Highlights

- With each passing day, more and more companies are suspending their operations in Russia.

- Global card operators such as American Express, MasterCard, and Visa have halted their services in Russia.

- Rio Tinto, Imperial Brands, and Mothercare Plc were latest to join the list following tougher global sanctions on Russia.

With each passing day, more and more companies are suspending their operations in Russia as a response to escalating Russia’s invasion of Ukraine. Globally, Western countries, companies, and individuals have imposed sanctions and suspended their operations in Russia.

Besides, card networks such as American Express, MasterCard, and Visa have halted their services in Russia, which mean cards issued in the country will no longer work beyond their borders, and card issued outside Russia will no longer work in the country. Therefore, making payments will be more difficult than before. Therefore, businesses that are still operating in the country are incurring high costs.

© 2022 Kalkine Media®

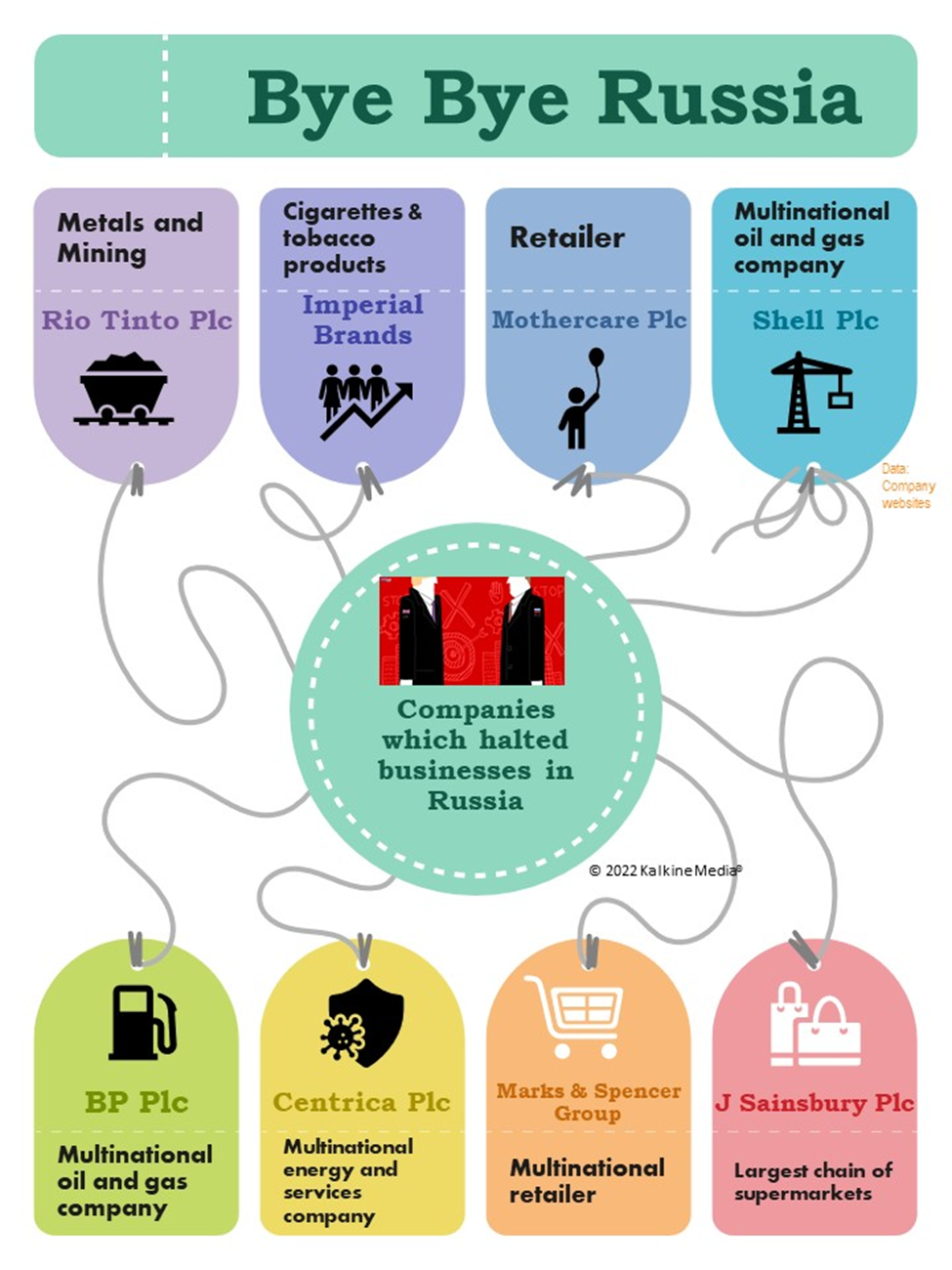

Various London Stock Exchange-listed companies have also joined the list of companies suspending operations and trade with Russia to show solidarity to Ukraine. Let us look at seven FTSE-listed companies that have suspended their operations with Russia.

