Highlights

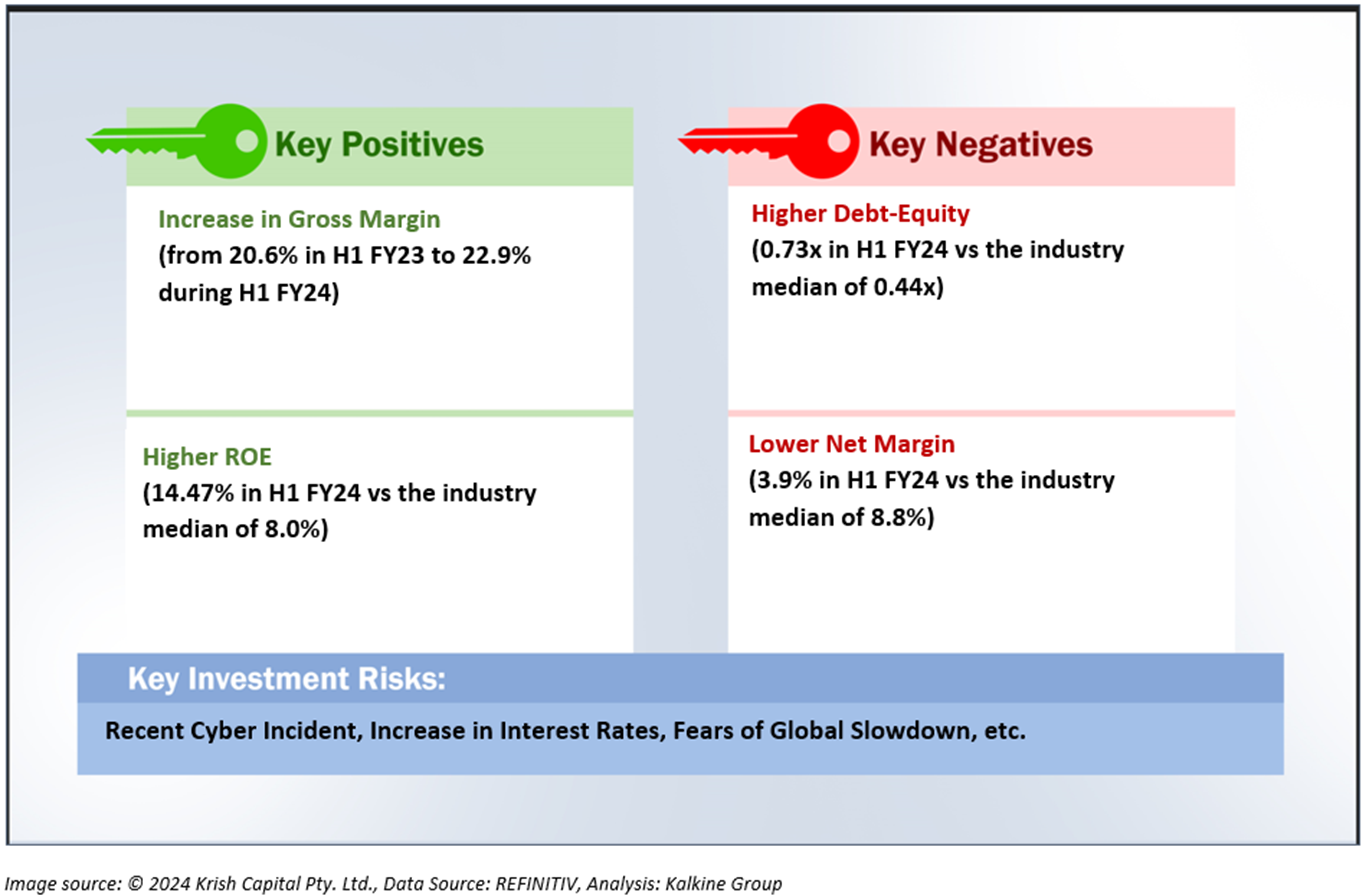

- Volex registered a 11.2% year-on-year increase in its top-line business in the first half of the fiscal year 2024.

- Its statutory profit before tax witnessed a 2.3% YoY growth in the reporting period.

