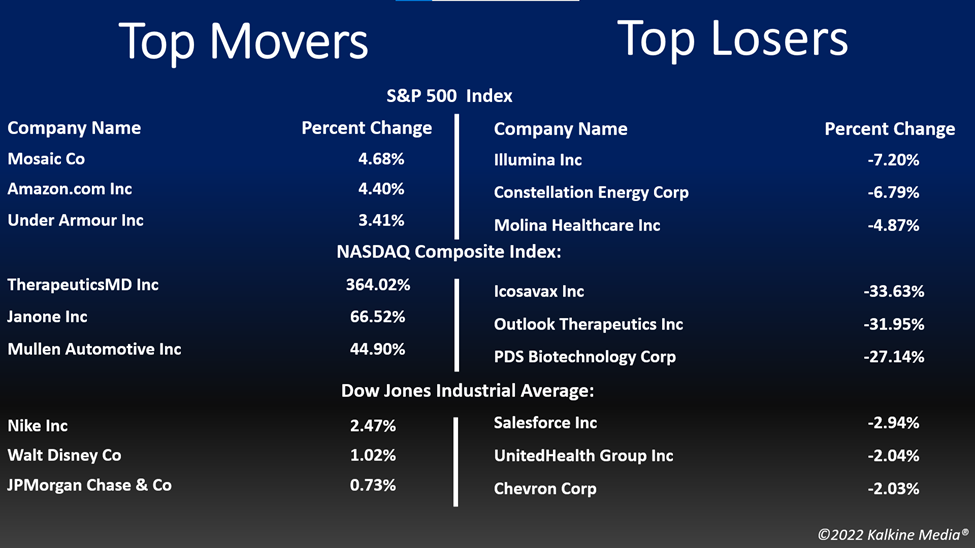

The S&P 500 was down 0.63% to 4,132.15. The Dow Jones fell 0.67% to 32,990.12. The NASDAQ Composite decreased by 0.41% to 12,081.39, and the small-cap Russell 2000 was down 1.26% to 1,864.04.

Traders eagerly waited for the outcome of the Biden-Powell meeting. The president was expected to discuss the issue of soaring gasoline and consumer prices. It was their first meeting after Powell's confirmation by the Senate for a second term early this month.

Meanwhile, Fed Governor Christopher Wallet’s aggressive remarks on Monday about raising the interest rates at every monthly meeting until inflation comes down may have concerned the investors. Some traders expected a tone down from Fed after its next two rate hikes.

On Tuesday, the communication services and consumer discretionary sectors were the top movers on the S&P 500 index. Eight out of the 11 sectors of the S&P 500 index stayed in the negative territory. The energy and material segments were the laggards.

Shares of Canadian mining company Yamana Gold Inc. (AUY) surged nearly 4% after the Johannesburg-based Gold Fields Ltd. agreed to acquire it for US$6.7 billion in an all-share deal.

Glucose monitoring device maker DexCom, Inc. (DXCM) stock gained 3.40% after it refuted having merger talks with Insulet Corporation (PODD). The PODD stock fell around 9%.

Shares of Unilever PLC (UL) rose 9.99% in intraday trading after the British consumer goods firm said it appointed Nelson Peltz as a board member, who now holds a 1.5% stake in the company.

In the consumer discretionary sector, Amazon.com, Inc. (AMN) increased by 4.40%, Alibaba Group Holding Limited (BABA) gained 2.83%, and Nike, Inc. (NKE) added 2.47%. Starbucks Corporation (SBUX) and JD.com, Inc. (JD) advanced 2.33% and 4.55%, respectively.

In communication services stocks, Alphabet Inc. (GOOGL) rose 1.29%, The Walt Disney Company (DIS) surged 1.02%, and Netflix, Inc. (NFLX) ticked up 1.15%. Telus Corporation (TU) and Telefónica, S.A. (TEF) soared 1.09% and 1.14%, respectively.

In the energy sector, Exxon Mobil Corporation (XOM) decreased by 1.63%, Chevron Corporation (CVX) fell by 2.03%, and Shell plc (SHEL) declined by 1.33%. ConocoPhillips (COP) and Schlumberger Limited (SLB) plummeted 1.95% and 4.32%, respectively.

In the crypto space, Bitcoin (BTC) jumped 1.66% while Ethereum (ETH) ticked down 0.07%. The global crypto market cap soared 1.75% to US$1.30 trillion at 4:33 pm ET on May 31.

Also Read: BABA, PDD among top 5 Chinese stocks to watch as lockdowns ease

Also Read: HPQ, CRM, GME among top 5 stocks to watch this week

Also Read: Five AI stocks to consider in June: IBM, MU, AMAT, AI & ADBE

Futures & Commodities

Gold futures were down 0.90% to US$1,840.60 per ounce. Silver decreased by 1.93% to US$21.547 per ounce, while copper fell 1.20% to US$4.2815.

Brent oil futures decreased by 1.07% to US$116.34 per barrel and WTI crude was down 1.60% to US$115.31.

Also Read: Is Cardano (ADA) crypto rising on Iagon’s Ethereum-Cardano bridge news?

Bond Market

The 30-year Treasury bond yields were up 2.68% to 3.056, while the 10-year bond yields rose 3.66% to 2.849.

US Dollar Futures Index increased by 0.49% to US$101.800.