Summary

- Dechra Pharmaceuticals revenue increased by 6.8 percent year on year in FY2020, which was supported by the full-year impact of the acquisitions.

- The underlying EBITDA was £142.5 million, and the EBITDA margin was 27.7 percent in FY2020.

- Diaceutics PLC's revenue increased by 20.5 percent year on year in H1 FY2020 due to an increase in client base and repeated sales.

- The Company expects to post a full-year EBITDA loss as the conversion of proposals is lower than the expectation.

Dechra Pharmaceuticals PLC (LON:DPH) is a veterinary healthcare stock, and Diaceutics PLC (LON:DXRX) is a healthcare technology stock. Shares of DPH were down by around 2.24 percent, whereas shares of DXRX were up by close to 8.8 percent, respectively from the last closing price (as on 8 September 2020, before the market close at 12:50 PM GMT+1). It is mindful to note that the shares of DXRX fell 29.1 percent on 7 September 2020 after the Company stated that it expects EBITDA loss in FY20.

Dechra Pharmaceuticals PLC (LON:DPH) - Acquired Osumia and Mirataz brands

Dechra Pharmaceuticals PLC is a UK based company that is engaged in the business of veterinary pharmaceuticals. The Company produces products focused on Companion Animal, Equine and Food producing animal products.

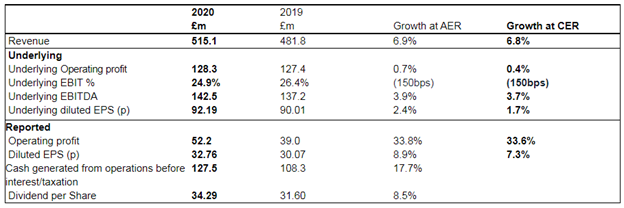

FY2020 results (ended 30 June 2020) as reported on 7 September 2020

(Source: Company website)

Dechra Pharmaceuticals reported revenue of £515.1 million in FY20, which grew by 6.8 percent year on year from £481.8 million in FY19. The sales of £502.1 million were generated from the existing business, whereas £13.0 million was generated from the acquired business. Companion Animal Products (CAP), Food-Producing Animal Products (FAP) and Equine are main products of necessary clinical pharmaceutical and their demand was resilient. The underlying EBITDA was £142.5 million, and the EBITDA margin was 27.7 percent in FY20. The underlying operating profit was £128.3 million, and the underlying earnings per share were 92.19 pence. Dechra Pharmaceuticals announced the final dividend of 24.00 pence per share, and it paid the interim dividend of 10.29 pence per share for FY20. The net cash generated from the operation was £127.5 million in FY20. As on 30 June 2020, Dechra Pharmaceuticals had net debt of £127.6 million and liquidity headroom of £353.2 million. The return on capital employed was 15.4 percent in FY20, which was slightly lower than 15.6 percent reported in FY19. In July 2020, Dechra Pharmaceuticals acquired the Osumia product, a treatment for inflammation in the outer ears of the dogs, from Elanco Animal Health. The deal was for £104.7 million, and it gives the worldwide rights to the Company. Mirataz, a transdermal treatment for weight loss in cats, was acquired in April 2020 from Kindred Bio for £34.9 million.

Performance by Product Category in FY2020

Companion Animal Products (CAP) revenue grew by 5.5 percent year on year to £361.3 million in FY20. The growth of CAP revenue was supported by new product launch and increased market penetration. Food Producing Animal Products (FAP) segment reported revenue of £74.8 million, which increased by 33.5 percent year on year from £57.3 million a year ago. The covid-19 did not disrupt the FAP segment, and it had a full year impact of Dechra Brazil (Venco) that was acquired in December 2018. Equine segment revenue grew by 6.1 percent to £36.4 million in FY20, and the full-year impact of Caledonia acquisition supported the growth. Nutrition segment revenue declined by 0.7 percent year on year in FY20 to £28.6 million.

