The Federal Reserve earlier today released the official minutes of its Federal Open Market Committee (FOMC) meeting that was held on September 19-20, 2023.

During the meeting, the Committee members unanimously voted to maintain the target rate at 5.25% – 5.50%; shrink the balance sheet by allowing the “roll off” of $60.0 billion (£48.73 billion) in maturing treasuries and $35.0 billion in MBS on a monthly basis; and strongly committed to bringing inflation down to the 2% target.

It should be noted that although the 12 voting members were unanimous in their decision, the complete 19-member Committee, which consists of Federal Reserve bank presidents as well as governors was not.

As per the minutes, the Committee’s broad views on the economy were as follows,

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated. The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

In addition, the Board of Governors voted unanimously to maintain both the interest rate paid on reserve balances at 5.4% and the primary credit rate of 5.5%.

Key takeaways

Members were largely in agreement that the domestic and global outlook remains clouded and “highly uncertain.”

Although the US economy has been much more resilient than expected over the past year, the Committee emphasized that coming interest rate decisions must be data-driven and approached with caution.

The published minutes noted, that amid a robust job market, geopolitical frictions, and above-target inflation,

A majority of participants pointed to upside risks to inflation from rising energy prices that could undo some of the recent disinflation or to the risk that inflation would prove more persistent than expected.

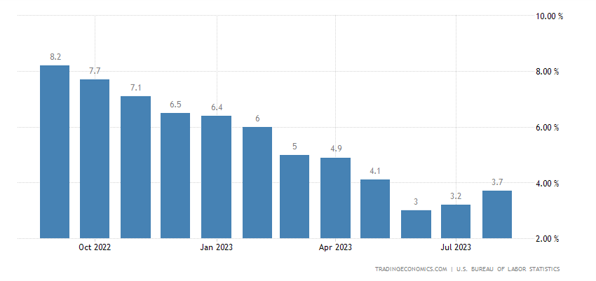

The graph below shows retail inflation over the past 12 months and the recent upward momentum in the previous two reports.

However, the economy is not without downside risks with a subset of members arguing,

…larger-than-anticipated lagged macroeconomic effects from the tightening in financial conditions, the effect of labor union strikes, slowing global growth, and continued weakness in the CRE sector.

This piece looks at the views of Danielle DiMartino Booth, CEO and Chief Strategist at Quill Intelligence, and an advisor to the Dallas Fed from 2006 – 2015, on the unpredictability of monetary lags.

The Committee noted that risks were precariously balanced and “two-sided,” with the potential for rising inflation in an environment that was too dovish, or of companies laying off workers if policy was excessively tight.

For the apex monetary body, of utmost importance is the need to balance the risk of overtightening against the risk of insufficient tightening.

Additional hikes unlikely

As a result, despite the agreement that rates must stay higher for longer, the FOMC did see a divergence in views in relation to the need for additional rate hikes.

The closely followed dot plot, which was released in the September meeting, noted that two-thirds of the Committee expected an additional rate hike by the end of the year.

However, dissent came from some voting members such as Vice Chair Philip Jefferson and Lorie K. Logan, President, and CEO of the Dallas Fed, who argued that financial conditions are tightening in any case, as evidenced by higher bond yields and near-8% mortgage rates.

In addition, Christopher Waller, a member of the Fed’s governing board noted that high borrowing costs are helping to combat inflation and are likely sharing the burden of tighter monetary policy.

During the past 52 weeks, 10-year treasuries were at a low of 3.262%, recently peaked at 4.887%, and are currently trading at 4.575%.

However, as often is the case, an organism as complex as the US economy will be filled with contradictory data points and opposing arguments.

For instance, the Chicago Fed’s National Financial Conditions Index (NFCI) which represents the weighted average of 105 variables relating to financial activity, remains in negative territory, which is “historically associated with looser-than-average financial conditions.”

In September 2023, the NCFI was at (-)0.37, having loosened from (-)0.1 from 12 months prior, despite the Fed’s policy.

However, in light of the impact of delayed monetary lags, the recent rise in bond yields, and geopolitical uncertainties, the Fed’s tone is more watchful and unwilling to commit to higher rates.

This article discusses the IMF’s recent appraisal of the risks that deeper fragmentation poses to global supply chains.

EY Chief Economist Gregory Daco added that the Fed’s approach is,

…shifting away from how much more restrictive monetary policy should be to how long the restrictive stance should be maintained…

The market seems to concur with this assessment, with yesterday’s surging PPI data having a muted impact on market expectations.

Further details of yesterday’s PPI release are available here.

Consumption

A key focus of the minutes was also on the health of household budgets and consumer spending.

Other than tightening credit conditions and lower fiscal stimulus, household savings that were accumulated amid the pandemic, are near being extinguished.

In August 2023, the SF Fed’s study estimated that there is lower than $190.0 billion of excess savings in the economy, less than a tenth of just two years earlier.

This is likely to threaten consumption demand in the months ahead and pressurize household budgets amid high inflation.

Market expectations

As per the CME’s FedWatch Tool, the Fed funds futures market reacted to the latest minutes by increasing the probability of maintaining rates in the November meeting up to 88.2%

This follows the unexpected rise in the PPI, which resulted in a 2% increase in the probability of a rate hike in the penultimate meeting of the year.

Conclusion

Policymakers maintained the policy rate at 5.25% – 5.50% and agreed that rates must stay restrictive to sustainably combat the uptick in inflation.

At the same time, with an uncertain outlook, the Committee is divided on the balance of upside and downside risks, particularly given sharply higher bond yields throughout the year, rapidly changing international landscape, robust labour market, and weaker household savings.

In all likelihood, policymakers are expected to take a data-driven and cautious approach heading forward, which will likely be reflected in the policy rate remaining unchanged in November.

This may prove to be crucial given the unpredictability of monetary lags that are yet to fully be transmitted through the financial system.

CPI data

Given that retail inflation has cooled substantially from the peak of 9.1% YoY in June 2022, to 3.7% YoY in the latest print, overall, the minutes tilted towards the importance of maintaining rates at these levels.

Later today, the much-anticipated CPI for September 2023 will become available.

Analysts at TradingEconomics.com note a consensus forecast of 3.6% YoY, a shade below last month’s figure of 3.7% YoY, and annualized core inflation is expected to moderate to 4.1% from 4.3% in the previous report.

However, it is unlikely that the Fed will alter its pathway on price stability ahead of the November announcement, while market expectations are firmly tilted towards maintaining the status quo.

With plenty of uncertainty around the economic future, the Fed’s narrative suggests that the rate hike cycle is at its close.

The post Fed minutes raise expectations of the end of the rate hike cycle appeared first on Invezz