THORChain (RUNE) price has continued defying gravity as demand for the coin and its ecosystem jumps. RUNE has risen in the past five straight weeks and is now moving to the highest level since May 2022. The token has surged by over 900% from the lowest point this year, bringing its total market cap to over $2.1 billion.

THORChain ecosystem is thriving

THORChain is one of the fastest-growing blockchain networks in the network. Built on the Cosmos ecosystem, the platform makes it possible for people to swap tokens in a simple way. It facilitates native asset settlement between Bitcoin, Ethereum, Avalanche, and Litecoin.

THORChain’s ecosystem is doing well. Data in its website shows that the network has a Total Value Locked (TVL) of over $985 million. Total liquidity jumped to over $310 million while the total validator bond has moved to $675 million.

Further, the network has handled over $63 billion while the total 24-hour volume has moved to over $278 million. According to CoinMarketCap, THORChain has become the fifth-biggest DEX in the world after dYdX, Uniswap, Kine Protocol, and PancakeSwap.

Like other cryptocurrencies, THORChain price has jumped because of the ongoing risk-on sentiment. Bitcoin has jumped to a high of $37,000, the highest point since April last year. Also, the total market cap of all cryptocurrencies has jumped to over $1.4 trillion.

The rally has also led to sharp shorts liquidations. According to CoinGlass, the total shorts liquidations surged to a record high of over $3.27 million. Bullish liquidations came in at just $103k. Most of these liquidations were from Binance.

THORChain futures open interest chart

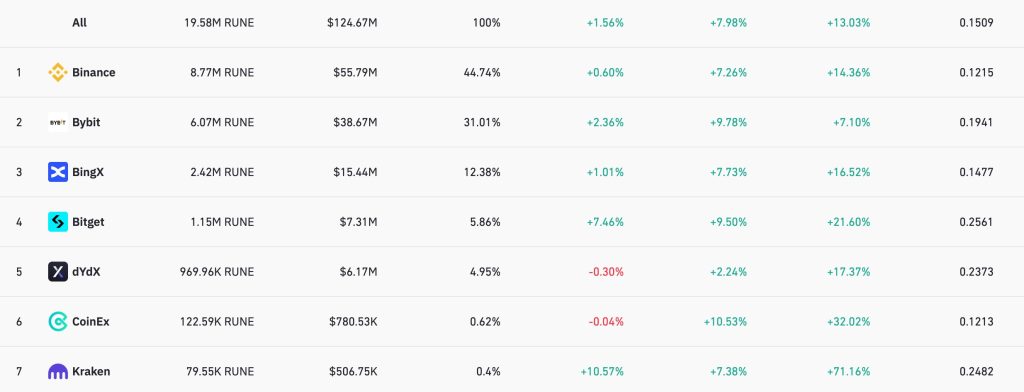

Further, the total open interest surge to an all-time high of over $124.6 million. As shown below, most of this interest was also from Binance, Bybit, BingX, and Bitget. Open interest is an important metric that shows the number of outstanding derivative contracts.

RUNE price forecast

The daily chart shows that the THORChain crypto price has been in a strong bullish trend in the past few months. It has moved above the Supertrend indicator and all moving averages.

Further, the Relative Strength Index (RSI) and Stochastic Oscillator have moved to the overbought level. This trend shows that the coin still has momentum. Its volume has also been in an uptrend.

Therefore, the outlook for the coin was bullish. If this happens, the next level to watch will be at $8. However, the token could have a small pullback as some existing investors start taking profits.

The post THORChain RUNE liquidations, open interest jump as price surges appeared first on Invezz