- Rio Tinto Plc (LON: RIO)

Rio Tinto Plc, the second-largest metals and mining company in the world, is the latest company to announce that it was snapping all its ties with Russian businesses in the wake of the Russia-Ukraine crisis. The company has 80% interest in Queensland Alumina Ltd (QAL) in a joint venture with Russian aluminum producer, Rusal International PJSC.

The market cap of the FTSE 100-listed company stood at £73,641.33 million as of 9 March 2022. The company’s shares since the start of this year have given a return of 18.91%. Rio Tinto Plc’s shares were trading at GBX 5,443.00, down 6.43%, at 9 AM (GMT), on 10 March 2022.

- Imperial Brands Plc (LON: IMB)

Cigarette maker Imperial Brands joined the list of companies and stopped its Russian operations following tougher global sanctions on Russia. Winston cigarette and Golden Virginia cigarette maker said it will halt production at its factory in Volgograd and will stop all marketing and sales activities in the country. It has already suspended its Ukraine operations in order to prioritise its employees’ safety. Both the countries together accounted for around 2% of the company’s net revenue in 2021.

The market cap of the FTSE 100-listed company stood at £14,180.09 million as of 9 March 2022. The company’s shares since the start of this year have given a return of -6.94%. Imperial Brands Plc’s shares were trading at GBX 1,532.50, up by 0.03%, at 9 AM (GMT), on 10 March 2022.

Also Read: AMTE, Ceres: Stocks on radar with surging prices of metals

- Mothercare Plc (LON:MTC)

British retailer, Mothercare Plc that specializes in products for expectant mothers and in general merchandise for children up to eight years of age has recently announced the immediate suspension of all its operations in Russia, including shipments. The company operates nearly 120 stores, accounting for around 20-25% of its retail sales.

The market cap of the AIM-listed company stood at £76.12 million as of 9 March 2022. The company’s shares since the start of this year have given a return of -41.18%. Mothercare Plc’s shares were trading at GBX 11.05, down by 5.56%, at 9 AM (GMT), on 10 March 2022.

- Shell Plc (LON: SHEL)

Oil giant Shell Plc has exited from its joint ventures with Russian state energy company, Gazprom, including a major liquified natural gas plant. The company has recently announced that it will cut all ties with Russia, including closer of its aviation fuels, service stations, and lubricants operations, after it was criticised for purchasing a shipment of crude oil from the country at a record discount. Currently, oil from Russia accounts around 8% of the company’s working supplies.

The market cap of the FTSE 100-listed company stood at £154,956.59 million as of 9 March 2022. The company’s shares since the start of this year have given a return of 23.84%. Shell Plc’s shares were trading at GBX 1,975.20, down by 1.46%, at 9 AM (GMT), on 10 March 2022.

- BP Plc (LON: BP.)

The global energy giant has recently announced to offload from its 19.75% shareholding in Russian oil giant Rosneft, with a valuation of around £10.4 billion. The company’s half of oil and gas reserves and a third of its production companies were from the Rosneft.

The market cap of the FTSE 100-listed company stood at £73,962.25 million as of 9 March 2022. The company’s shares since the start of this year have given a return of 11.41%. BP Plc’s shares were trading at GBX 365.85, down by 1.53%, at 9 AM (GMT), on 10 March 2022.

- Centrica Plc (LON: CNA)

British Gas owner Centrica Plc became the third-largest UK’s energy company to halt its Russian operations by ending its natural gas supply agreement with Kremlin-controlled Gazprom.

The market cap of the FTSE 250-listed company stood at £4,379.47 million as of 9 March 2022. The company’s shares since the start of this year have given a return of 5.43%. Centrica Plc’s shares were trading at GBX 77.38, up by 1.42%, at 9 AM (GMT), on 10 March 2022.

© 2022 Kalkine Media®

- Marks and Spencer Group Plc (LON: MKS)

The global retail company, Marks and Spencer Group Plc that specialize in selling food, cloths and home products has recently announced halting supply of goods to its FIBA franchise stores in Russia. The company has over 40 franchise stores in the country.

The market cap of the FTSE 250-listed company stood at £2,961.67 million as of 9 March 2022. The company’s shares since the start of this year have given a return of -31.85%. Marks and Spencer Plc’s shares were trading at GBX 159.70, up by 0.76%, at 9 AM (GMT), on 10 March 2022.

Also Read: Tullow Oil, M&G, GSTechnologies: Why are these stocks in news?

- J Sainsbury Plc (LON: SBRY)

J Sainsbury Plc, the leading operator of supermarkets and stores in the UK, has recently removed all Russian products from its stores and has decided to no longer sell Russian Standard vodka and Karpayskiye black sunflower seeds.

The market cap of the FTSE 100-listed company stood at £5,816.11 million as of 9 March 2022. The company’s shares since the start of this year have given a return of -8.56%.

Marks and Spencer Plc’s shares were trading at GBX 255.10, down by 0.16%, at 9 AM (GMT), on 10 March 2022.

Note: The above content constitutes a very preliminary observation or view based on industry trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.

.jpg)