Summary

- Royal Mail Plc had reported a surge of 13.5% in its Group revenue during 9M FY21.

- RMG had reported the Q3 FY21 as its busiest quarter ever since its inception in terms of parcel volumes.

- RMG had ample liquidity of around £2.0 billion as of 27 September 2020.

- The Parcel volumes and Parcel revenues grew by 31.0% and 37.0%, respectively during 9M FY21.

Royal Mail Plc (LON:RMG) is the LSE listed industrial stock. RMG’s shares have generated a return of about 154.12% in the last 12 months. It is listed on the FTSE 250 Index. It was incorporated in 2013.

On 20 May 2021, RMG will announce its full-year FY21 results.

Business Model

Royal Mail is the leading provider of postal services through a network of 50 depots in the UK. It operates under two broad business segments –

- General Logistics Systems (GLS)

- UK Parcels, International and Letters (UKPIL)

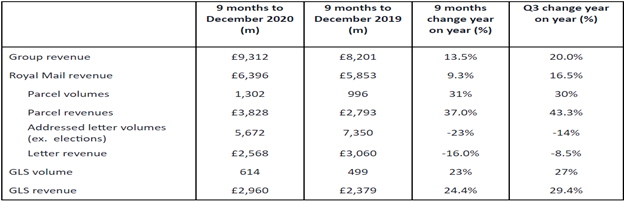

9M FY21 Trading Update (as on 11 February 2021)

(Source: Company update)

- The Group had delivered a revenue surge of 13.5% from £8.20 billion during 9M FY20 to £9.31 billion for 9M FY21.

- Royal Mail’s 9M FY21 period had ended on 27 December 2020, and GLS’s 9M FY21 period had ended on 31 December 2020.

- The Company had achieved resilient performance during Q3 FY21 and shown significant growth of 20.0% in its group revenue during the period compared to Q3 FY20.

- The Parcel volumes and Parcel revenues grew by 31.0% and 37.0%, respectively during 9M FY21 compared to an equivalent period of the prior year benefitted by positive price mix and Black Friday holiday period. The business performance was also boosted by government implementation of Covid-19 tighter restrictions.

- RMG had made a significant contribution in Covid-19 testing programme as it delivered around tens of millions Covid-19 test all around the UK. RMG had also provided approximately one billion Personal Protective Equipment (PPE) kits since April 2020.

- However, the letter volumes and revenue had witnessed a decline of around negative 23.0% and negative 16.0%, respectively during 9M FY21 compared to 9M FY20, illustrating lower consumer demand and usage for letters.

- GLS division had reported a substantial rise of 23% in its volumes during 9M FY21 due to strong performance of International and B2C segment. The GLS revenue had demonstrated a growth of 24.4% during 9M FY21 benefitted by strengthening of the Euro in Q3 FY21.

Recent News

On 11 January 2021, RMG updated that Simon Thompson became Chief Executive of its UK business effective today. Martin Seidenberg will join the Royal Mail Plc Board with effect from 1 April 2021.

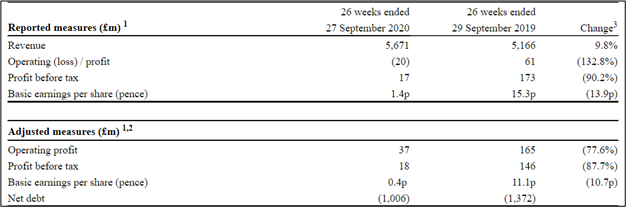

H1 FY21 Financial Highlights (for six months period ended 27 September 2020, as on 19 November 2020)

(Source: Company result)

- RMG had shown revenue growth of 9.8% during H1 FY21 compared to an equivalent period of the last year, primarily driven by robust growth in parcel delivery segment.

- Parcel revenue growth of 33.2% had partially offset the 20.5% decline in letters revenue during H1 FY21 compared to H1 FY20.

- Royal Mail had reported an operating loss of negative £20.0 million during H1 FY21, while it had achieved an operating profit of approximately £61.0 million during the comparative period of the last year. The loss of Royal Mail had outweighed the profit made by its GLS division.

- During the period, the basic earnings per share of RMG was 0.4 pence.

- The Company had sufficient liquidity of around £2.0 billion as of 27 September 2020.

- With reference to its financial position, RMG had brought down its net debt from £ 1.37 billion during H1 FY20 to £ 1.01 billion during H1 FY21.

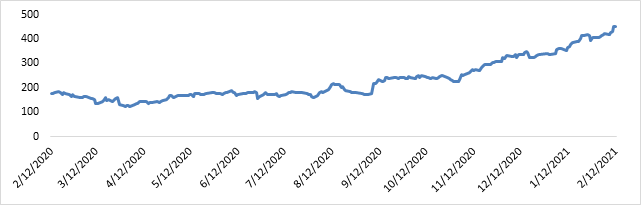

Share Price Performance Analysis of Royal Mail Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of Royal Mail Plc were trading at GBX 449.90 and were down by close to 0.20% against the previous closing price as on 12 February 2021, (before the market close at 08:52 AM GMT). RMG's 52-week Low and High were GBX 118.86 and GBX 479.70, respectively. Royal Mail Plc had a market capitalization of around £4.51 billion.

Business Outlook

Royal Mail had demonstrated its resilient trading performance during Q3 FY21 and continued to make significant progress during January 2021 as well. Covid-19 pandemic had boosted the business progress for RMG. Royal Mail revenue had achieved its highest growth during 9M FY21 ever since it got listed in 2013. It has delivered around 496 million parcels during Q3 FY21 and reported its busiest quarter ever since the inception. The largest parcel hub of RMG is in the development stage, and it would have a capacity of delivering around 1 million parcels per day.

RMG had expected its GLS division FY21 revenue growth to remain around 23.0% and its FY21 adjusted operating profit margin of approximately 8.9%. It had pointed out that reintroduction of Covid-19 related lockdowns would incur certain additional costs.