- The company has registered around 16.5% YoY growth in underlying operating profit to USD 37.4 million in H1 FY24.

FTSE AIM UK 50 Index listed Volex PLC (LSE:VLX) is a global supplier of manufacturing services and power products. Recently, the company completed the acquisition of Murat Ticaret. This would mark Volex’ immediate entry into a new growth market, supporting the off-highway sector across three continents and eight manufacturing sites.

In the first half of the fiscal year 2024, Volex registered a 11.2% year-on-year increase in its top-line business from USD 357.50 million in H1 FY23 to USD 397.50 million in H1 FY24.

Its statutory profit before tax witnessed a 2.3% YoY growth in the reporting period. The company has registered around 16.5% YoY growth in underlying operating profit to USD 37.4 million in H1 FY24.

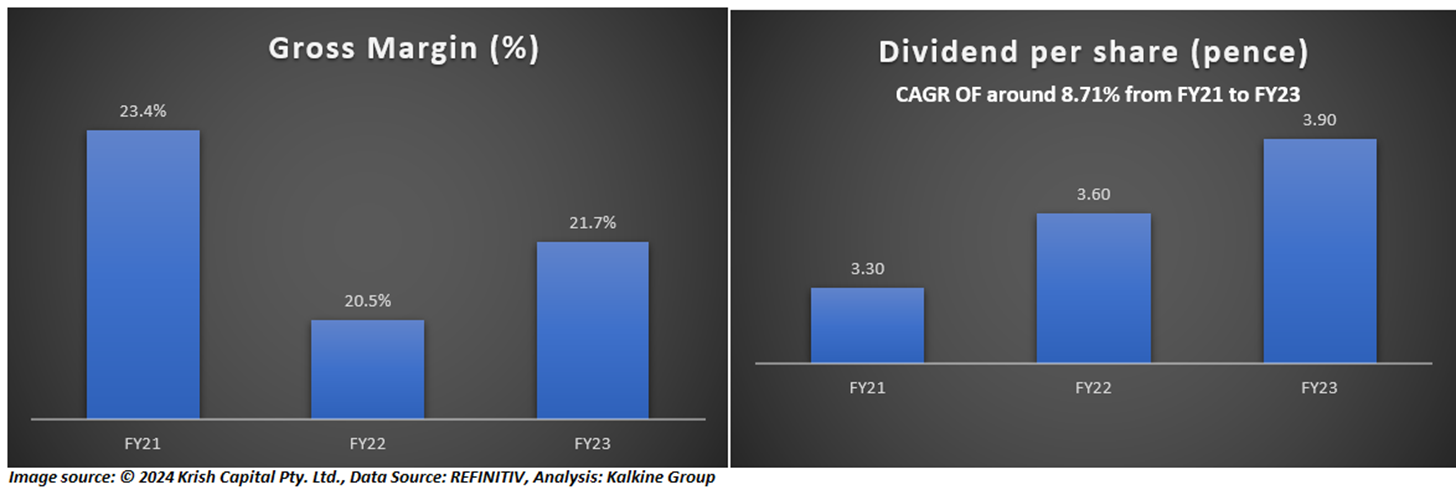

The firm’s interim dividend per share rose by approximately 7.7% YoY in H1 FY24. It paid an interim dividend of 1.40 pence per share on 10 January 2024, with an ex-dividend date of 30 November 2023.

According to the company, it has made a substantial progress towards the five-year plan supported by a targeted investment programme expanding capacity and capabilities. Also, VLX believes that it has improved its production activities due to enhanced supply chain facility. Going forth, VLX is planning to fast pace its growth with increased investment in elevating capacity across India, Mexico, Poland and Indonesia.

