Highlights

- ETFs are professionally managed asset classes that can be structured to track a particular sector or theme.

- Some ETFs also have a regular dividend payout and offer attractive dividend yields.

Investors use various kinds of strategies and asset classes to invest and earn good returns in the stock market. Exchange-traded funds (ETF) is one such asset class that has gained a lot of investor attention. ETFs are professionally managed asset classes that can be structured to track a particular sector or theme.

Investment in the UK stock market listed ETFs are capable of providing a robust return to investors in the long run. Some ETFs also have a regular dividend payout and offer attractive dividend yields. Let us explore some of the best dividend-paying ETFs:

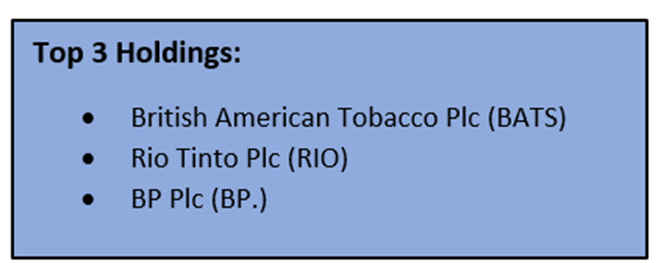

iShares UK Dividend UCITS ETF (LON:IUKD)

The ETF fund was launched in November 2005 and is managed by BlackRock Asset Management Ireland Limited. The fund aims to invest in the top 50 UK-listed companies and provides a regular dividend to investors.

The fund’s total expense ratio is 0.40%, which is the lowest compared to other similar funds. Its current dividend yield stands at 5.2% as of 23 February 2022. The ETF has given a 17.93% return in the last one year.

Data Source: Company Website

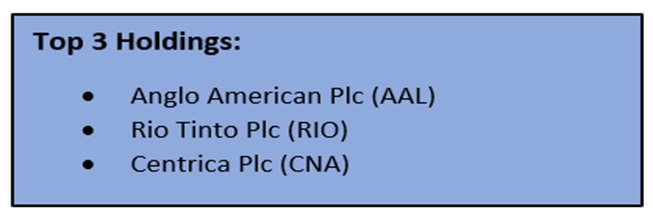

First Trust United Kingdom AlphaDEX Fund (LON:FKU)

The exchange-traded fund was started in February 2012 and is managed by The First Trust. The fund uses the AlphaDEX® stock selection method to select stocks from the NASDAQ United Kingdom Index and aims for price appreciation and higher dividend yield.

The fund’s dividend yield is 4.15% as of 31 January 2022. In the last one year, the ETF has given a 7.93% return to investors.

Data Source: Company Website

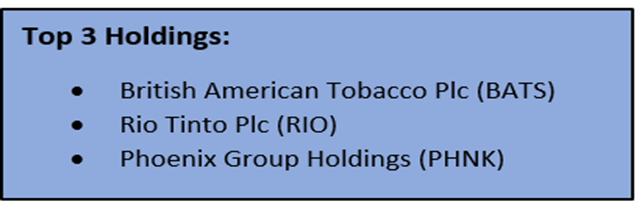

SPDR UK Dividend Aristocrats ETF (UKDV)

The fund aims to invest in high dividend yield companies listed on the UK stock exchange. State Street Global Advisors Europe Limited has managed the fund since its inception in February 2012.

The sectors that hold the largest exposure in the fund are Financials, Industrials, and Consumer Staples. Its dividend yield stands at 4.76% as of 22 February 2022. In the last one year, the ETF has given a 4.60% return to investors.

Data Source: Company Website

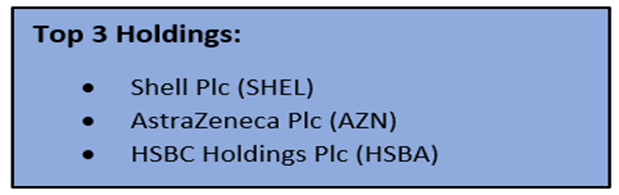

Franklin FTSE United Kingdom ETF (FLGB)

The UK stock market-focused fund aims to invest in large and mid-sized companies and track its performance against FTSE UK Capped Index.

The fund has been in operation since November 2017 and has an annual dividend yield of 4.47%. Consumer Staples, Financials, and Healthcare are the top three largest sectors where the fund has put its investment. It had a 4.47% annual dividend yield. In 2021, the fund gave a 17.15% return to its investors.

Data Source: Company Website

.jpg)