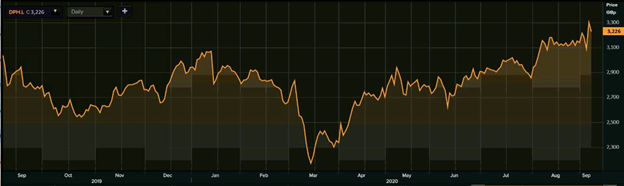

Share Price Performance Analysis

1-Year Chart as on September-8-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Dechra Pharmaceuticals PLC's shares were trading at GBX 3,226.00 and were down by close to 2.26 percent against the previous closing price (as on 8 September 2020, before the market close at 12:50 PM GMT+1). DPH's 52-week High and Low were GBX 3,414.00 and GBX 2,030.00, respectively. Dechra Pharmaceuticals had a market capitalization of around £3.56 billion.

Business Outlook

The Company witnessed positive growth cues from the business activity in the first few weeks of the FY21. The wholesale stocking would be back to normal slowly as the economy is re-opening. The Company is confident over the potential of the newly acquired brands such as Osumia and Mirataz, and it would focus on marketing and sales over the next few months. It is also working on the product for the treatment of diabetes in dogs, and the preliminary results of the concept study were encouraging.

Diaceutics PLC (LON:DXRX) - Won the first contract for a commercial diagnostic solution

Diaceutics PLC is a UK based company that provides healthcare solutions. The Company provides data analytics services for the development and sales of precision diagnostics. It has a data repository for close to 2,500 laboratories across 51 countries. The Company categorizes the business under Data Analytics and Implementation Services.

H1 FY2020 results (ended 30 June 2020) as reported on 7 September 2020

In H1 FY20, the Company reported revenue of £5.3 million, which increased by 20.5 percent year on year from £4.4 million in H1 FY19. Data Analytics added £4.8 million to the total revenue in H1 FY20, which increased by 70 percent year on due to the resilient performance of Landscape and Tracking products. Implementation Services contributed revenue of £0.5 million, which declined from £1.6 million in H1 FY19 due to less in-person interaction with labs following covid-19 restrictions. The gross profit increased to £3.8 million in H1 FY20 from £3.1 million in H1 FY19. The gross margin was 71 percent. The Company reported adjusted EBITDA of £0.3 million in H1 FY20, whereas it reported a negative EBITDA of £1.7 million in H1 FY19. The profit before tax was £0.03 million, and the earnings per share were 1.52 pence during the reported period. As on 30 June 2020, Diaceutics had cash of £29.8 million. In H1 FY20, the Company increased its client base to 29 across 28 countries. It also won the contract from a pharmaceutical company for commercial diagnostic solution, and the contract is for USD 1.27 million for 18 months. The Company added data of 53 million customers to its data repository.

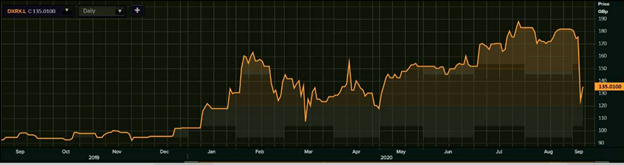

Share Price Performance Analysis

1-Year Chart as on September-8-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Diaceutics PLC's shares were trading at GBX 135.01 and were up by close to 8.8 percent against the previous closing price (as on 8 September 2020, before the market close at 12:50 PM GMT+1). DXRX's 52-week High and Low were GBX 195.00 and GBX 90.00, respectively. Diaceutics had a market capitalization of around £104.25 million.

Business Outlook

In Q3 FY20, the Company highlighted that it is experiencing lower conversion of proposals for its product due to the deferment of product launch following the covid-19. In H2 FY20, the revenue would be negatively impacted, and it may report full-year revenue lower than the previous year. It expects to post FY20 EBITDA loss of less than £1.0 million, and it is taking measures to bring down the expense by around £0.6 million. The development and launch of DXRX platform (The Diagnostic Network) for the precision medicine is on track, and it is expected to be available for clients by Q4 FY20.