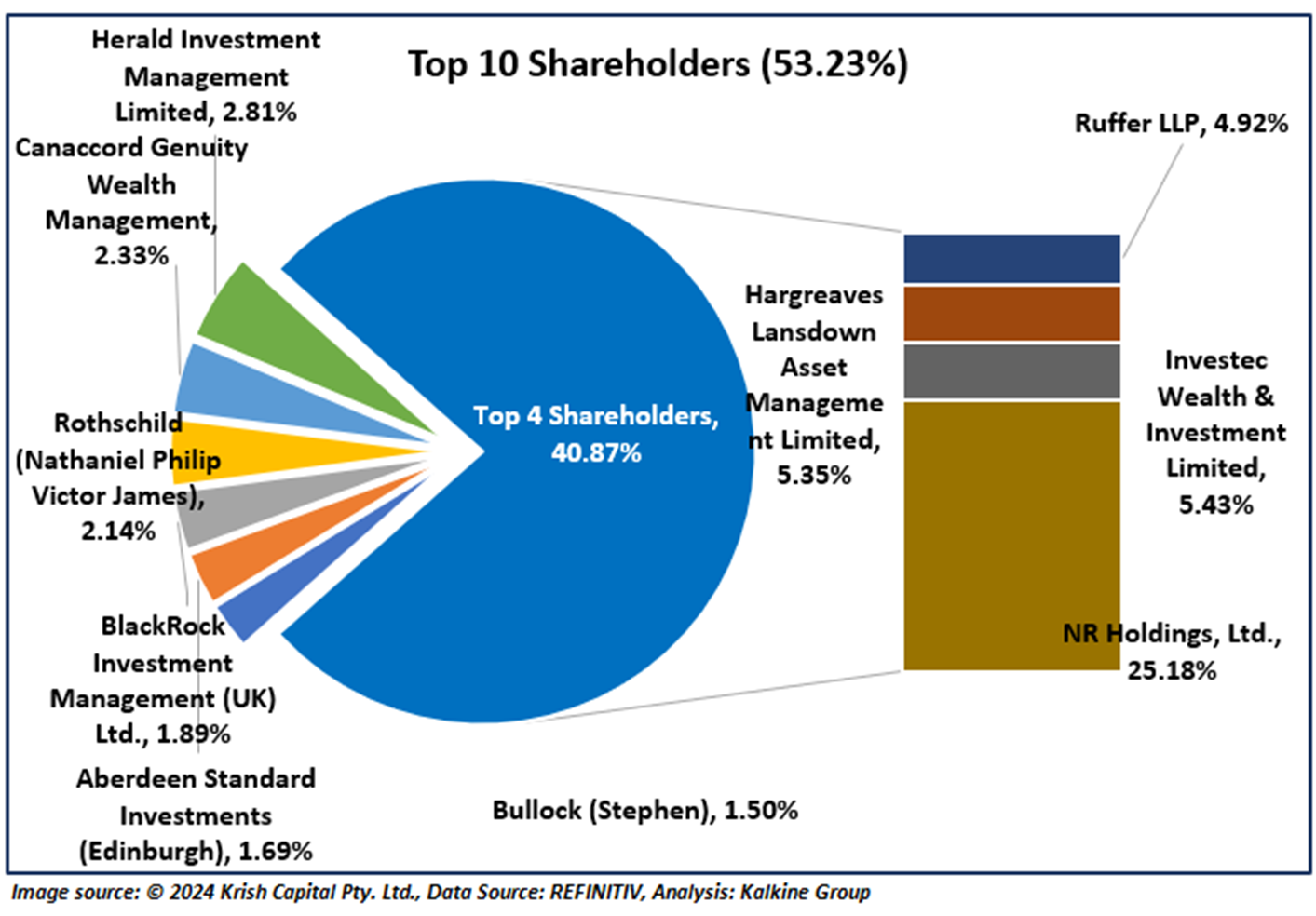

Top 10 Shareholders:

Around 53.23% of the total shareholdings in VLX is held by its top ten shareholders. While NR Holdings, Ltd. is the biggest shareholder of the firm with approximately 25.18% shareholding, Investec Wealth & Investment Limited is the secondbiggest shareholder in VLX with over 5.43% shareholding.

Stock Price Performance

VLX’ stock price has increased by 2.01% in the last one month. It has gained by over 9.32% in the last six months. The stock’s 52-week low and 52-week high price stand at GBX 198.00 and GBX 340.00, respectively.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is 08 January 2024. The reference data in this report has been partly sourced from REFINITIV.